No panic today, though stocks continue to sell down. Maybe some are just panicking before others.

Geithner out on the tape, reported by CNBC, saying tax rates have to be raised on the upper income. Negotiating positions hardening?

Equities couldn’t hold early gains and flopped into the close as the S&P500 continues to submerge below the 200-day.

A former NYSE floor trader posted this comment on our blog today,

It may seem logical to go to gold as a safe harbor but liquidity needs are the reason why all correlations go to one in times of distress and that is why, I believe, gold will be down with the market should we slip over the Fiscal Cliff. Awesome blog.

Thanks for that!

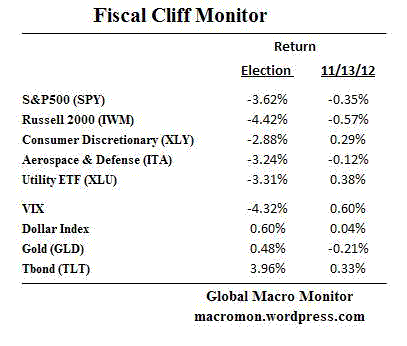

What would a real fiscal cliff panic look like?

Stocks down hard; Russell 2000 down harder; consumer discretionary down hard; gold up; dollar down; VIX spiking; and defense stocks in the tank.

Bonds? Tough to extract a clear signal with the Fed’s financial repression, but, initially, the cowboys would most likely be in buying on recession fears and increased worries about going over the cliff.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply