In our down is up world, Equity markets in Europe are higher after S&P put all of Europe on credit watch “negative.” The spin is this will prompt them into action and thus it is a good thing! What a charade.

With our futures slightly higher, the dollar is also higher. Is the U.S. a safe haven? LOL X 100 trillion, plus or minus a few tens of trillion. Bonds are slightly lower, oil is still hovering above $100, gold & silver are slipping, while food commodities head in the correct direction – lower.

There is no meaningful economic data today, so I want to take the time to talk a little bit more about Exchange Traded Funds (ETFs).

Many brokers are pushing them as a way for people to be “self-directed” in their retirement plans. When they first came out I actually thought they may be a good thing as they allow people to “invest” in things they couldn’t otherwise and they do allow ordinary people to play the markets in both directions. However, this industry has morphed into something that more closely resembles a gambling parlor. My advice is to stay as far away from ETFs as possible, here’s why…

An ETF is a DERIVATIVE. It is simply a piece of paper of some underlying market. It’s basically a market on top of some other market. It is someone’s attempt to create a market so that they can profit from the market – it is NOT created to benefit you, society, or some business. And unlike stock, it provides no working capital for any legitimate business. In fact, I would contend that they are not legitimate as they serve no real purpose to society, they are simply a form of legalized gambling.

Some would say they provide a legitimate hedge opportunity – and to that I would say that “investing” in something that requires you to hedge means that you are assuming too much risk in the first place! Thus the very need for hedging means there is too much risk already. In the second place I would contend that there are insurance markets for legitimate hedge reasons and those insurance markets are at least regulated.

ETFs have two ways of eating through your money. The first is that they are extremely high in management fees – remember, they are created to benefit the manager, not the sucker who buys them! But even bigger than that is the fact that the managers buy other derivatives to make their own derivatives work! This causes massive slippage. Slippage is when the underlying market moves say 10%, but the derivative only moves in that direction by 7%! Slippage is so bad in some ETFs, that if you own them for more than a few days then you can be right in your direction but still lose money because the ETF slips so badly!

In fact, this effect is so bad that many ETFs hide slippage under verbiage like this that accompanies SDS, the “Ultrashort” (2x) SPX ETF (designed to go up when SPX goes down at two times the rate):

This Short ProShares ETF seeks a return that is -2x the return of an index or other benchmark (target) for a single day, as measured from one NAV calculation to the next. Due to the compounding of daily returns, ProShares’ returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period. These effects may be more pronounced in funds with larger or inverse multiples and in funds with volatile benchmarks. Investors should monitor their holdings consistent with their strategies, as frequently as daily.

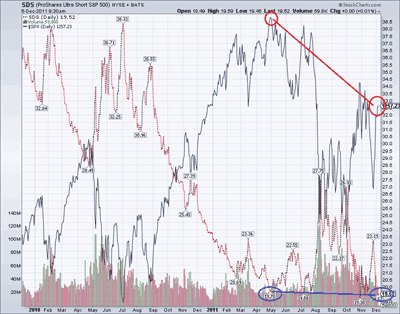

Get that? Not only will your returns vary, but they may even differ in direction! To see a real world example of this, let’s look at a two year chart of SDS (red and black dashed line) with SPX (solid black line) in the background:

(click to enlarge)

If you had purchased SDS in say May of this year and held it until today, you would have been absolutely correct in direction, and thus you would expect SDS to pay double the amount that the SPX is down. But in fact your SDS investment LOST YOU MONEY! You were right, you bet correctly, and yet you LOST MONEY. Great investment, great “hedge!”

So, what happened to your money? The derivatives players took it from you – period.

This “market” is completely not regulated – as in any regulators left, like the SEC, are completely in on the scam via the revolving door.

Again, my advice is to stay completely away from ETF’s of ALL types. Although some are better than others, they are all derivatives and they are not guaranteed by anybody. Again, they are nothing but sanctioned gambling, STAY AWAY.

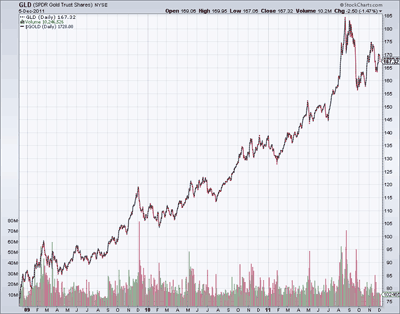

To be fair, I will show you an example of an ETF that does track the underlying very well – that is the gold ETF, GLD. Below is a 3 year chart of GLD with the price of Gold underlying it, you can see that indeed it does have a nearly perfect correlation:

(click to enlarge)

To their credit, the managers of GLD buy actual physical gold and place it in a vault. Thus your derivative has an actual physical something behind it – most ETFs do not. This is the proper way to run an ETF, and in my opinion if you’re going to allow them, then they must track the underlying by actually owning the underlying or they should be illegal. Still, as good as GLD is, I do not personally recommend owning it, I would prefer to simply own the physical metal myself as I know that when our monetary system unwinds that history proves that gold can be confiscated and I think it wise that ownership not be tracked or known by anyone.

I hope this article saves someone some grief – buyer beware! Stay as far away from ETFs as you can.

Leave a Reply