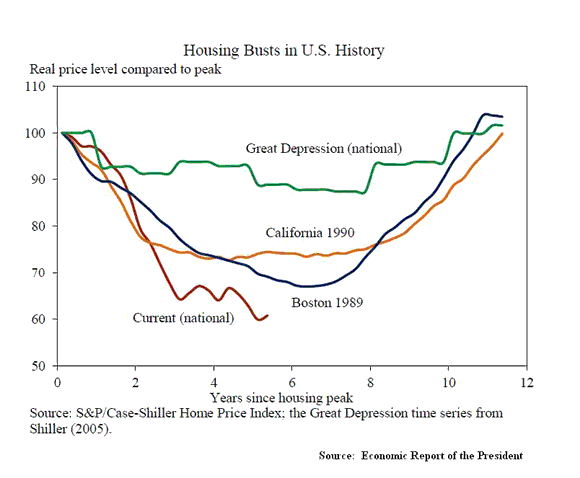

Great chart from the recently released Economic Report of the President. We suspect the Great Depression housing bust didn’t have the government props to soften the blow as we do today, which, therefore, on a relative basis, makes the current bust much worse. The prior conditions to the current bust must have been much worse than those before the Great Depression.

The Council of Economic Advisers (CEA) do note,

…during the Great Depression, the only other instance of nationwide price declines since WWI, much of the comparably-sized decline in nominal home prices was offset by a concurrent drop in general price levels, so the decline in real housing values was only about one-quarter as large as the one we recently experienced.

Thus the current collapse in housing prices is a relative price shift whereas the housing bust of the Great Depression was more a symptom of general price deflation in the economy.

If not for the decisive action of Paulson, Bernanke, Geithner and Co. we all may have become farmers living under the freeway. Can’t prove counterfactuals, but that is what we believe. So we give them an A+ for stabilization. Structural adjustment and long-term reform is an entirely different story, however.

We heard Meredith Whitney say yesterday morning that 95 percent of current mortgages are backed, effectively, by the taxpayer,

…95-plus percent of mortgages today are being backed by Fannie and Freddie. Fannie and Freddie are effectively subsidizing unprofitable mortgages that the banks wouldn’t put on their balance sheet. That’s not sustainable and ultimately the taxpayer is paying the bill for it. The banks used to price profitable loans and you know, they’re a myriad of loan products that they’re still not pricing for profits.

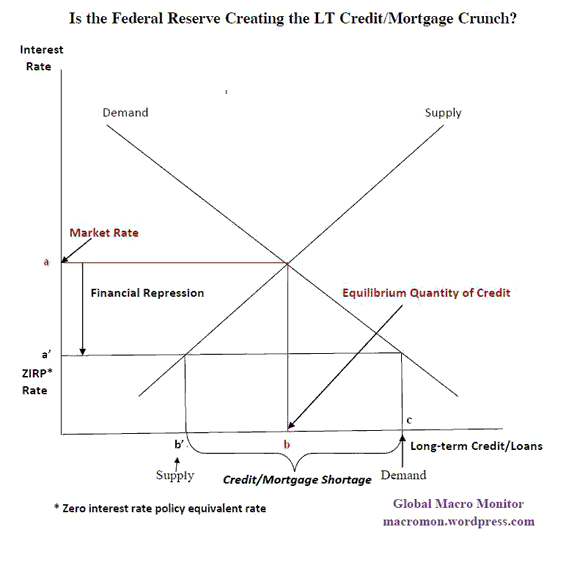

Basic microeconomics tells us that government repression of prices creates supply shortages. Think back to the rent control supply and demand graphs in Econ 101, which we have modified in the chart below.

This is one of the reason why we believe housing is so slow to recover. Who in their right mind x/ the Govie would lend long-term money at a rate lower or close to the current inflation rate? Rational lenders also take into account the massive monetization that is currently taking place globally and its impact on future inflation in calculating their expected real returns.

Leave a Reply