Dallas Federal Reserve President Richard Fisher is quick to continue his fear mongering about inflation. Via Bloomberg:

“I do not see an overall argument for letting inflation rise to levels where we might scare the market,” Fisher said on Bloomberg Radio’s “The Hays Advantage” with Kathleen Hays and Vonnie Quinn. “We have seen a sharp rise in inflation expectations. If you let this get out of hand, then I think we will have a market reaction.”

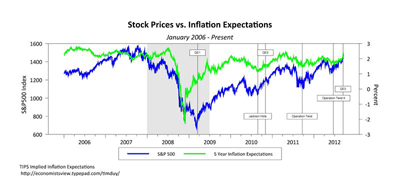

Let’s go to the chart:

(click to enlarge)

You really can’t say that inflation expectations are surging beyond anything we have seen in the past six years. Moreover, supporting inflation expectations was an expected outcome of Fed easing. And financial markets seem to like it.

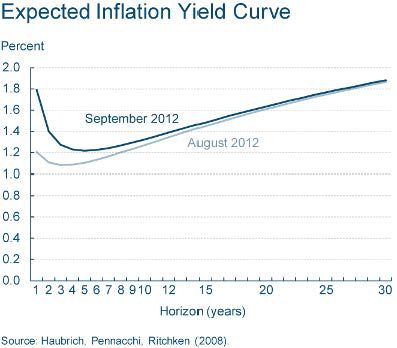

Also, it is not clear that TIPS-derived expectations are the best measure (a point I don’t make enough). The Cleveland Federal Reserve works on teasing out inflation expectations, and on September 14th reported:

The Federal Reserve Bank of Cleveland reports that its latest estimate of 10-year expected inflation is 1.32 percent. In other words, the public currently expects the inflation rate to be less than 2 percent on average over the next decade.

Yes, near term expectations have gained but from a too-low 1.2% to 1.8%. Moreover, this would be expected not just from anticipation of QE3, but from the rise in gas prices (and note that oil prices are now falling again). By this measure, the more important longer term expectations remain mired well below the Fed’s 2% inflation target. Let’s at least agree to stop worrying about inflation until we get expectations back up to the Fed’s target.

Bottom Line: Fisher stays true to form, clutching to his fears of inflation like a drowning man grabs onto a life preserver. My guess is that he doesn’t need to be marginalized by the doves; he does a fine job marginalizing himself.

Leave a Reply