There is an art to trading an IPO on its first few days, and also to recognizing the macro buyable pattern 4-6 weeks later!

If you are a trained technical trader, you were not one of the retail victims of the Facebook (FB) IPO fiasco because you have a set of rules to follow to judge whether a new issue is priced right. You have clues to look for to gauge whether to get involved or to avoid. For a trained technical trader, it shouldn’t matter what the company is; once the stock opens, it should be treated like any other stock.

The bottom line is: It’s all about supply and demand, not about hype.

Trading IPO’s, even more-so than stocks that have been listed for long periods of time, is ALL about supply and demand. When trading older stocks, you have historical price levels to watch. With a new issue, all you have is that very recent movement.

Facebook will go down as one of the worst IPOs in history. There are many people and aspects to blame: excess supply, astronomical valuation, Nasdaq botching the execution, too much media hype, etc. At the end of the day, you have to accept the fact that those things are out of your control, and only look to manage the things that are within your control.

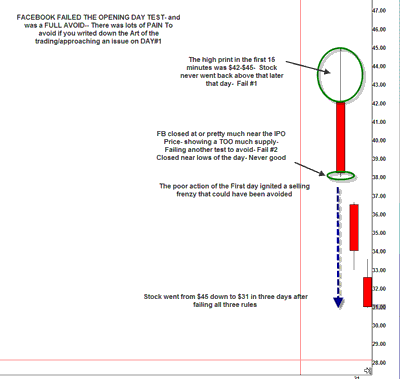

Here are a few rules that are part of the Art of Trading an IPO, many of which could have saved you from harm in this disastrous new issues:

1) Never use a market-on-open order! (you have no control over price paid, you are relying exclusively on hype)

2) After an hour or two of trading, if the IPO can’t get and stay above the opening print or high print of first 15 minutes, that is a technical sign that there is more supply than demand and stock is not worthy of a trade on the first day! That price for FB was $42-45ish

3) If the IPO doesn’t hold the price offered or close near the lows of the day, it tells you it was mis-priced and mis-handled. At that point, its DEFINITELY not worth getting involved in. Run for the hills! For FB that was $38.

Facebook failed all three of these simple rules to get involved in the first day. This got me telling my traders to stay away, be ultra cautious, and wait for FB to build a more constructive pattern to get involved. The stock went from $45 to $31 in three days after failing all the tests!

(click to enlarge)

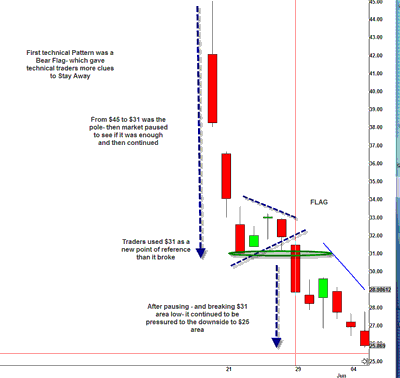

The first pattern that formed in FB was a Bear Flag, and the stock continued to the downside, giving additional clues to stay away. The pole of the flag was from $45 down to $31, then it paused for a few days and tried to find support. Traders used $31 as the pivot (traders love pivots since you can define risk). When it broke that it was a short/stay away scenario still. It wasn’t ready to bounce yet.

(click to enlarge)

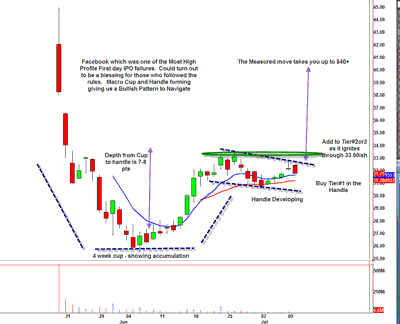

Eventually, though, things started to turn around for FB. After a historic “Face-plant” on Day 1 and then a bear flag that led to lower prices, a potentially bullish situation started to develop. I was looking for a bottoming signal to initiate a Tier 1 position, and thought macro investors could do the same with FB. The pattern also had a few points where you could look to add to the trade if it started to move in your favor.

FB was showing the beginning stages of a cupping pattern that shows accumulation. Finally FB got down to a reasonable price that triggered some demand to exceed supply, and that was evident in the price action. The Cup and Handle Pattern is a very bullish, reliable pattern that gives investors areas to get involved then add as it works.

(click to enlarge)

Two different strategies to get involved:

Investors can buy tier one now and anticipate that the pattern will ignite at another time in coming weeks to get involved (this is a bit riskier for those with a longer term time-horizon). The first entry would be right around here if they haven’t already bought in the cupping stage. So the tier one buy is in the handle between $30.50-32.00 (stock shouldn’t really trade below $28- that can be your stop if you are anticipating).

If you want to wait till pattern is in motion and ignites, don’t buy now, but rather wait for it to clear the major pivot area of $33.40-33.60, then the add on a tier as it’s working. That pivot area to add would be when it clears $33.40-$33.60. If it ignites before earnings (July 26th) I would stay with Tier 1 or go back to Tier 1 before earnings to be a bit safe as new public companies have a lot to prove in the first few earnings reports.

The measured move, which typically is the depth of cup to the handle–in this case 7-8 points, takes the stock back to the prices of the first day of trading above $40+.

The FB offering was doomed by a lot of egregious mistakes by a number of parties, but I think there is still excitement about this company that can drive the stock higher through its excess float. If you tactically approach new issues, there are prudent ways to get involved by using technical analysis. You can often find big long-term winners in the form of recent IPOs, and this has all the ingredients to be one of them.

Disclosure: Scott Redler is long FB

Leave a Reply