International investment patterns play an important role in policy debates ranging from global imbalances to banking crises. This column shows that history should not be neglected on this score. It suggests that 10% to 15% of the cross-country variation in US investors’ foreign bond holdings is explained by this ‘history effect’, which reflects fixed costs of market entry and exit together with endogenous learning.

Recent years have seen growing interest in the geography of international finance. In particular, a series of studies have used gravity models to analyse the direction and determinants of cross-border financial stocks and flows (e.g. Aviat and Coeurdacier 2007). In this approach, bilateral trade in assets is posited to increase with country size and to decline with transaction costs and information asymmetries, as captured by geographic distance and related variables.

This literature has focused on recent decades. This usefully highlights the recent progress of financial globalisation, but it is not capable of capturing longer-term historical forces that may also influence patterns of international investment. It tells us nothing about the generality of the factors emphasised by the gravity model.

Beachhead costs in international finance

Fixed costs can explain why past international financial investment influences current investment. The theoretical and empirical literature on so-called ‘beachhead’ or ‘hysteresis’ effects (Baldwin 1988, Dixit 1989, Baldwin and Krugman 1989) has shown that transitory shocks resulting in market penetration can permanently impact patterns of trade if firms incur fixed costs when entering new markets but cannot easily recoup them when exiting. Intuition suggests that what is true of international trade is also true of international investment. Financial firms face fixed costs when seeking to market the bonds of a foreign country to domestic investors. They face fixed costs of gathering intelligence on foreign markets. And they face fixed costs if they wish to underwrite the bond issues of foreign borrowers.

These costs do not have to be large to have persistent effects on the geography of international investment. As the literature on endogenous learning suggests (e.g. Van Nieuwerburg and Veldkamp 2009), they only have to differ across countries. Lower fixed costs of investing in some countries may significantly tilt investment in their direction, and this pattern may persist and be amplified over time through endogenous learning.

The ‘history effect’ on international finance

In Chiţu et al. (2012) we use past holdings of a country’s bonds as an indicator that investors have sunk the costs of acquiring information about a class. We estimate a gravity model of international investment using data on US investors’ holdings of foreign bonds in 88 countries seven decades ago, a period for which we have uniquely detailed information. The results are strongly supportive of a ‘history effect’.

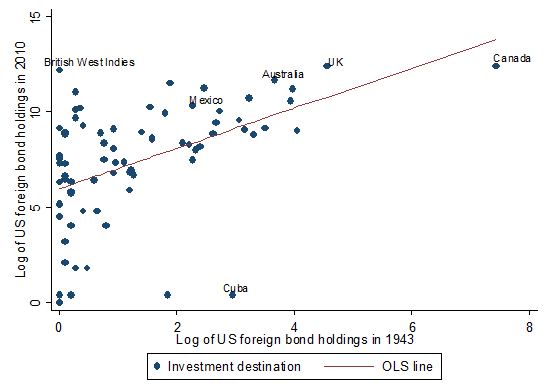

To show this, Figure 1 juxtaposes the logarithm of US foreign bond holdings in 1943 against log 2010 holdings. The correlation is statistically significant, robust and economically important even after controlling for the arguments of the standard gravity model (distance and size), bilateral trade (a traditional complement to bilateral financial investment) and informational frictions (proxied by common language, legal origin, and past colonial status). A 1% increase in US holdings of foreign bonds in a country 70 years ago is associated with holdings of some 1% higher in the same country today. Ten to 15% of the cross-sectional variance of today’s US holdings of foreign bonds is attributable to the effect of the holdings of 70 years ago.

Figure 1. US foreign security holdings: 1943 vs. 2010

This ‘history effect’ is robust to controlling for omitted variable with regional fixed effects. It is robust to outliers. It extends to other securities besides bonds. It remains when one instruments lagged holdings with dummies that aim to capture the effects of the disintegration of the gold standard and of the sovereign defaults of the 1930s, which contributed to the growing segmentation of global financial markets during the Great Depression. It is also twice as large for foreign currency-denominated bonds as for dollar bonds. As much as 30% of the worldwide allocation of US investors’ foreign holdings of non-dollar bonds today can thus be explained by the pattern of such holdings seven decades ago. This makes sense. In the case of non-dollar bonds, investors have to learn not just about the foreign issuer but also about his or her currency; and they might also need adequate markets or institutions to hedge currency risk. This implies larger sunk costs and, in turn, a larger history effect.

Earlier studies found that international financial markets are segmented by market size, informational asymmetries and familiarity effects. Subsequent analysis then established the importance of complementarities between trade in goods and trade in assets. Our results show that history also matters. Historical patterns persistently weigh on the geography of bilateral asset holdings.

These findings underscore the importance of analysing fixed costs and the historical forces that shape them when seeking to understand international investment patterns. Among other things, they suggest that the role of the dollar as a global investment currency today is partly a legacy of this earlier era when it dethroned sterling as the leading international currency.

References

•Aviat, A and N Coeurdacier (2007), “The Geography of Trade in Goods and Asset Holdings”, Journal of International Economics, 71, pp. 22-51.

•Baldwin, R (1988), “Hysteresis in Import Prices: The Beachhead Effect”, American Economic Review, 74, pp. 773-785.

•Baldwin, R and P Krugman (1989), “Persistent Trade Effects of Exchange Rate Shocks”, Quarterly Journal of Economics, 104, pp. 635-654.

•Chiţu, L, B Eichengreen and A Mehl (2012), “History, Gravity and International Finance”, ECB Working Paper, No. 1466, September 2012.

•Dixit, A (1989), “Hysteresis, Import Penetration and Exchange Rate Pass-through”, Quarterly Journal of Economics, 104, pp. 205-228.

•Okawa, Y and E van Wincoop (2012), “Gravity in International Finance”, Journal of International Economics, 87, pp. 205-215.

•US Treasury (1947), Census of American-owned Assets in Foreign Countries, US Treasury Department, Office of the Secretary, Washington DC.

•US Treasury, Federal Reserve Bank of New York, Board of Governors of the Federal Reserve System (2011), Report on U.S. Portfolio Holdings of Foreign Securities (as of December 31, 2010).

•Van Nieuwerburgh S and L Veldkamp (2009), “Information Immobility and the Home Bias Puzzle”, Journal of Finance, 64(3), pp. 1187-1215.

![]()

Leave a Reply