It’s all quiet on the equity front. For the past month, the S&P 500 Index has experienced an unusually calm period of lower volatility.

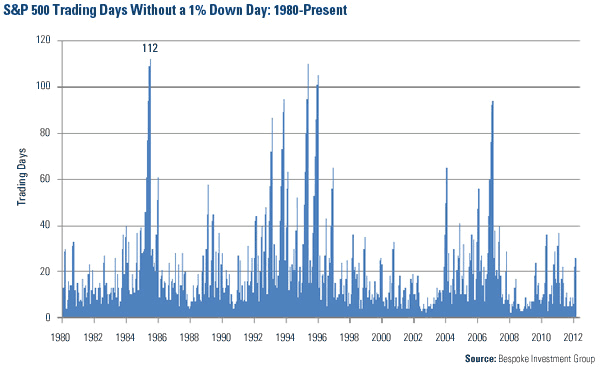

Bespoke Investment Group says the timeframe between December 28 and January 26 has been remarkably lacking in “1 percenters.” The firm found that it’s been more than a year since the S&P 500 has gone 26 trading days without declining one percent.

While 26 days is a lot in today’s volatile world, the consecutive lack of down days doesn’t even come close to a record streak for the S&P 500, says Bespoke. Over the past three decades, there were numerous streaks that lasted longer than 26 days, “with a few surpassing the 100-trading day mark,” according to Bespoke. The record number of days without a 1 percent drop appears to be 112 days during the mid-80s. The S&P 500 “quiet streak” these days hardly registers as out of the norm.

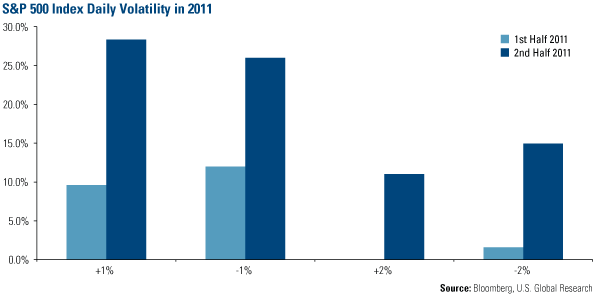

The market was particularly volatile last year, but we also noticed a distinct trend between the first half of the year and the latter half. Most of the daily movement in both directions was concentrated in the last six months of 2011. There were many more days that stocks increased or decreased at least 1 or 2 percent during the last half of the year compared to the daily movement during the first six months of the year.

During our January webcast with Jeffrey Hirsch of Stock Trader’s Almanac, Jeffrey noted an increase in severe moves since the 1999 repeal of the Glass-Steagall Act that removed the separation between investment banking and commercial banking. Jeffrey referred to an interesting blog post at the Stock Trader’s Almanac website that looked at the number of daily moves over the last century. Moves of 3 percent or more on a daily basis in either direction used to be rare, but since 2000, there were 125 in nearly 3,000 trading days. “Perhaps regulation (or the lack of) does contribute greatly to overall market volatility,” says the blog post.

We believe government policies are precursors to change, which is why our investment team continually monitors and tracks the fiscal, monetary and regulatory policies of countries. As active managers, in quiet or stormy markets, tracking this information helps us anticipate how markets might react so we may adjust our investment strategy accordingly.

Leave a Reply