William Blair’s Jason Ader & his team are upgrading Aruba Networks (NASDAQ:ARUN) this morning to Outperform from Market Perform.

– Their bullish stance is based on three main drivers:

1) the emergence of BYOD (bring your own device) in the enterprise, which makes mobility a strategic priority for IT departments, and they believe is still in the early innings (iPad 3 launch);

BYOD will sustain and potentially accelerate WLAN secular market growth;

Aruba best positioned vendor for BYOD. Firm believes that the BYOD phenomenon is only getting stronger, creating a paradigm shift in the way IT managers think about their networks and the devices, operating systems, and applications they need to support. The trend of employees bringing their own devices to work rather than using corporate-issued devices is still in the early innings, based on WBLR checks, and makes mobility a strategic priority for IT departments that fundamentally changes the discussion with an IT manager. This should sustain and potentially accelerate demand for WLAN solutions and puts Aruba in the catbird seat, given its technical DNA and large enterprise focus.

2) Aruba’s increasing ability to differentiate its solution from plain-vanilla WLAN infrastructure through the addition of rich software capabilities in mobility management, and security has boosted Aruba’s gross margin profile and likely means management’s prior long‐term gross margin target of 65%-68% needs to be raised;

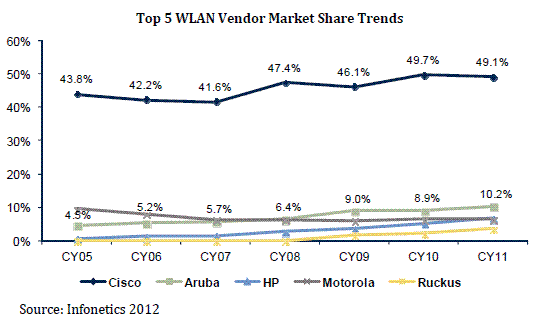

Aruba continues to take share; a two horse race in large enterprise. William Blair believes that Aruba’s competitive standing continues to improve, especially in the large enterprise focus area, where it has become a two-horse race between Cisco (CSCO $19.41; Market Perform) and Aruba, according to their checks, and where Aruba’s comprehensive management and security features really stand out. In the most recent January-ending quarter, Aruba appeared to gain share against market leader Cisco as evidenced by the company’s product year-over-year growth rate of 34%, compared to Cisco’s 25% growth in the same time period.

3) Aruba’s valuation has come down to earth, with the stock currently trading at 23 times WBLR calendar 2013 earnings estimate; they believe this bakes in the current revenue deceleration that the company is experiencing, but fails to account for potential revenue reacceleration as BYOD/tablets garner mass adoption in the enterprise and Aruba’s exit from the China hotspot business no longer hurts year over- year comparisons (firm is conservatively modeling the inflection point on year-over- year revenue growth to occur in the upcoming January quarter). They further believe the analyst day on March 28 will be a positive catalyst for the stock, as investors better appreciate how the BYOD phenomenon has caused a fundamental change in the way enterprise networks need to be built and managed, and how strategically positioned Aruba is for this transition to a mobility-centric world.

Valuation and expectations have come down to earth. Current Street consensus estimates call for 30% and 21% top-line growth in fiscal 2012 and 2013, respectively, which we believe leaves ample room for outperformance, given the company’s track record of exceeding expectations.

Notablecalls: Ader & his crew move these names. Sometimes big, 6-10%. I expect this to be the case today. Period.

Leave a Reply