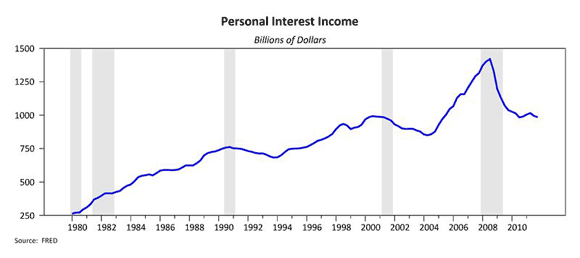

Edward Harrison at Credit Writedowns describes the Fed’s zero interest rate policy as “toxic,” noting that it is a transfer from savers and fixed-income investors to borrowers. On net, this is stimulative if the spending propensities of the latter exceeds that of the former, but the willingness of the borrowers to spend is constrained by weak household balance sheets. The Fed is thus pushing on a string, and possibly even making matters worse by reducing the income flow to households. Harrison points to the following chart to illustrate the severity of the problem:

If the Obama Administration takes advantage of low interest rates and is able to push forward with refinancing efforts for underwater borrowers, then we can expect an at least temporary economic boost of potentially substantial magnitude. See Joe Gagnon for estimates. I would expect more modest outcomes, as the Administration has proved itself capable of half-hearted efforts in the past. Anything, however, would be helpful at this point.

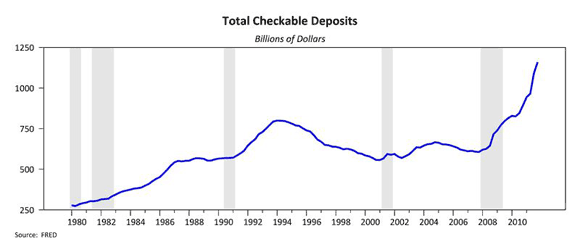

My question is how much of the zero interest rate environment is attributable to Fed policy directly? Or, in other words, is the Fed really just following the economy down? It seems that the banking system is awash with cash – note the trend of total checkable deposits:

Considering the lack of take-up on the other side of the savings/borrowing equation, I have trouble seeing that interest rates would go to anywhere but down to rock bottom levels. And I certainly have trouble seeing that the Fed would improve conditions by raising interest rates.

That said, I fully agree with Harrison when he predicts:

But remember, households are still over-levered and interest rates cannot be stimulative since they are zero percent. When the next recession hits and the yield curve is still flat as a pancake, bad things are going to happen. That’s why I have to remind you how toxic this policy is.

We have witnessed lower interest rates with each recession since the mid-1980’s, which begs the question of what happens when the next recession hits and the economy is still locked on the zero bound. Bad things, I think. From this I conclude that the Federal Reserve is clearly not taking the zero bound seriously enough. This is even more evident when one recognizes the central tendency for the Fed Funds rate forecast over the longer term is 4.0 to 4.5%, while six FOMC participants see the rate unchanged through 2014! Seems like a serious disconnect between where the economy is and where it should be. It is simply tough to disagree with Brad DeLong, who, upon reading Jim Hamilton, concludes the Federal Reserve is just plain wrong in its implementation of policy.

Maybe the next round of QE will do the trick, but I remain skeptical. Policy has consistently fallen short of that necessary to decisively propel the economy off the zero bound. Such policies have, in my opinion, fallen victim to fears of inflation. The Federal Reserve appears committed to a 2% target under any circumstances, with even a temporary increase considered unacceptable.

In short, I see the Fed’s policy as toxic not so much because interest rates are locked at the zero bound, but because the Fed sees no urgency in rectifying the situation. I think this will be proven to be a serious policy failure when the next recession arrives, and I wish the Fed would make a clear objective to lift the economy off the zero bound, rather than issue a forecast that, when coupled with lack of immediate policy action, represents acceptance of the zero bound. As far as what the Fed can do to accomplish such an objective, in addition to loosening the inflation target, I tend to think they need to shift their policy framework to regular, permament additions to the balance sheet until the economy is well beyond the zero bound rather than emphasize the temporary nature of the entire monetary policy agenda.

Leave a Reply