In recent months central banks have resorted to using the phony “credibility” issue. The claim is that they had to fight hard in the 1970s and early 1980s to get markets to believe they were serious about inflation.

Fortunately, that is simply not true. Markets have little difficulty figuring out what central banks are up to. When the central bank wants to reduce inflation (as they did after 1981) markets believe them. When they didn’t want to, markets didn’t believe they’d lower inflation. There never was a credibility problem.

In an earlier post I pointed out that this myth was partly due to a misreading of the early Volcker years. Volcker took over at the Fed in the fall of 1979, but it wasn’t until two years later that inflation started to fall significantly. But there shouldn’t be any big mystery as to why inflation didn’t fall earlier, money wasn’t tight earlier. For instance, in the spring of 1980 Volcker cut the fed funds rate from 17.6% to 9.0%, despite the fact that inflation in 1980 was over 13%, the highest in my entire lifetime.

Why would Volcker have done such a stupid thing? Why slash rates sharply (driving real rates far below zero) when inflation was running 13%? BECAUSE HE WASN’T FOCUSED ON INFLATION, HE WAS TARGETING REAL GDP. And we were sliding into recession in the first half of 1980, which threatened to cost Jimmy Carter his job. (Jimmy Carter appointed Volcker.)

Indeed that was the problem from 1967 to 1981. In late 1966 the Fed tightened slightly to slow inflation, which was gradually rising. The yield curve inverted. Normally we should have had a recession, but instead the Fed quickly switched to a policy of easing in 1967, and we merely had a slightly slowdown. Then we entered the 15 year period of very high inflation. If the Fed was trying to control inflation, they would have never once cut interest rates during that 15 year period, as inflation was always too high—usually much too high (although prices controls temporarily held it down in 1972). The Fed raised and lowered rates again and again during this period, because they weren’t trying to bring inflation down, they were targeting real GDP. Even worse, to the extent they cared about inflation at all, they were doing growth rate targeting, not level targeting.

After the Fed eased in 1980 by slashing rates, NGDP growth soared to 19.2% in 1980:4 and 1981:1. This scared Volcker so much that he finally put his foot down in mid-1981, and decided to do something about inflation. Inflation came down very quickly in late 1981, and ever since then the Fed has never had the slightest difficulty keeping inflation low. Nor has the ECB or the BOJ.

So the credibility problem is a complete myth. Where did it come from? It came from time inconsistency models developed in the early 1980s, which tried to explain why central banks created too much inflation. Unfortunately, no sooner were those models published than events discredited them, as central banks got inflation under control. Later Krugman tried the opposite tack–arguing too much credibility could lead to excessively low inflation in countries like Japan. Indeed that the BOJ might not be able to inflate if it had too much credibility. That model was also quickly discredited, as the BOJ tightened money twice (2000 and 2006) even as Japan was suffering deflation. It turns out both the conservative time inconsistency models and the liberal expectations trap models are completely wrong. Markets see very clearly what central banks are up to. If they are planning to inflate, the markets figure this out quickly. If they plan to let NGDP languish at excessively low levels, markets also figure that out, sometimes (as in late 2008) before the central bankers themselves even realize what they will do in the future.

And it’s not just financial markets. Wage contracts are more closely linked to NGDP growth than inflation, which is why wage growth stayed well behaved in 2008. As long as the Fed commits to a 5% NGDP trajectory, wage growth will remain quite stable, regardless of what happens to inflation.

This post was triggered by an excellent David Glasner post, which contains this gem:

Now, the ECB, having similarly focused on CPI inflation in Europe for the last two years, is in the process of causing inflation expectations to become unanchored in precisely the other direction. Why is it that central bankers, like the Bourbons, seem to learn nothing and forget nothing?

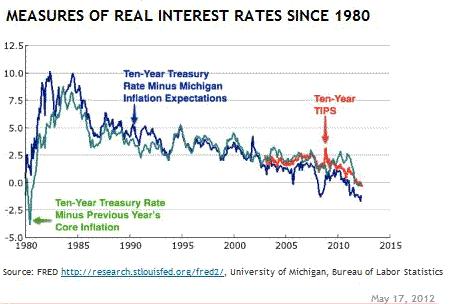

I’ve frequently argued that interest rate targeting is like a car with a steering wheel that locks when you need it most–on twisty mountain roads with no guardrail. I’ve also argued that although we rarely hit the zero rate bound in past recessions, it may well become the norm in future recessions. This graph provided by Brad DeLong shows why:

Focus on the red line. Real yields on 10 year TIPS seem likely to fluctuate between 0% and 2% in the future, with the lower rates occurring in recessions. If we target inflation at 2%, then nominal yields on 10 year Treasuries will fall to about 2% in future recessions, which means short rates will hit the zero bound. It’s not just this recession; we’ve seen a secular decline in risk-free real rates going back for decades.

The Fed is committed to a policy that failed in this cycle, and will keep failing until they figure out what they are doing wrong. Fortunately (as is obvious from my previous two posts), the profession is catching on quickly, so let’s hope this is the last time we see central banks so inept during a major crisis.

PS. Yes, it’s true that inflation fell a bit faster than markets expected during the 1980s. But it’s equally true that inflation fell faster than Volcker wanted in the 1980s.

Leave a Reply