With everyone hoping for positive GDP growth in Q3 and Goldman Sachs analyst Jan Hatzius now predicting growth at an annual rate of three percent in the second half of the year, the banks, investors, and politicians are all hoping that that nasty problem of foreclosures would just go away already. Unfortunately for everyone – especially the people losing their houses – there’s no reason for it to go away.

Unemployment is always a lagging indicator, and given the record low number of average hours worked, it will turn around especially slowly this time. Until then, people will continue to lose their jobs and wages will remain flat, and any small rebound in housing prices is unlikely to help more than a few people refinance their way out of unaffordable mortgages. So unless the other part of the equation – monthly payments – changes, the number of foreclosures should just continue to rise.

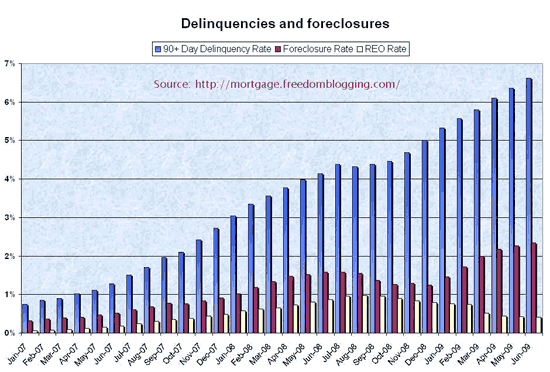

Calculated Risk provides this great chart from Matt Padilla (see the CR post for definitions of the categories):

The foreclosure problem has gotten a little more press recently as the Treasury Department attempts to follow through on its “name and shame” campaign to pressure mortgage servicers to modify more loans.

There seem to be two main explanations for why more loans are not being modifyied. The New York Times recently reported that for the servicers at the center of the process, it is simply more profitable to make fees off of delinquent loans than to foreclose on them and give up that stream of fees. On this theory, the cash incentives being provided by the government are simply not big enough to change their financial incentives.

The servicers prefer to argue that their hands are tied by the investors who own the mortgage-backed securities that have swallowed up the mortgages. On this theory, the Pooling and Servicing Agreements that govern these securitization trusts restrict the ability of servicers to modify mortgages. However, an article by Karen Weise in ProPublica yesterday casts serious doubt on this claim. Weise follows a household that is trying to get a modification of their mortgage, serviced by Wells Fargo, under the Making Home Affordable plan. Wells Fargo (NYSE:WFC) claims that it cannot modify the mortgage under those terms because “the investors need their money,” and instead proposed a different modification, which would increase the loan principal by $80,000. However:

researchers at UC Berkeley’s law school looked at the contracts covering three-quarters of the subprime loans that were securitized in 2006. The researchers found that only 8 percent prohibited modifications outright. About a third of the loans were in contracts that said nothing about modification, and the rest set some limits but generally gave the servicers a lot to leeway to modify, particularly for homeowners that had defaulted or would likely default soon.

And that is the case with the loan in question, for which the servicer need only make a “reasonable and prudent determination” that the modification is in the investors’ interests. What’s more, in this case, “Deutsche Bank [trustee for the securitization trust] spokesman John Gallagher said servicers are ’solely responsible’ for deciding all modifications.”

According to Weise’s article, the administration anticipated servicers’ fear of being sued by investors, but a key phrase in the proposed legislation was removed by Congress as a result of lobbying efforts. Servicers would probably have preferred the phrase be left in, but the end result is it gives them a convenient excuse for failing to modify mortgages – which, as the Times pointed out, is often in their own financial interests.

It will be interesting to see if the administration chooses to take serious action to reduce foreclosures, or whether it sticks to a “name and shame” strategy that is likely to be ineffective.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply