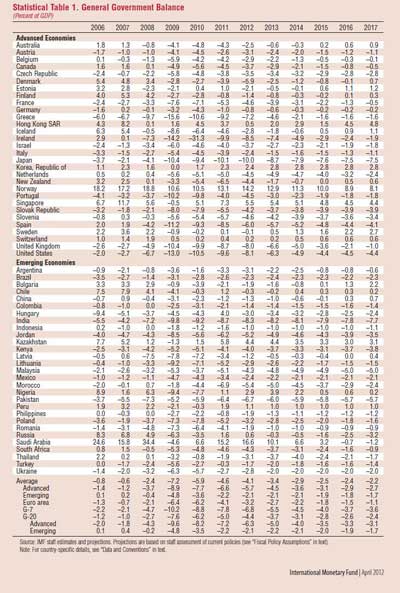

The IMF is out with their Fiscal Monitor today. Great stats. Here is a comparison of the fiscal health of the world’s economies.

Contrast Norway and Saudi (both oil exporters) with, say, the U.S. and Japan. Italy doesn’t look so bad when compared to other nations, no?

The upshot? This is IMF’s analysis,

Short- and medium-term fiscal indicators. These continue to show a high degree of risk. Despite substantial fiscal consolidation efforts, cyclically adjusted deficits continue to be elevated in many advanced and some emerging economies, and in the short run debt ratios are still rising in many cases. Although conditions are in place for a stabilization of debt ratios in many advanced economies over the next few years, in some cases countries have little margin for error in fiscal out turns or little space in current policies to absorb growth or interest rate shocks without the debt ratio’s continuing to rise. Debt ratios are decelerating in emerging economies, but remain higher than in the precrisis period. Overall, risks in this area remain broadly unchanged from six months

ago, with both deficits and debt ratios evolving more or less in line with expectations at that time, on average, in both advanced and emerging economies.

We’ll be posting more as we digest the document. Stay tuned.

(click to enlarge)

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply