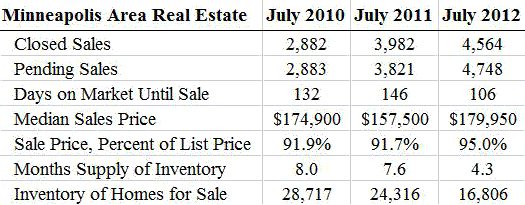

The chart below provides evidence of the significant recovery going on in the Minneapolis Area real estate market, based on new data for market activity there in July:

1. Closed home sales in July increased by 14.6% above last year, and by 58% above two years ago. On a year-to-date basis, the 27,413 homes sold so far this year is the highest for any January-July period since 2006.

2. Pending home sales in July (4,748) is 24.3% higher than the same month last year, and 65% higher than July 2010.

3. The average marketing time for houses sold in July was 106 days, down from 146 days last year and 132 days in 2010, and was the shortest average marketing time since at least 2006.

4. The median sales price in July was $179,500, a 14.3% increase over last year and a four-year high for the month of July. The median price increase in July was the largest year-over-year gain since January 2004 and the fifth straight month of an annual increase.

5. The average sale price as a percent of list price was 95% in July, the highest percentage for a July since 2007, and above the 91.7% average last year and the 91.9% two years ago.

6. The months supply of inventory in July was down to only 4.3 months, the lowest level in almost 7 years, since the fall of 2005.

7. The inventory of homes for sale in July was only 16,806, the lowest inventory level since December 2003.

Bottom Line: By every relevant measure (median price, closed sales, pending sales, average marketing time, percent of list price received, etc.), the real estate market in the Minneapolis-St. Paul Area is experiencing a full and sustainable recovery this year, and the housing market conditions there are reflected very closely in many other metro areas around the country.

In fact, with the home inventory level currently at a 9-year low and the months supply of homes at a 7-year low, the biggest challenge for the Minneapolis-area real estate market is now a shortage of homes for sale relative to the increasing demand. With the tight supply of homes listed for sale and more buyers coming into the market, we can expect multiple offers and further increases in home prices going forward.

Here’s how the Minneapolis Area Association of Realtors explains the situation in the Twin Cities:

“With the Olympics in full swing, housing has already medaled in several arenas. A few short years ago, housing was considered a headwind to economic recovery. Today, housing is seen as a tailwind to a stalling economy. For the first time since 2005, housing is on track for contributing positively to national GDP in 2012. That can occur either by way of direct residential investment or through remodeling and other ancillary services. Watch for signs of sustained tailwinds in a variety of indicators, including market times, seller concessions, prices and absorption rates.”

Leave a Reply