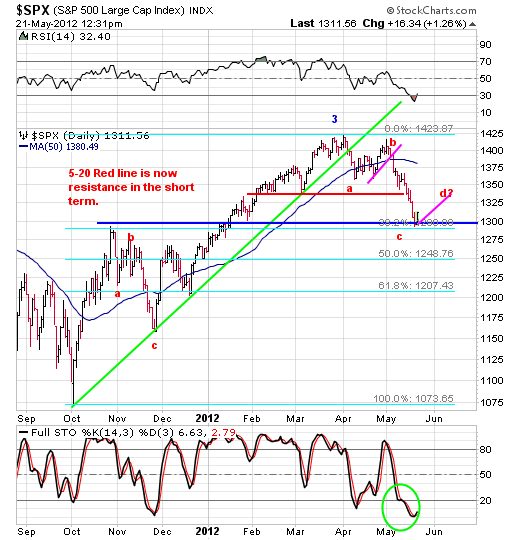

The market bounced off S&P 1292 on Friday’s “Faceplant Day”. This is a key level, since it marked the peak of the initial Wave 1 rally off the October 2011 bottom at SP1075. This mid-day alert chart from AllAboutTrends shows the bounce:

A lot of the doom-and-gloom Elliott Wave crowd were expecting it to break, confirming (in their counts) that the long-awaited and dreaded P3 wave down had begun. If we had broken it, the rally since last October would no longer be countable as an impulse wave since wave 4 (the current wave) would have breached into the range of Wave 2 (the wave after that 1292 peak). If we now hold above, the current wave since last October looks like a classic C wave, which breaks as an impulse in either a Flat or Zigzag correction.

If this holds, we should expect my predicted final leg 5 up to new highs (since 2009), and a Triple Top at SP 1550 +/- (going back to the peaks 2000 and 2007). If this leg 5 mimics leg 1, it should run for about six weeks and go around 220 points, putting it above 1500. Structure isn’t optimal, as we would have expected wave 3 to extend (ie go 1.6x wave 1 or 5). Also, historical patterns would point to a peak in August not July, to be followed by a September/October market drop, so this may run up more slowly than wave 1.

Leave a Reply