Oh dear. The expected feel-good rally ran into a juddering halt, and instead morphed into a “sell the fact” on the Obama victory. Of course, pundits being what they are, they could obviously claim that yesterday’s rally was “always” going to happen. The market rallies? An obvious result of the Obama feel-good factor! The market tanks? Having bought the rumour of an Obama victory (and its presumed beneficent impact on consumer confidence), markets were always going to sell the fact once he was elected.

Of course, such Harry Hindsight analysis is utterly useless, particularly when you’re running risk. Your P/L tells you whether you had the right call. From Macro Man’s perspective, he has completely disengaged from positioning in equities. For choice, he would have expected the feel-good rally to continue, so being flat was the right choice.

In any event, it seems like the grim reality of the global recession is swiftly intruding into the recent rally. The notion of “value” is a movable feast, and overnight news suggests that the earnings target is moving swiftly…..lower.

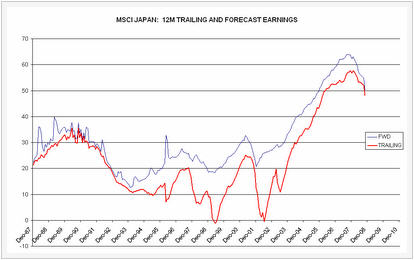

After last night’s close Cisco guided down forward revenue expectations to levels well below prior expectation. Perhaps even more significantly, Toyota slashed its profit forecasts after japan’s close this morning; the e-coupling dream seems a long time ago, doesn’t it? While analysts are forecasting relatively little earnings growth in Japan over the next year, it nevertheless seems likely that earnings will fall quite a bit more than currently expected. Sound familiar?

Of course, central banks globally are trying to address the dramatic economic slowdown. Of course, trying to do something and actually doing it are two different things, and it is now probably time to exhume a word last heard in 2003: “traction.” Specifically, the ability (or lack thereof) of policymakers’ actions to gain traction, to have an impact.

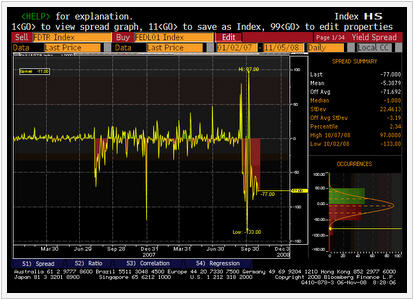

So far, the Fed’s policy actions have had mixed results. Bernanke and co. made a big deal about paying interest on reserves, as it would theoretically allow them to quantitatively ease while maintaining a nonzero funds rate. So far, that effort appears to be failing, despite repeated announcements from the Fed raising the level of interest (aka, the “floor” on the effective funds rate) that they will pay institutions depositing reserves at the central bank.

So far, it’s not working. For the last few days, the effective funds rate has traded well through the floor, at 0.23% (versus a floor of 0.65%.) There are a couple of esoteric technical factors driving this (relating to insurance and the exclusion of the GSEs), but it confirms that the devil with saving the world is in the details.

Today in Europe is, of course, central bank day, with both the Old Lady and the ECB poised to trim rates. While markets are demanding 100 and 50, respectively, Macro Man can’t shake a sneaky belief that the BOE will do a compromise 75 bps, which would disappoint both markets and mortgage holders.

A number of UK institutions have already announced that they will not pass through all of the cuts and/or pre-emptively raised their base-rate tracker spreads on new business. So unfortunately for Macro Man, it will take a 50 bp cut just to get him levels for his new mortgage that he could have achieved last week! Alas, the margin between joy and pain is often very thin indeed.

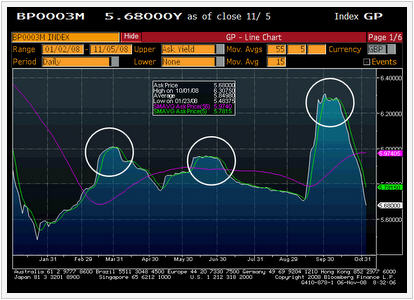

More broadly, he is bemused by the aggressive pricing in short sterling. December 2008 is currently pricing 3 month LIBOR at 4.10%, more than 1.50% above yesterday’s fix. Macro Man would rankly be rather surprised if the BOE cuts more than 1.5% this month and next. And given that we’ve already heard from mortgage lenders that not all of the base rate cuts will be passed on, why is the market expecting all of them to be passed on in the unsecured interbank lending market? Oh, and let’s nor forget….at quarter/year end, banks tend to hoard cash. Observe how 3 month sterling LIBOR has ticked up at each of the quarter ends this year.

Surely it’s not unreasonable to expect the same to happen at year end?

So even if Macro Man is wrong and the Bank does ease rates very aggressively in November and December….he still reckons the market is overoptimistic that the Old Lady gets traction.

Leave a Reply