Deutsche Bank and the Wall Street Journal are out with some numbers that paint a grim picture of the negative equity position of the nation’s homeowners. The numbers don’t add up precisely but the implications are pretty much the same.

Some 24% of owner-occupied homes had mortgage debt that exceeded the values of those homes at the end of June, according to data from Equifax and Moody’s Economy.com. That number rises to 32% when looking at the share of homeowners with mortgages that don’t have equity left in their homes.

Overall, 16 million homeowners are “upside-down” on their mortgages, up from 10 million, or 15% of owner-occupied homes, one year ago.

Nearly 10% of owner-occupied homes now have mortgage debt with loan-to-value ratios of at least 125%, and roughly half of those homes have mortgage debt with loan-to-value ratios of 150% or more.

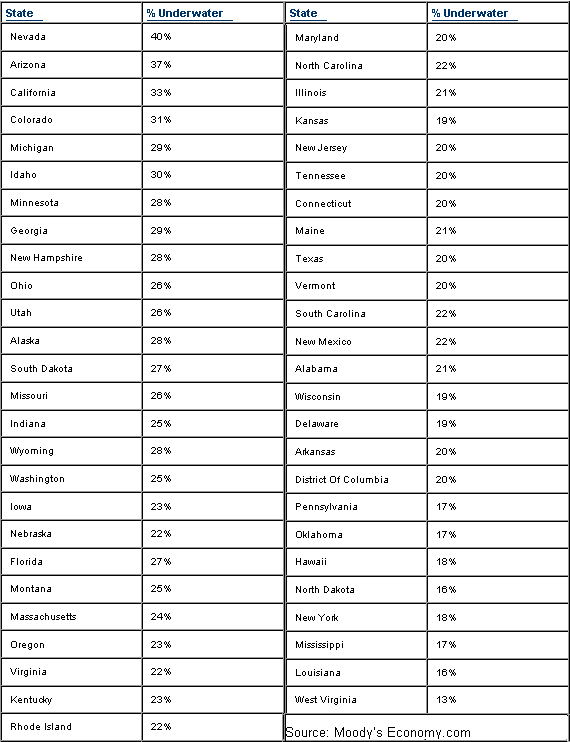

And they furnish this handy chart so you can see where your state stands:

Meanwhile, Bloomberg has an article citing numbers released by Deutsche Bank:

Almost half of U.S. homeowners with a mortgage are likely to owe more than their properties are worth before the housing recession ends, Deutsche Bank AG said.

The percentage of “underwater” loans may rise to 48 percent, or 25 million homes, as prices drop through the first quarter of 2011, Karen Weaver and Ying Shen, analysts in New York at Deutsche Bank, wrote in a report today.

As of March 31, the share of homes mortgaged for more than their value was 26 percent, or about 14 million properties, according to Deutsche Bank. Further deterioration will depress consumer spending and boost defaults by borrowers who face unemployment, divorce, disability or other financial challenges, the securitization analysts said.

“Borrowers may also ‘ruthlessly’ or strategically default even without such life events,” they wrote.

We could quibble with the inconsistencies between the two stories but that would be missing the point. Here are some of the implications:

- Labor mobility is significantly reduced.

- Residential real estate markets remain dysfunctional for an extended period as owners are trapped in existing housing.

- Historically high levels of foreclosures become chronic as a certain percentage of underwater owners inevitably face life altering events.

- Consumer demand is reduced as owners try and save their way out.

- New residential lending is constrained by concerns about equity values.

Feel free to add your own. These are just some that pop into my mind.

I would add that even if Deutsche Bank’s projections are wrong, the current situation is one that will most likely act as a brake on economic growth for a number of years to come.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply