I don’t think that there can be any disagreement that Hewlett Packard (HPQ) had a terrible day on November 20. In a surprise announcement, the company announced that it was taking a write off of $8.8 billion of the $11.1 billion that it paid to acquire Autonomy, a UK based technology company, in October 2011, and that a large portion of this write off ($ 5 billion) could be attributed to accounting improprieties at Autonomy. Even by the standards of acquisition mistakes, which tend to be costly to acquiring company stockholders, this one stood out on three dimensions:

- It was disproportionately large: While there have been larger write offs of acquisition mistakes , this one stands out because it amounts to approximately 80% of the original price paid.

- The preponderance of the write off was attributed to accounting manipulation: Most acquisition write offs are attributed either to over optimistic forecasts at the time (the investment banker made us do it..) of the merger or changes in operations/markets after the acquisition (it was not our fault). HP’s claim is that the bulk of the write off ($5 billion of the 8.8 billion) was due to accounting improprieties (a polite word for fraud) at Autonomy.

- The market was surprised: Most acquisition write offs, which take the form of impairments of goodwill, are non-news because they lag the market and have no cash flow effects. In other words, by the time accountants get around to admitting a mistake from an acquisition, markets have already admitted the mistake and moved on. In HP’s case, the market was surprised and HP’s stock price dropped about $ 3 billion (12%) on the announcement. Put differently, the market had priced in an acquisition mistake of $5.8 billion into the value already and was surprised by the difference.

The blame game

I am sure that this case will be examined and reexamined over time in books like this one, but at this moment, every one involved in the merger is blaming someone else for the fiasco. So, here is a roundup of the suspects:

- Meg Whitman, the current CEO of HP, blamed the prior top management at the company, and said that “(t)he two people that should have been held responsible are gone “.

- Leo Apotheker, the prior CEO who orchestrated the acquisition, claimed to be shocked at the “accounting improprieties” at Autonomy.

- Michael Lynch, the founder of Autonomy, said that two major auditors had performed “due diligence” on the financial statements and had found no improprieties at the company.

- Deloitte LLP, the auditor for Autonomy, denied all knowledge of accounting misrepresentations and claimed to be cooperating with authorities.

- The advisers on the deal (Perella Weinberg & Barclay’s Capital for HP, Quatalyst, UBS, Goldman Sachs, Chase & BofA for Autonomy) have all been mysteriously silent, though none have offered a refund of their advisory fees.

So, who is telling the truth here and who is to blame? Perhaps, the only way to answer this question is to go back to the original deal, which occurred just over a year ago.

Building up to an acquisition price: The original deal

Before we look at the numbers, it is worth reviewing the history of the two companies involved. Autonomy was a company founded at the start of the technology boom in 1996, which soared and crashed with that boom and then reinvented itself as a business/enterprise technology company that grew through acquisitions between 2001 and 2010. Hewlett Packard, with a long and glorious history as a pioneer in computers/technology, had fallen on lean times as it’s PC business became less competitive/profitable and due to top management missteps.

On August 18, 2011, HP’s then CEO, Leo Apotheker (who had worked at SAP) announced his intent to get out of the PC business and expand the enterprise technology business by buying Autonomy. While the deal making began on his watch, the actual deal was officially completed on October 3, 2011, with Meg Whitman as CEO. If she was a reluctant participant in the deal, it was not obvious in the statement she released at the time where she said that “(t)he exploding growth of unstructured and structured data and unlocking its value is the single largest opportunity for consumers, businesses and governments. Autonomy significantly increases our capabilities to manage and extract meaning from that data to drive insight, foresight and better decision making.”

One of the perils of assessing “big” merger deals is that the fog of deal making, composed of hyperbole, buzzwords and general uncertainty, obscures the facts. So, let me stick with the facts that were available at the time the deal was done (a time period that stretched from August 18, 2011, to October 3, 2011):

- Acquisition Price: While there have been varying numbers reported about what HP paid for Autonomy, partly reflecting when the story was written (between August & November) and partly because of exchange rate movements (HP paid £25.50/share), the actual cost of the deal was $11.1 billion.

- Market Price prior: Autonomy’s market cap a few days prior to the deal being announced was approximately $5.9 billion.

- Pre-deal accounting book value: The book value of Autonomy’s equity, prior to the deal, was estimated to be $2.1 billion. (Source: Autonomy’s balance sheet from its annual report for 2010)

- Post-deal accounting book value: After acquisitions, accountants are given a limited mission of reappraising the value of existing assets and this appraisal led to an adjusted book value of $ 4.6 billion for Autonomy. (Source: HP’s 2011 annual report, page 99)

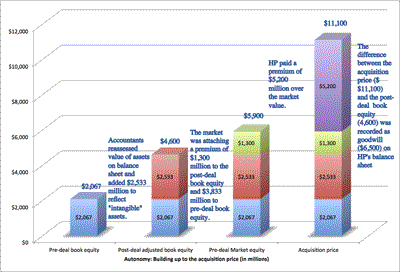

The advantage of working with these numbers is that differences between them are revealing. In the figure below, I attempted to deconstruct the $11.1 billion paid by HP into its constituent parts:

(click to enlarge)

You can see the build up to the price paid by HP as a series of premiums:

- The accounting “write up” premium for book value: One of the residual effects of the changes that have been made to acquisition accounting is that accountants are allowed to reassess the value of a target company’s existing assets to reflect their “fair” value. For technology companies such as Autonomy, this becomes an exercise in putting values to technology patents and other intangible assets and that exercise added $2,533 million to the original book value of equity.

- The pre-deal “market” premium over book value ($1.3 billion over post-deal book value): Even if accountants write up the value of assets in place to fair value, markets may still attach a premium for growth potential and future investments. As with any market number, this number can be wrong, too high for some companies and too low for others. Prior to the HP deal, the market was attaching a value of $6.2 billion to Autonomy, $3,833 million higher than the original book value of equity and $1.3 billion more than the post-deal accounting book value of equity.

- The acquisition premium ($5.2 billion): To justify this premium, HP would have to had to believe that one or more of the following held: (i) the market was undervaluing Autonomy, i.e., that the true value of Autonomy was much higher than the $ 5.9 billion, (ii) there are synergies between HP and Autonomy that have value, i.e., that there are value-enhancing actions that the combined firm (HP+Autonomy) can take that could not have been taken by the firms independently and/or (iii) that Autonomy was badly run and that changing the way it was run could make it more valuable, i.e., there is a control premium. Even without the benefit of hindsight, neither undervaluation nor the control premium seemed to fit as motives in this acquisition. First, Autonomy was being priced by the market richly in August 2011; the market cap of $ 5.9 billion was roughly 6 times revenues and 15 times earnings and neither number looked like a bargain. Second, for a company that had been as badly run as HP to be talking about inefficiencies at other companies (and control premiums) strikes me as absurd.

The reaction to the deal was negative, a the time that it was done. The analysts and experts were generally down on the deal, but more importantly, the markets voted against the deal by pushing down HP’s stock price. Between August 18, 2011 (the date the deal was announced) and October 3, 2011 (when the deal was consummated), HP’s market cap plummeted by $15 billion from $58.5 to $43.5 billion. It would be unfair to attribute this meltdown to the Autonomy deal alone, since HP was announcing spectacular failures on so many different fronts, but it would be fair to say that markets did not share HP’s hopeful assessments of synergy in this deal.

The cost of accounting impropriety & breaking down blame

Let’s fast forward to today. In the conference call on November 18, the CFO of HP attributed the write off of $8.8 billion to two primary sources: $5 billion to accounting improprieties at Autonomy and $3.8 billion to a drop in HP’s stock price. The latter rationale does not really hold up since it mistakes cause and effect; the stock price went down because of HP’s misstep (though it has made so many that I am not sure which one) and is not the cause of the write off. Thus, it makes sense to attribute the entire write off to the deal. Applying HP’s write off of $8.8 billion to the acquisition price of $11.1 billion, brings Autonomy’s estimated value (according to HP) back down to $2.3 billion (almost equal to the pre-deal book value of $2.1 billion). In effect, HP is arguing that almost all of the premiums in the original deal (the accounting write up, the pre-deal market premium, the acquisition premium) were not justified.

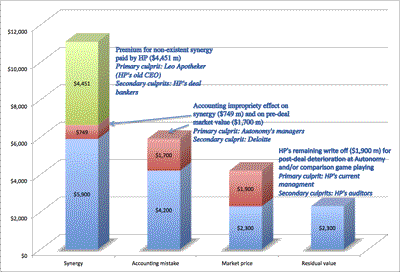

So, what form did these accounting improprieties take? Based on news reports, HP’s contention is that Autonomy was “overstating” and “mis-categorizing” revenues (they were allegedly booking low margin hardware sales as higher margin service/software sales). Assume for the moment that HP is right, and that Autonomy’s revenues in 2010 were overstated by 15% and that its true operating margin was the industry average of 31% (and not the 36% that Autonomy was reporting in 2010). Since the accounting misstatements predated the HP acquisition, the pre-deal market value of $5.9 billion should already have been inflated because of the misstatements. Using the pre-deal market value of $5.9 billion as a base, I extracted an expected revenue growth rate of 14.25%. I then substituted in the lower revenues (15% drop) and lower margin (31%) into the valuation and estimated a value for the equity of $4.2 billion. Put differently, if you buy into HP’s story fully, the value effect of the accounting misstatement was $1.7 billion (the difference between the pre-deal market value and the adjusted value) on the pre-deal value.

HP’s argument would be that the synergy premium of $5.2 billion that they paid was also overstated because of the accounting improprieties. Since we do not have access to the detailed synergy estimates (assuming that they were made), we assumed that the accounting overstatement would comprise the same percent of the synergy value it was of the pre-deal market value ($1.7 billion is 28.81% of $5.9 billion) and that half of this value is Autonomy’s share (since synergy accrues to the combined firm):

Estimated accounting impropriety portion of synergy value =0.5( 28.81% of $5,200) = $749 million

I know that this may not be fair and that I am going with incomplete information, but here is my breakdown of blame for the $ 8.8 billion write down:

(click to enlarge)

As I see it, everyone involved in this process owns part of this disaster. Leo Apotheker, the CEO who pushed this deal through, gets the lion’s share with $4,451 million, though the investment bankers who advised him were his enablers in the process. To the extent that HP is right in its contention that Autonomy cooked the books (inflating revenues and margins), Autonomy’s founder/ managers and its auditor (Deloitte) are responsible for $2,449 million in value destruction. That leaves us still with an additional $1,900 million in write offs, which I can attribute to either a deterioration of Autonomy’s business in the eleven months since HP took it over (a form of reverse synergy) or game playing on the part of HP, where taking bigger losses now will allow them to claim improvements and look better in the future. In either case, I would hold HP’s current management responsible for that portion ($1,900 million) damage. As HP stockholders, though, don’t expect any of these parties to offer to cover their fair share.

This deal offers important lessons about headstrong CEOs, the ineffectual accounting for acquisitions and the flaws in the acquisition process that allow bad deals like this one to get through, but this post has become too long to expand on these issues. So, more in my next few posts….

Leave a Reply