On April 17 I wrote about a conversation with an individual who lives in Athens. He had this to say about the coming Greek elections:

“The other parties are communists, radicals and crazies. If they have a hand in the new government, then on May 7 Greece will be forced to take dramatic steps. The whole idea that the country should suffer, so the bankers can get paid will have to change.”

He also said this:

“The attitude in Brussels and Bonn towards Athens will change after the election as well!”

He had that right, so I called him back to get an post-election update.

BK: Is it true that you will soon spending Drachmas?

Athens: This seems to be the only possible outcome. Germany will no longer support Greece, neither will the IMF.

BK: What would the new Drachma be worth in Euros?

Athens: Far less than the rate that was used to convert Drachma to Euros in 2001. At least 50% less. For Greece, the exchange rate for the Euro will be the key, but you can’t forget that the Drachma will also have a new exchange rate for the dollar.

Greece joined the Euro in 2001 at a fixed conversion of 341Greek Drachmas to the Euro (EURGDR). In the period preceding the link, the USDGDR was 328.

Assume the Drachma floats freely and promptly loses half of its value versus the Euro. The market rate would be EURGDR 682. If the EURUSD was trading at 1.3000 it would mean that the USDGDR would be 568. The GDR would lose half its value against the Euro but it would only lose on 37% versus the dollar. I asked the fellow from Athens about this:

Athens: There is the proof. The Euro is too high against the dollar.

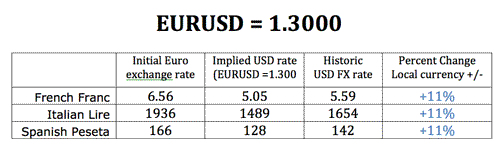

I thought that was an interesting comment. I went back and looked at the original conversion rates to the Euro for France, Italy and Spain and compared them to what the USD exchange rates would be today:

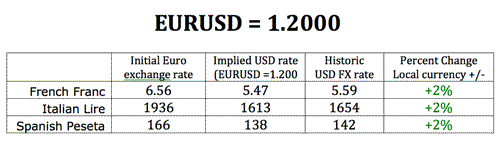

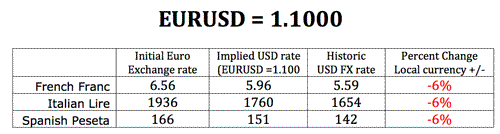

The +11% results for these countries versus the USA looks wrong to me. I considered what the local currency rates would be if the Euro were lower in value versus the dollar. A rate of EURUSD 1.20 still doesn’t get it done for me. It starts to “look right” with the EURUSD at 1.10

If the Euro were to be broken back into its original pieces, the old legacy currencies would trade around the Deutche Mark (DM). It is a very safe bet that if there was a free float of the currencies, the DM would increase in value versus all of the other EU members. It’s an equally safe bet that the USDDM of ~1.67 that was posted on 12/31/98 (last day of the DM) is going to also be much weaker (DM strength).

If the DM is going to make a comeback it will create a very nice new reserve currency. Money will migrate from both Switzerland and Japan to a different “safe” place. It will end up in Frankfurt. These are my estimate for what may happen:

| USDYEN = +10% | DMFF = +15% (1999 to date) |

| USDCHF = +10% | DMLIRE = +20% (1999 to date) |

| DMYEN = +30% (1999 to date) | DMPESETA = + 40% (1999 to date) |

| USDDM = -40% (1999 to date) | DMDRACHMA = +60% (2001 to date) |

| USDDM = Parity | DMESCUDO = +50% (1999 to date) |

| DMCHF = Parity | DMGUILDER = +10% (1999 to date) |

One thing is clear to me, Germany is going to take the brunt of the adjustments that must follow. The Germans are going to get hit from all sides. Its currency will rise against all the EU countries, it will rise against the Dollar and the Yen. This reality is the reason that Germany has done what they have to avoid a breakup of the Euro. I don’t think they can avoid the consequences much longer. Germany is now stuck between a rock and a hard place.

Leave a Reply