I have been hesitant to embrace the recent positive data flow – once bitten, twice shy perhaps. Something about the current dynamics that seems a little too familiar. Indeed, I felt something of relief when FT Alphaville came to a similar conclusion in the waning days of 2011. Cardiff Garcia reports on a Nomura research note that details a new bias in the seasonal adjustment process, noting:

Up next, writes Nomura, you can expect exaggeratedly strong readings from the Chicago PMI later this month and the next ISM manufacturing survey at the start of January.

I imagine it is premature to call the readings “exaggerated,” but both did surprise on the upside, as much data has of late. Read the whole piece – it is worth the time.

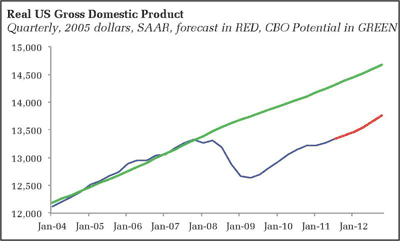

Indeed, flirtations with either excessive optimism or excessive pessimism were not richly rewarded last year, as on average the economy simply edged upward in pretty unremarkable fashion:

It seems reasonable to expect the same in 2012, at least as a baseline – a slow “recovery” that is really more of an adjustment to what appears to be the economy’s new equilibrium path, one that is decisively subpar to the pre-recession trend. I don’t believe that such an adjustment is necessary, as in my view it simply reflects a shortfall of aggregate demand. That said, the longer the cyclical downturn grinds on, the more likely it is that we will indeed see a new equilibrium path. A greater percentage of the cyclical unemployment will become structural unemployment or permanent shifts in the labor force participation rate. In addition, investments will go unmade as firms hoard cash. And, increasingly, policymakers will manage policy along the new equilibrium path, forgetting entirely the pre-recession path.

More than not, this is already the case. To be sure, some FOMC members are moving toward QE3, setting the stage for additional asset purchases, perhaps in the spring now that inflation concerns have eased somewhat. Still, the pace of policy change is agonizingly slow. From the most recent minutes:

A number of members indicated that current and prospective economic conditions could well warrant additional policy accommodation, but they believed that any additional actions would be more effective if accompanied by enhanced communication about the Committee’s longer-run economic goals and policy framework. A few others continued to judge that maintaining the current degree of policy accommodation beyond the near term would likely be inappropriate given their outlook for economic activity and inflation, or questioned the efficacy of additional monetary policy actions in light of the nonmonetary headwinds restraining the recovery. For this meeting, almost all members were willing to support maintaining the existing policy stance while emphasizing the importance of carefully monitoring economic developments given the uncertainties and risks attending the outlook. One member preferred to undertake additional accommodation at this meeting and dissented from the policy decision.

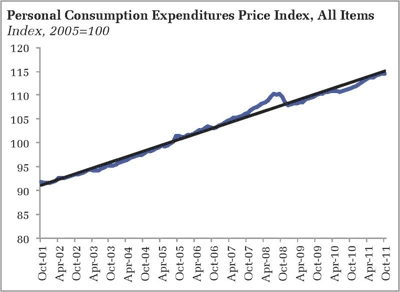

“Could well” warrant, but might not. Other than Chicago Federal Reserve President Charles Evans, FOMC members have been hesitant to act further despite the gaping and persistent output gap. It would seem that they are more willing to manage the economy along it current path, allowing unemployment to slowly decrease gradually – job gains or labor market exodus – rather than risk another percentage point of inflation. And with the PCE price index essentially now returned to pre-recession trend, there has been little enthusiasm to embrace such a risk:

But again only Evans appears willing to accept higher inflation. Perhaps policy change will accelerate now that Presidents Kocherlakota, Fisher, and Plosser are rotated off the FOMC, but note that this was always a minority block. Had the majority wished to advance policy more aggressively, they could have. The majority simply was not motivated enough to fight such a battle. And while they would act should the economy falter, that action will be delayed if the incoming data once again reflects Nomora’s upward seasonal bias, regardless of the underlying trend.

In short, while the FOMC has been edging toward additional action – and will likely do something after first enhancing communication procedures with additional rate forecast – they have not done so with the urgency called for by the anemic recovery.

While a repeat of last year is a reasonable baseline, I remain more concerned with downside rather than upside risks. Europe is still on the ropes, in my opinion. The ECB has bought some time with its LTRO, but the still high yields on long-term Italian debt suggest that that southern European nation is suffering from something closer to a solvency crisis than a liquidity crisis. And the austerity push is far from over, as, unsurprisingly, peripheral European nations will continue to miss budget targets, with Spain being the latest example. In my view, the European periphery will have trouble breaking the debt-deflation dynamic in the absence of currency devaluation. Such devaluation is a key mechanism to resolving balance of payments crisis, allowing for a rapid increase in competitiveness and stoking inflation that reduces the real burden of domestic-denominated debt. No such option is available to European nations, locked in as they are to the Euro. Consequently, I see 2012 as another year of challenge as Europe struggles to hold the Euro together by pressuring troubled nations into ever-greater austerity.

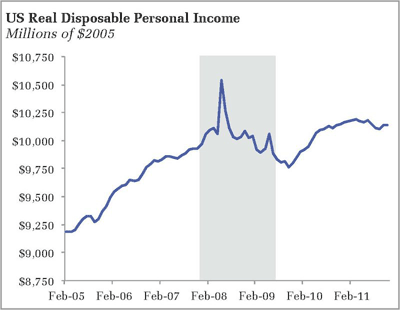

In addition to Europe, I remain concerned that US politics will usher in an ill-timed fiscal contraction. The payroll tax credit was extended for just another two months, and Stan Collender is warning that there may not be an easy path to an extension. And I continue to think that spending would be vulnerable to any sudden hit to income, especially when disposable personal income isn’t exactly surging forward:

Finally, the festering Iran situation is a wildcard, with posturing by both the US and Iran looking increasingly like a game of chicken, and both sides looking to provoke the other into a rash action. Of course, if any escalation of hostilities triggers an actual supply disruption that spikes oil back to $150 or higher, we would expect the global economy to lurch downward. Note, however, this is a perennial concern, and one that will not fade until we find an alternative to fossil fuels. Something we simply learn to live with, it seems.

Bottom Line: I want to believe the recent improvement in the tenor of economic data signals that activity is set to accelerate substantially in 2012. But the ups and downs on the past two years smoothed out to nothing exciting or catastrophic, just a moderate path of activity that remains woefully insufficient to return the US economy to its pre-recession trend. For now, I will stick to that middle ground, while remaining watchful of the all-too-many downside risks that leave me just a little bit sleepless each night.

Leave a Reply