A new Economic Letter put out by the Federal Reserve Bank of San Francisco, “Asset Price Booms and Current Account Deficits“, by Paul Bergin, addresses a subject that I’ve been thinking a lot about lately. The question is this: is there a systematic relationship between current account deficits and booms in housing prices, and if so, why?

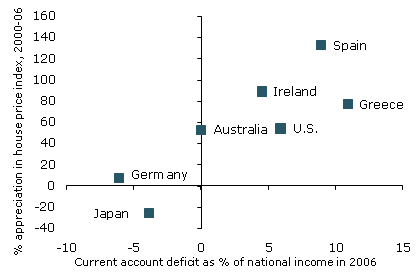

The picture to the right (from Bergin’s paper) summarizes why many people think that the answer to the first part of that question is yes. There are exceptions, of course, such as the recent boom in property prices in China (which has been running current account surpluses), but looking across countries there’s clearly a significant correlation between the house price appreciation and current account deficits. And looking across time within a single country, the relationship is also easy to see — for example, the biggest boom years in the US housing market (2002-06) coincided perfectly with the largest current account deficits in modern US history. Many European countries experienced the same coincidence in timing.

The picture to the right (from Bergin’s paper) summarizes why many people think that the answer to the first part of that question is yes. There are exceptions, of course, such as the recent boom in property prices in China (which has been running current account surpluses), but looking across countries there’s clearly a significant correlation between the house price appreciation and current account deficits. And looking across time within a single country, the relationship is also easy to see — for example, the biggest boom years in the US housing market (2002-06) coincided perfectly with the largest current account deficits in modern US history. Many European countries experienced the same coincidence in timing.

So if we believe that there is indeed a causal relationship between house price appreciation and current account deficits, what’s the explanation? Bergin mentions a couple of possibilities:

1. Rising house prices make consumers wealthier, so they spend more, which causes an increase in imports.

2. Rising house prices give consumers more collateral against which to borrow, easing credit constraints and allowing more consumption, which causes an increase in imports.

A third possibility, discussed in a paper by Pedro Gete, is this:

3. Rising house prices cause a reallocation of an economy’s productive resources away from manufacturing and into construction. The country must therefore source more manufactured goods from elsewhere, leading to an increase in imports.

All of these mechanisms are probably at least part of the story. But notice that these explanations all assign the role of cause to the house price boom, and leave the widening current account deficit as an effect. But in some cases at least, it is entirely possible that the causality could go in the opposite direction.

When a country experiences a surge in capital inflows — and yes, I’m thinking particularly about the periphery eurozone countries during the years after euro adoption — that capital flow itself may have a substantial impact on house prices, for a couple of reasons:

4. Capital inflows reduce interest rates, which has the effect of driving up the value of long-lived assets like houses.

5. Capital inflows require offsetting current account deficits, which imply a real exchange rate appreciation. With fixed exchange rates (e.g. within the eurozone) this will typically happen through a rise in price levels in the recipients of the capital inflows, and such price increases will disproportionately affect non-traded goods like real estate.

This is certainly not an exhaustive list; I think that this is an important area for additional research, both to explore other possible mechanisms as well as to better understand the relative importance of each. Just as importantly, better insight into how capital flows can affect asset prices will be crucial to understanding how policies that affect capital flows might impact house prices, or might even be used to dampen real estate bubbles. And as a bonus, this line of research will also help shed crucial light on how the flow of capital from the core to the periphery in the eurozone, by contributing to real estate booms in the periphery countries, may have done much more to sow the seeds for the eurozone crisis than commonly believed.

Leave a Reply