The September employment report from the U.S. Bureau of Labor Statistics (BLS) was predestined to create a significant amount of buzz. But the confluence of headline jobs growth at a modest clip of 114,000 and a surprisingly large 0.3 percentage point reduction in the unemployment rate has made the report more buzz-worthy than we (here at macroblog) expected. Although some of the commentary has been more heat than light, there have been some particularly good reminders of the difference between the establishment survey data, from which the headline jobs figure is derived, and the household survey data, from which come the unemployment statistics. The discussions on Greg Mankiw’s blog and by Catherine Rampell (at The New York Times‘s Economix blog) are especially useful. Or, perhaps even better, you can go to the source at the BLS.

It’s important to remember that both surveys are subject to error and, because of its much smaller sample size, the household survey can be subject to particularly sizeable swings. Specifically, the standard error of the household survey’s monthly change in employment is 436,000(!). Based on the most extreme assumptions about flows in and out of unemployment and in and out of the labor force, understating or overstating actual employment by 436,000 would imply a measured unemployment rate ranging from 7.5 percent to 8.1 percent. (The BLS estimate of the standard error for unemployment puts a range on September’s number of 7.6 percent to 8 percent.)

In his post, Greg Mankiw makes reference to a Brookings Institution paper by George Perry from a few years back that offers what is probably good advice: since both the payroll and household surveys are subject to error, and since the errors in each are likely unrelated to one another, the clearest picture about what is happening to employment in real time can be gleaned by combining information from both.

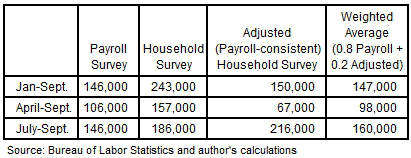

In fact, in a directional sense, both the household and payroll surveys are giving the same signals. In the table below, we compare the recent trends in monthly job gains measured in both surveys. The coverage in the two reports is slightly different. Unlike the payroll count, the household survey includes the self-employed and counts multiple jobs held by a single person as a single instance of employment. Because of this, the BLS also reports an adjusted version of the household survey, called the payroll concept adjusted employment measure. This payroll-consistent measure is designed to control for definitional differences across the household and establishment reports and also makes statistical adjustments for changes to the population controls in various years. So we include the data from this measure in the last column of the table.

Overall, all three measures suggest a weaker trend over the last six months than over the last nine months. All three measures also indicate that things were somewhat stronger on average in the last three months than in the prior three months. The bottom line in our view is that, though the employment levels can be quite different across the three measures, all suggest that the jobs picture has improved somewhat in the past three months.

The suggestion in George Perry’s Brookings paper—combining the household and establishment data—can be implemented by constructing a weighted average of the two surveys. In our variation we put weights in proportion to the inverse of the sampling variability of the payroll and household surveys, which would roughly imply an 80 percent weight on the establishment measure and 20 percent on the payroll-consistent household measure. The estimates using these weights are reported in the last column of the table above. Because the component employment measures display directionally similar trends in recent months, the weighted average does as well.

In a speech given a few weeks ago, Atlanta Fed President Dennis Lockhart, our boss here, offered the opinion that

Taking a two-year view, the trend rate of gains in employment has been roughly 150,000 per month. This pace would be sufficient, at current levels of participation in the workforce, to sustain a steady, gradual reduction of the unemployment rate.

As the September employment reports show, predicting the unemployment rate month to month can be tricky business, and there may be better ways than just extrapolating from the jobs data. But thus far we are inclined to think that slow but steady progress on the jobs front is still the best story.

Leave a Reply