Tough markets.

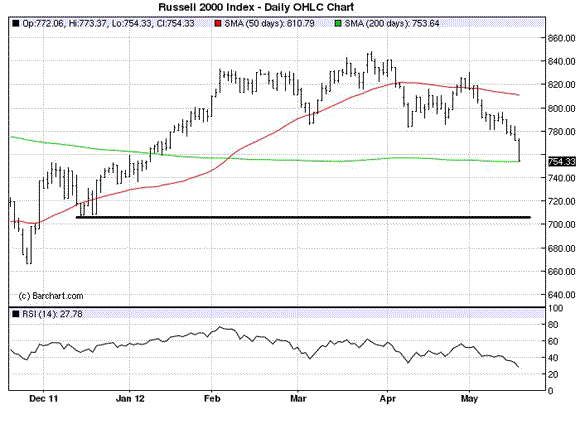

The Dow and Russell are just one more bad trading day from giving up all their gains for the year. France, Brazil, and UK equities are now negative for 2012. Most Asian equity indices have broken their 200-day moving averages.

Can the Facebook (FB) IPO save the stock market?

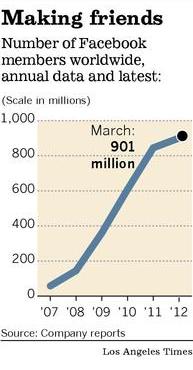

We don’t know and have mixed vibes about the FB. On the one hand, what an incredible and unprecedented information distribution system with a captive audience of almost 1 billion, many of whom are highly addicted.

On the other, does or can it add to a nation’s productivity and general wealth creation? Highly debatable, in our opinion, and some even argue FB is, or can be, unproductive. We tend to agree, unless, of course, we’re talking about revolutionaries.

Where will the stock price go? Don’t know, but probably higher in the long run until it proves it can’t or can grow into its valuation.

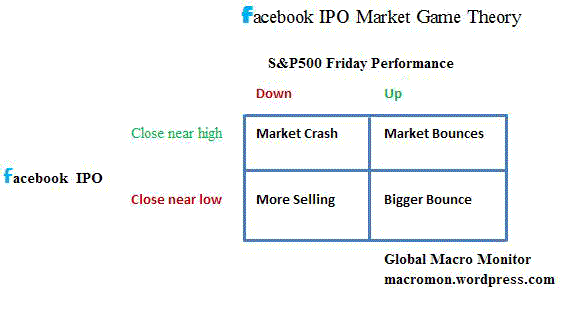

What if it flops? Glad you asked. Check out our market payoff matrix below.

We think if FB and the S&P500 close strong tomorrow we’re in for a market bounce that could last a few days. If FB closes weak and the S&P500 bounces, the relief rally could be even a bit more vigorous, in our opinion.

If FB closes strong and the S&P500 can’t find any traction and closes weak, grab your crash helmets and pray for some positive developments out of Europe.

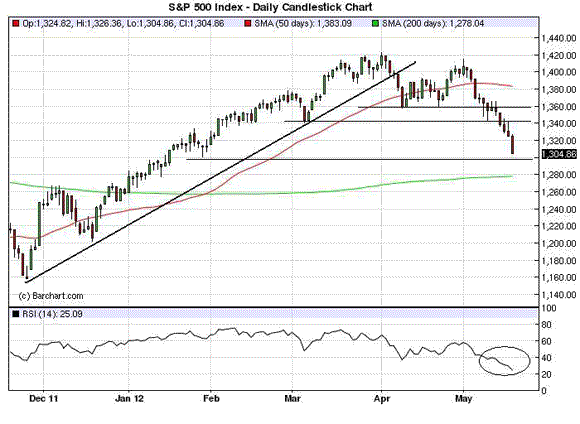

By the way, the major U.S. indices are nearing their 200-day moving averages. Watch 1,278 on S&P500. An early morning test and bounce could add vigor to a relief rally. The chart below shows the Russell closed today right on top of its 200-day.

Also note how oversold the S&P500 is with an RSI of 25.

As always, stay tuned!

Leave a Reply