In the past, I made the case that the shortage of safe assets is really just an excess money demand problem. That is, the sharp decline in the stock of safe assets that began in 2008 matters because it means there are fewer assets that can facilitate exchange relative to the demand for them. This relative shortage of transaction assets or money implies a deficiency of aggregate nominal expenditures and can explains the ongoing slump. This notion of excess money demand is not novel, but what is new and makes this view a compelling narrative of the crisis is our expanded understanding what constitutes money.

Prior to the crisis, most observers thought of some measure of retail money assets like M2 as an appropriate measure of money. Thanks to efforts of Gary Gorton (2008), Wilmot et al. (2009), Sing and Stella (2012), and others we now know that a more accurate measure of money should also include institutional money assets that facilitate exchange for institutional investors. One attempt to measure this broader notion of money comes from the Center for Financial Stability (CFS). Using their data, one can show that the supply of money has fallen sharply since 2008 and has yet to recover. By itself, this decline in the stock of money assets implies an unsatisfied demand for money. Throw into this mix the heightened demand for safe assets arising from economic fears and you have a pronounced excess money demand problem. One would never know this, though, by looking at traditional measures of money.

The nice thing about this excess money demand view is that it helps shed light on the ongoing debate as to whether there is a large negative output gap. Since money assets are on every market, excess money demand implies a general glut that in turn should create a negative output gap. Thus, relative money shortages should be correlated with the output gap. So is there any evidence for this view?

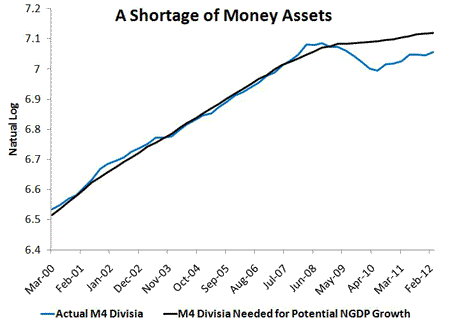

Michael Belognia and Peter Ireland provide a clever technique in a recent paper that can answer this question. They solve for the optimal amount of money assets by plugging in potential Nominal GDP (as estimated by the CBO) and actual trend money velocity (as estimated by the Hodrick-Prescott filter) into the equation of exchange (i.e. M*t= NGDP*t/V*t ). I reproduce their procedure here using the CFS’s M4 divisia money supply1 and come up with the following figure:

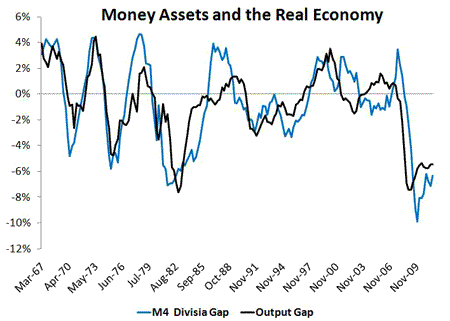

The figure shows that the quantity of money assets is currently about 7% below what is needed to generate full potential NGDP growth. Now if one takes the percent difference between the actual and needed M4 divisia in the figure above–the M4 divisa gap–and plots it against the the output gap you get the following figure:

I find this figure striking. With a R2 of about 60%, it shows that the output gap typically tracks the M4 gap. For the recent crisis in particular, it shows the acute shortage of money assets (or excess money demand) is matched by the large output gap. This figure, then, indicates the excess money demand explanation for the recent crisis is a compelling one.

Now some observers like James Bullards and Stephen Williamsons believe that the shortage of safe assets or money is the consequence of real shocks to financial intermediation that have permanently lowered the productive capacity of the U.S. economy. The relationship evident in the figure above, however, suggests that there is in fact a large output gap given the significant shortage of money assets. And even if the shortage were caused by a real shock, there are still policy options that could close the M4 gap.

First, the government could create more safe assets in the form of treasuries. This approach, however, is politically controversial as it requires more budget deficits. It is also not clear to me that this approach would be able to create enough safe assets to completely close the M4 gap. Second, the Fed could create the incentive for the private sector to start producing more safe assets by adopting a NGDP level target. Such a target would raise the expected level of future NGDP and, in turn, raise the current demand for financial intermediation services. That would lead to more privately-produced safe assets and ultimately a recovery. There are ways out of this economic morass.

1I specifically use the CFS’ “M4 minus” money supply measure. It had a better fit than the regular M4.

Leave a Reply