Nokia (NOK) came out with an awful earnings report on Friday, with warnings of more bad news to come, and its stock price, not surprisingly, plummeted.

While investors are fleeing the stock and a ratings downgrade looms, is it a contrarian play? What about JP Morgan Chase? Or Research in Motion? Netflix or Green Mountain Coffee, anyone? By focusing on stocks that other investors are abandoning, contrarian value investing is the “anti-lemming” strategy, but it takes a unique personality and a strong stomach to pull off successfully.

The basis for “contrarian” investing

The core belief that underlies contrarian investing is that investors over react to both good and bad news, pushing prices up too much on the former and down on the latter. If you carry this view to its logical conclusion, it then follows that prices will reverse in both cases as investors come to their senses.

While you may believe that investor overreaction is the norm, is there evidence to back up the claim? The statistical and the psychological evidence is mixed and contradictory. On the one hand, there is significant evidence that investors under react to news stories (earnings reports, dividend announcements), leading to momentum (and drift) in stock prices, at least over short periods. On the other, there is also evidence that investors over react to information, with price reversals occurring over longer periods. In behavioral finance, as well, there are two dueling “psychological” characteristics at play: the first is that of “conservatism“, where individuals, faced with new evidence, update their prior beliefs (expectations) too little, thus creating under reaction, and the second is “representativeness“, where individuals over adjust their predictions, based upon new information. To reconcile the co-existence of the two, you have to bring in two factors. One is time, with under reaction dominating the short term (days, weeks, even months) and over reaction showing up in the long term (years). The other is the magnitude of the new information, with over reaction being more common after big events.

Contrarian investing strategies

Within the construct of contrarian investing, there are at least four variants. In the first, you invest in the stocks that have gone down the most over a recent period, making no attempt to be a discriminating buyer. In the second, you focus on sectors or markets that have been hard hit and try to identify individual companies in these groups that have been “undeservedly” punished. In the third, you look at companies that have taken hard hits to their market value but that you believe have underlying strengths which will help them make it back to the market’s good graces. In the final approach, you buy stock in beaten up companies with the same intent (and expectations) that you have when buying deep out of the money options. You know that you will lose much of the time but when you do win, your payoff will be dramatic.

1. The Biggest Losers

If you believe that investors tend to over react to events and information, the effects of that over reaction are most likely to be seen in extreme price movements, both up and down. Thus, stocks that have gone down the most over a period are likely to be under valued and stocks that have gone up the most over a period are likely to be over valued. It follows, therefore, that if you sell short the former and buy the latter, you should be able to gain as the over reaction fades and stock prices revert back to more “normal” levels.

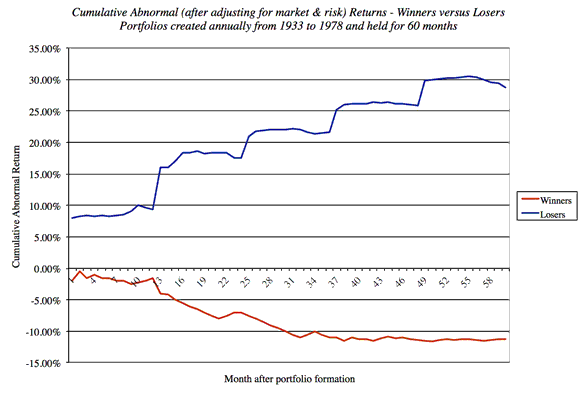

In a study in 1985, DeBondt and Thaler constructed a winner portfolio, composed of the 35 stocks which had gone up the most over the prior year, and a loser portfolio that included the 35 stocks which had gone down the most over the prior year, each year from 1933 to 1978. They examined returns on these portfolios for the sixty months following the creation of the portfolio and the results are summarized in the figure below:

An investor who bought the 35 biggest losers over the previous year and held for five years would have generated a cumulative abnormal return of approximately 30% over the market and about 40% relative to an investor who bought the winner portfolio.

Looks good, right? Before you rush out and load up on the biggest losers of the last year, a few notes of caution:

- Watch out for transactions costs: There is evidence that loser portfolios are more likely to contain low priced stocks (selling for less than $5), which generate higher transactions costs and are also more likely to offer heavily skewed returns, i.e., the excess returns come from a few stocks making phenomenal returns rather than from consistent performance.

- Timing is everything: Studies also seem to find loser portfolios created every December earn significantly higher returns than portfolios created every June. This suggests an interaction between this strategy and tax loss selling by investors. Since stocks that have gone down the most are likely to be sold towards the end of each tax year (which ends in December for most individuals) by investors, their prices may be pushed down by the tax loss selling.

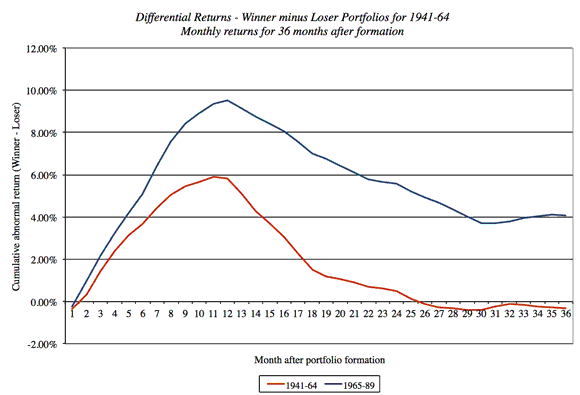

- Time horizon matters: In a test of how sensitive the results were to holding period, Jegadeesh and Titman tracked the difference between winner and loser portfolios by the number of months that you held the portfolios and their findings are summarized in the figure below. There are two interesting findings in this graph. The first is that the winner portfolio actually outperforms the loser portfolio in the first 12 months. The second is that while loser stocks start gaining ground on winning stocks after 12 months, it took them 28 months in the 1941-64 time period to get ahead of them and the loser portfolio does not start outperforming the winner portfolio even with a 36-month time horizon in the 1965-89 time period.

If you feel that, in spite of these caveats, this strategy may work for you, you can take a look at a list of the 50 companies that have gone down the most (in percentage terms) over the last 52 weeks (June 2011-June 2012). I have added a stock price constraint (to ensure that you don’t end up with low-priced stocks) and reported the dollar trading volume per day (as a red flag for trading costs). I have compiled the list for the US (with price>$5), Europe (with price>$5), Emerging Asia (with price>$1), Latin America (with price>$1) and global (with price>$5). Your timing is off (since it is not January) but you can still browse for bargains. You can also adapt the screening plus strategy that I talked about in my post on passive screening and subject the companies on these lists to follow up analysis (intrinsic valuation or qualitative assessments).

2. Collateral Damage

It is not uncommon for markets to turn negative on an entire sector or market at the same time. In some cases, this is justified: a big news story that affects an entire sector, or a macro economic risk that hurts a market. In others, it may represent either an over reaction by investors to the idiosyncratic problems of an individual company in a sector or a failure to consider that companies within a market/sector may have different exposures to a given macroeconomic risk. As an example of the former, consider how banking stocks were punished on the day that JP Morgan Chase reported its big trading loss. As an illustration of the latter, you can look at the Spanish stock market, where investors have punished all companies (though some are less exposed to Spanish country risk than others) over the last year.

About a decade ago, I penned a paper on measuring company risk exposure to country risk that argued that we (as investors) were being sloppy in the way we assessed exposure to country risk, using the country of incorporation as the basis for measuring risk exposure. With this view of the world, US and German companies are not exposed to emerging market risk, an absurd argument when applied to companies like Coca Cola and Siemens that derive a large chunk of their revenues from emerging or risky economies. By the same token, all Brazilian companies are equally exposed to country risk, though some (such as the aircraft manufacturer, Embraer) derive most of their revenues from developed markets. This laziness in assessing country risk does provide opportunities for perceptive investors during crises. This was the case when Brazilian markets went into a tailspin in 2002, faced with the feat that Lula, then the socialist candidate, leading in the polls, would win election to lead the country. As Embraer fell along with the rest of the Brazilian market, you could have bought it at a “bargain basement” price. If you are interested in following this path, here is my suggestion. Start putting together a list of companies like Embraer, i.e., emerging market companies that have a significant global presence and then wait for a crisis in the emerging market in question. When there is one (it is not a question of whether, but when….), and your “global” company drops with the rest of the market, you are well positioned to take advantage.

It is trickier, though, playing this game within a sector. Consider the JP Morgan Chase case. While the trading loss was clearly specific to JPM, you could argue that the event affected the values of all banks at two levels. The first is by increasing the chance that the Volcker rule, barring proprietary trading at banks, would be adopted, it affects future profitability at all banks. The second is the fear that in response to the loss, the regulatory authorities would require higher capital ratios be maintained at all banks. If those are your concerns, you should focus on banks that do not make have a large proprietary trading presence and are well capitalized. If investors have over reacted across the board, those banks should be trading at attractive prices.

3. Comeback Bet

When stock prices drop precipitously for an individual stock, there is usually a reason. If the drop reflects long term, intractable problems, there may be no reversal. If the drop reflects temporary or fixable problems, you are more likely to see prices reverse. As you look at the reasons for the price drop, you should keep in mind your overriding objective, which is to find a company whose price has dropped disproportionately, relative to its value.

Here are some possible reasons for a stock price collapse, with the ingredients for a comeback:

a. Unmet expectations: When expectations are set too high or at unrealistic levels, it is inevitable that investors will be confronted with reality not matching up to expectations. When that happens, they will abandon the stock, causing stock prices to drop. (Netflix and Green Mountain Coffee, both of which make the list of biggest losers over the last year are good examples of what happens to high flyers when they disappoint…)

Ingredients for a comeback: Expectations have dropped not just to realistic levels but below those levels. Investors have over adjusted.

b. Corporate governance issues: Events that lay bare failures of managers and oversight by the board of directors shake investor faith and, by extension, stock prices. A case in point would be Chesapeake Energy, where the CEO, Aubrey McLendon, stepped down after evidence surfaced that the board of directors had allowed him to use $800 million in personal loans to acquire stakes in company-operated oil wells.

Ingredients for a comeback: (a) A new CEO from outside the firm, (b) with a full cleaning out of management team and revamping of board of directors, and (c) an activist investor presence.

c. Accounting fraud/ manipulation: As investors, we start with the presumption that financial statements, while reflecting accounting judgments that may work in the company’s favor, are for the most part true. Any suggestion of accounting fraud can lead to a meltdown in the stock price, not to mention open the company up to legal jeopardy.

Ingredients for a comeback: (a) Full reporting of all accounting misstatements, with (b) removal of top management, and (c) no legal jeopardy.

d. Operating/Structural problems: Operating problems can range from problems with a key product (see Dendreon, on the list of biggest losers last year) to deeper structural problems, where the company’s products just don’t match up well to consumer demands or to the competition.

Ingredients for a comeback: (a) Management that is not in denial about operating problems and (b) a realistic plan for dealing with operating problems.

e. Financial problems: When operating problems combine with significant debt burdens, you have the seeds of distress, which can spiral very quickly out of control, as suppliers, employees and customers react pushing the company deeper into trouble.

Ingredients for a comeback: (a) A clear debt restructuring/repayment plan, (b) Solid operating performance.

Whatever the reason or reasons for a price collapse, investors have to follow up by asking and answering three questions:

1. Is “it” a one-time or continuing problem? While the line between one-time and continuing can be a shade of grey, the answer is critical. One time problems tend to have much smaller impact on value than continuing problems, and are easier to deal with and move on.

2. How fixable is the problem? Some problems are more easily fixable than others. In making this judgment, you should look at three factors. The first is whether the problem is entirely an internal problem or whether it is partly or mostly due to outside or macro factors. Internal problems are easier to remedy than external ones. The second is whether the solution can be “quick” or will take “time”. Thus, a firm with significant debt may be able to restructure that debt quickly, whereas a firm that has deep-rooted structural problems will need more time. The third is whether the managers of the firm seem to have both a reading of the problem and a solution in hand.

3. Is the market decline disproportionately large? To make this assessment, you have to work through the consequences of the problem for the determinants of value: its effect on current cash flows, the expected value of growth (both the level and the quality) and the risk in future cash flows.

Using this framework, let’s look at JP Morgan Chase. At first sight, it looks like a slam dunk. The trading loss was reported to be $2 billion at the first announcement and it seems like a fixable problem in the short term, with better risk management in place. The fact that the market capitalization went down by more than $30 billion on the announcement of the loss seems to suggest an over reaction, but there is more to this story than meets the eye. The first is that the trading loss of $ 2 billion is an estimate and the actual losses may be higher (the rumor mill suggests that they could exceed $5 billion). The second is that the loss will reduce the current regulatory capital and may increase the target regulatory capital ratio that JP Morgan aspires to reach over time; the combination of a lower current capital ratio and an increasing target capital ratio will translate into lower returns on equity, going forwards, and lower cash flows available to stockholders in the future (in the form of dividends or buybacks). To make a judgment on whether the stock is a bargain at the current price, I used a simple test. The price to book ratio for a mature bank can be written as:

Price to book ratio = (ROE – Expected growth)/ (Cost of equity – Expected growth)

Conservatively, if you assume a growth rate of 1.5% in perpetuity and a cost of equity of 9% (about 1% higher than the cost of equity for an average risk company), the return on equity implied at the JPM’s current price to book ratio of 0.73 is about 7%:

0.73 = (ROE – 1.5%)/ (9%-1.5%)

Implied ROE = 6.98%

The ROE in the most recent year for JPM, prior to its loss, was 10.34%. Even allowing for higher regulatory capital requirements (which will increase book equity) and lower profits (perhaps from the Volcker rule), the adjustment seems like an over reaction. I know that there are other fears hanging over large banks, but I have a spreadsheet that I think contains a a conservative valuation of JPM that yields a value of about $46/share, well above the current stock price of $35. You can use it to make your own judgments for JPM or any other bank.

4. “Long odds” option

There is one final scenario: a company whose stock price has collapsed, with good reason and where a turnaround is neither anticipated nor expected. In other words, the stock looks fairly priced, given its prospects and problems today. However, let’s assume that the firm has proprietary assets is in a risky business, where technology shifts could make today’s winners into tomorrow’s losers and vice versa. You could consider investing in this company’s shares, for the same reasons that you buy an out of the money option.

In effect, you are leveraging the fact that equity in a publicly traded company has a floor of zero and that your losses are therefore restricted to the prevailing market value of equity. For your option (equity investment) to have a big payoff, though, you will need the value of the firm’s assets to increase significantly from existing levels (because of a new product, market shift or an eager acquirer) and that will require that your firm have a proprietary technology/product/license and operate in a shifting, risky business. While the value of the assets could drop just as precipitously, you care less about downside because you don’t have much to lose (since your equity value is so low).

Nokia (NOK) and Research in Motion (RIMM) come to mind as potential option plays. They both have proprietary technologies and patents (though the market does not think that either technology looks like a potential winner in the market today) and operate in a risky business where the landscape can shift dramatically over night. While the Blackberry technology is a more reliable cash provider for RIM, there are three factors that tip me towards Nokia. The first is Nokia’s stock price has dropped far more than RIM’s over a shorter period, reducing the cost of my option. The second is that Nokia’s debt burden is a mixed blessing: it could cut my option game short, if Nokia defaults, but it also leverages any upside in value. Small changes in Nokia’s asset value will translate into big changes in equity value. The third is that the turmoil in the Euro zone adds to the value of my option. Put differently, I like Nokia because it is riskier than RIM, but risk is my ally, not my enemy, with an option. If you plan to invest in Nokia, do so with the full recognition that you may have to write off the entire investment a few months or years from now, but if the stars align, watch out!!!

Leave a Reply