There’s plenty of commentary on the ongoing China-US Strategic Economic Dialog, from the Economist [1], Reuters [2], [3], and Bloomberg [4] [5]. Here are three pictures to place some of the issues in perspective.

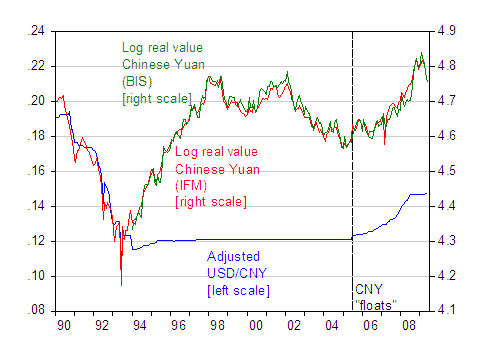

My first observation is while the nominal USD/CNY had stabilized in recent months, the exchange rate that matters most for global imbalances, the Chinese real trade weighted CNY, has moved around a bit, as the dollar has appreciated and depreciated.

Figure 1: Bilateral nominal USD/CNY exchange rate, period average (blue, left scale), log IMF trade weighted real effective CNY (red, right scale), and log BIS trade weighted real effective CNY (green, right scale). Bilateral exchange rate adjusted for swap center rates used before 1994; see Fernald, Edison, Loungani (JIMF, 1999) for details. Source: St. Louis Fed FREDII, IMF, BIS, and author’s calculations.

I must confess that while I’ve thought the yuan should have been allowed to appreciate more rapidly in the past [6], I’ve never believed that that in itself would substantially shrink the US-China trade deficit, in particular because of the relatively small estimated trade elasticities (see this post)

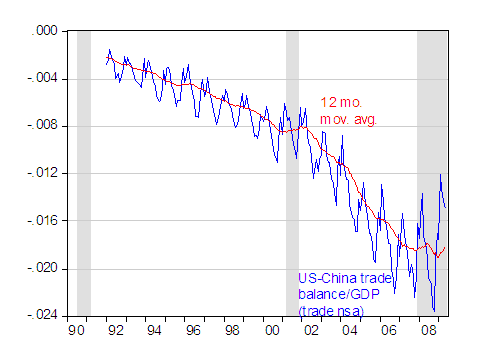

Second, the US-China bilateral trade balance, as measured by US trade statistics, has — like the non-oil US trade balance overall, stabilized as well, and seems like it may be increasing (i.e., the deficit shrinking) in the short term.

Figure 2: US-China trade balance, nsa (blue) and twelve month trailing moving average (red), divided by Macroeconomic Advisers estimate of monthly GDP. NBER defined recession dates shaded gray. Source: BEA/Census via St. Louis Fed FREDII, Macroeconomic Advisers, NBER, and author’s calculations.

Notice that since the trade balance is normalized by nominal GDP, there’s a “race” going on; the 12 month trailing moving average of the bilateral deficit in the numerator is shrinking, but so too is the nominal GDP in the denominator.

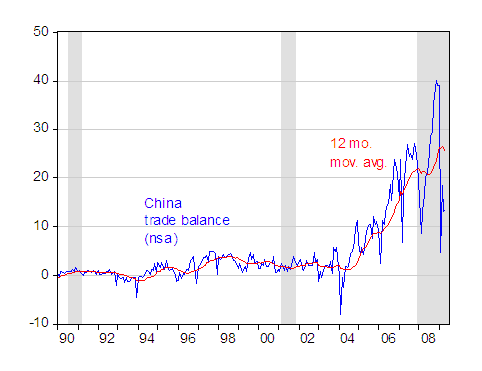

While the US-China trade balance is of interest primarily for political reasons, it’s the Chinese overall trade surplus which is key for thinking about global imbalances.

Figure 3: Chinese trade balance, in millions USD per month, nsa (blue), and twelve month trailing average (red). NBER defined recession dates shaded gray. Source: Chinese trade statistics from IMF, IFS, ADB; and NBER, and author’s calculations.

Here too, it’s early in the story to be able to say where the trade balance will go. In the April 2009 IMF World Economic Outlook, the Chinese CA surplus was forecasted for 10.3 ppts of GDP in 2009, and 9.3 in 2010. The most recent Public Information Notice for China (released 5 days ago) forecasts 9.5 for 2009, so clearly events are fast overtaking forecasts.

Here, of course, I’m talking about short term trends, and these are dominated by the financial crisis and recession [7]. My Eswar Prasad writes on prospects and policy implications for China while Bertaut, Kamin and Thomas write about what happens after the recession to the US external accounts, based upon pre-crisis trade elasticites. Whether those estimated trade elasticities will be the right ones in the longer term is up for debate (see here).

In any case, I think it is a good sign that in the debate, we see a greater focus on relative saving in the US and China (Bloomberg, Reuters), as a variable that has to be affected over the longer term, in order address global imbalances on a sustained basis.

By the way, Brad Setser has beat me to the punch (again), so be sure to read his post.

Three Pictures: China’s Exchange Rate and Trade Balances

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply