One of the hotly debated issues among those debating policy in the pages of various Fed publications (virtual and otherwise) is why job creation in the United States cannot seem to break out of its sluggish mode. One potential source is an elevated level of uncertainty about the political and economic future that is damping business enthusiasm for risk and, consequently, holding back the expansion.

Heightened uncertainty as an impediment to growth has intuitive appeal to many and, in our Reserve Bank’s experience, considerable anecdotal support from business contacts. Unfortunately, intuition and anecdote don’t quite rise to the level of evidence. Fortunately, the work of uncovering the evidence (one way or the other) is under way. One example is a recent entry by Mark Schweitzer and Scott Shane in the Federal Reserve Bank of Cleveland’s Economic Commentary series:

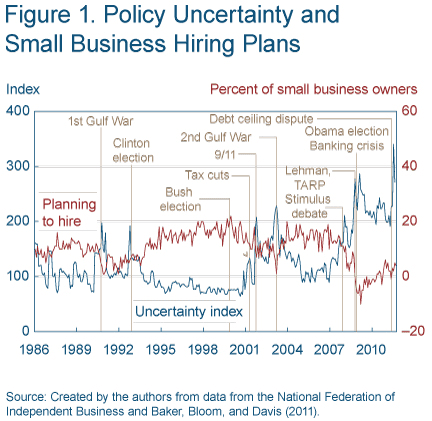

“In this Commentary, we empirically examine the hypothesis that ‘policy uncertainty’ adversely impacts small business owners’ expansion plans. To do this, we looked at the statistical association between data on small business plans to hire and make capital expenditures and a measure of ‘policy uncertainty.’ The data on small business plans cover January 1986 through July 2011 and were collected by the National Federation of Independent Business (NFIB).”

The picture relating the claims of respondents to the NFIB survey and the uncertainty measure employed by the authors is pretty compelling:

The correlation that can clearly be seen in this chart survives more formal statistical analysis:

“We find statistically significant negative effects of policy uncertainty on small business owners’ plans to hire and make capital expenditures over the 1986 to 2011 period. We also find a large effect of the economic downturn on small business plans, but the two effects do appear to be independent. The negative effects of policy uncertainty show up even when we weight the components of policy uncertainty in several different ways. The results also stand up when consumer confidence is controlled for, suggesting that the effects are distinct from consumer sentiment.”

The authors note the appropriate caveats but are pretty clear about how they read the results of the analysis:

“While this statistical analysis is informative about the relationship between policy uncertainty and small business expansion plans, we cannot say that ‘policy uncertainty’ causes small business hiring and capital expenditure plans to decline. That is because a purely statistical model cannot identify fundamental causes. But whatever the fundamental cause, our analysis indicates that adding information about policy uncertainty improves our ability to explain the survey responses provided by the NFIB’s survey respondents.

“In that sense, we can say that the correlations between the two are strong enough to reject the argument that policy uncertainty is irrelevant for currently weak small business expansion plans. In our view, policymakers should take seriously the widespread anecdotal reports that policy uncertainty is adversely affecting small business owners’ expansion plans.”

I think this study is really intriguing, but I would add another caveat to the results, emphasized not too many posts back here at macroblog:

“Talking about the role of the average or typical small business in job creation is problematic. Discussing it is challenging because job creation is highly skewed along the age dimension of small firms.”

Smallness per se is not the defining characteristic of the businesses that are responsible for driving job creation. In fact, research shows that once firm age is controlled for, no systematic relationship exists between net growth and firm size. The distinction between young and mature firms—which our own regular poll of small businesses verifies is important—is absent in the NFIB data that Schweitzer and Shane exploit.

Although the Schweitzer-Shane study is a good start to turning anecdotal reports into evidence, the results would be more compelling if they pertained to the actual universe of companies that we would expect to be creating jobs—that is, firms that are young, not just small.

Leave a Reply