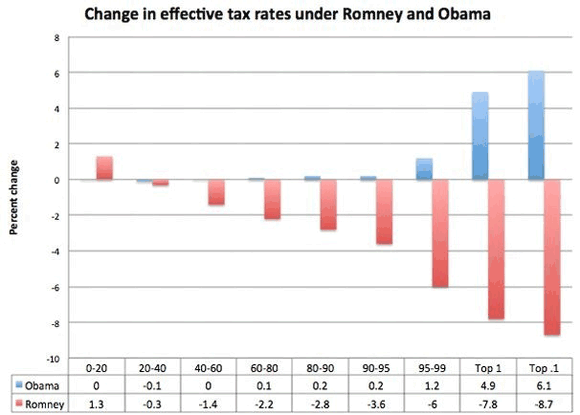

Two big problems America faces are that there is not enough tax revenue, and income is skewed to the top 10%. These issues will define the 2012 election. Obama wants to lower the taxes that middle-income earners pay at the expense of those bastards who are in the lofty top 10% of income. Romney wants to lower taxes across the board, but his plan heavily favors the shit heels that are at the top of the pile. This chart compares the two candidate’s proposals:

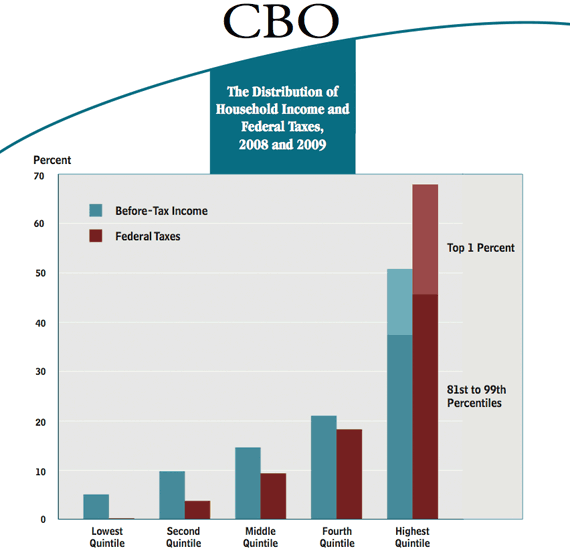

The Congressional Budget Office (CBO) wrote on this topic last week, presenting the following chart to describe what is happening:

The CBO used the actual IRS tax data from 2009, so this info is an accurate description of who made what and what taxes were paid. The results confirm the problem. The top 20% of income earners make 51% of all income. This same group pays fully 68% of all Federal tax dollars.

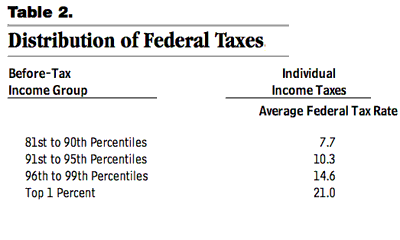

So who are these “fat cats” who are on top of the income pile and how much are they making? The results are surprising, the following shows the incomes for those in the top 20%:

81st to 90th percentile = $137,500

91st to 95th percentile = $175,800

96th to 99th percentile = $271,800

Top 1 percent = $1,219,700

So who are these “wealthy” people in America?

Nearly half of those “rich folks” are a husband and wife who each make $65,000 a year. I understand that there are plenty of folks who don’t earn this much, but if those same people think that the households that bring in $132k a year are “rich”, they are wrong. The people in this group are not fat cats, they are not rich and they are not bastards. This is your Dr., Dentist, accountant, small business owner. This group is what fuels the economy. Take half their income away and you have a big fall.

If you’re wondering who fits into this income group (91st to 95th percentile) consider that every Senator and Congressman is in this bracket.

We get up to the stratosphere of income when household income averages $272,000 a year (96 -99%). The folks in this group have nothing to complain about; they are doing fine. But I ask the question, “Are they truly getting rich?”

Then you get to the top of the pile. The average salary for the top 1% is a whopping $1,220,000. So the reality is that the top 1% includes:

– Damn near every pro athlete.

– Any face that you see on the silver screen.

– The bozos you see on TV every day (including the “names” on CNBC).

– Paul Krugman (His book sales this year will make him a 1%er.)

– Mitt Romney. But we shouldn’t forget that Obama is also in the 1% group. In 2010 the Prez made nearly five times the average income of those top 1% earners.

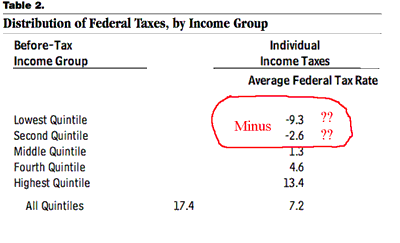

Now lets see who is paying federal income taxes. This chart from the CBO report includes transfers from the federal government:

– The negative tax rates for the bottom 40% (minus 9.3% for the lowest quintile, and minus 2.6% for the second lowest quintile) includes payments of Social Security, Medicare/Medicaid and other government transfers.

– The middle 20% has an average income of $64,000 but pays only an average of 1.3% in Federal taxes.

– Those who make $93.5k (the fourth highest quintile) are still only paying 4.6% of their income in federal taxes, on average.

– The highest 20% of income earners pay 13.4% of their income on average. The breakdown of tax rates among this group are:

Many people are advocating raising taxes on people who are making the “big bucks”.

What would happen if there was a giant increase in taxes? Assume that those “fat cats” that earned more than $250k had to pay 50% in income taxes and the “super rich” (top 1%) had to pay 75% of their income in Federal taxes. Would that solve the problem?

The answer is yes and no.

If taxes had been 50% for the 96-99% group and 75% for the top 1% in 2009, it would have generated addition tax revenues of $770B. A very big chunk of change. Projected deficits as far as the eye can see are in excess of $1 Trillion. Raising taxes on the top 5% would eliminate three-quarters of the shortfall. This result would be close enough to a balanced approach to take most of the budget pressure off of the table.

If we truly sock it to those with high current incomes, we can solve one problem. But another one is created. If we raise income taxes to levels that now exist in France, the result will be that 5% of the working population will be paying 80% of all income taxes!

A large percentage of American’s might like an outcome like this. A manageable deficit; paid for by soaking the rich. I’m sorry to tell them that it won’t work. A plan where 5% pay 80% is not going to work. A plan that sucked $3/4 of a trillion of income out of the economy would result in a near immediate depression.

I look at the information provided by the CBO and conclude that there is no way out of the revenue hole the country is in by raising income taxes. While tax increases are part of the fix, cutting expenses has to provide the heavy lifting. But that is a joke, as there are very few places to cut expenses without also cutting entitlements. So cutting expenses is another political dead end.

There is no combination of cutting expenses and raising income taxes that would actually be effective. There is an additional option.

The only alternative is a wealth tax. Anyone who has a net worth over $5m (or $20m, or chose a number) has to pay 1% (or 2%) of that amount, every year. It would be like a death tax, except you paid it while you were alive. Think – pre-paid estate taxes.

Warren Buffett is always complaining that he doesn’t pay enough in taxes. The guy has a net worth of about $40b. If there was a 2% wealth tax he would have to cough up an extra $800m a year. That would shut him up quick; it would also solve all the fiscal problems. Bill Gates would be forced to come up with an extra $1.2B. The Walton family would have to pony up $1.6B. And the good old Koch brothers would toss in a $1b.

If a 2% wealth tax was applied to everyone who had a net worth in excess of $5m it would add up to about $700B a year. That’s just about the right amount to get the budget to where it starts to make sense. This tax increase would not come out of current income, therefore the consequences to the economy would be muted versus a similar sized income tax increase.

Hopefully, I’ve convinced some readers that raising income taxes is a dead end. It may sound like a politically “smart” thing to say, but it doesn’t mean spit when shown in the light. Taxing income does not get the job done without too many adverse consequences. Only a wealth tax can make a dent.

I’m amazed that Team Obama has not proposed a tax on America’s wealthy. They must have concluded that there is no other option to balance the books. Maybe Buffett is blowing smoke in Obama’s ears. He should be. Buffett is going to get fleeced if something like this were to happen.

Note: I doubt we will hear talk of a wealth tax before the election. It would be very bad for Obama’s fund raising efforts if he brought it up. That does not mean he will not propose this if he is re-elected. I don’t see another away around the budget problems.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply