One way to measure the ability to service debt is to compute a debt-to-income ratio. Suppose, for example, that your income is $50K per year, that your home is worth $200K, and that you have a $150K mortgage. Then your debt-to-income ratio is 150/50 = 3; or 300%.

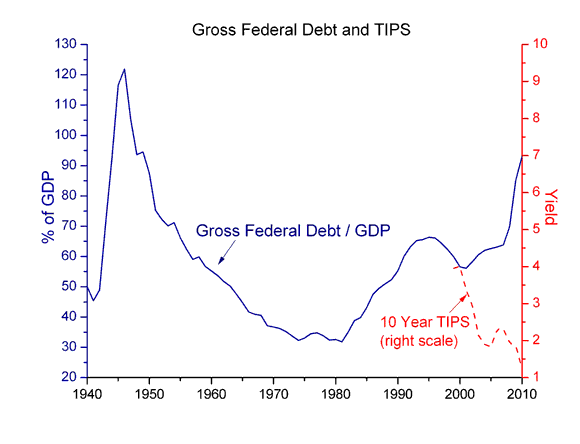

Similarly, one way to measure the ability of a country to service its national debt is to compute debt-to-GDP (a measure of domestic income) ratio. The ratio of U.S. federal debt to GDP is currently close to 100%.

Of course, what has a lot of people worried is not the level, but the trajectory, of this ratio. Clearly, the debt-to-GDP ratio cannot rise forever.

No, but on the other hand, there is some evidence to suggest that it can feasibly go much higher. (Whether it should be permitted to do so is a different question, of course.)

Before I go on, I want to clear up a misguided analogy that I frequently hear repeated. The misguided analogy is the idea of the government behaving like a household running up a massive amount of credit card debt.

If this is the way you like to think about things, let me ask you this: Which of your credit cards charge you 0% interest? I ask because that is the interest rate creditors around the world are willing to lend to the U.S. federal government. And what sort of credit card company starts to reduce the interest it charges on your debt as you become progressively more indebted (see the figure above)?

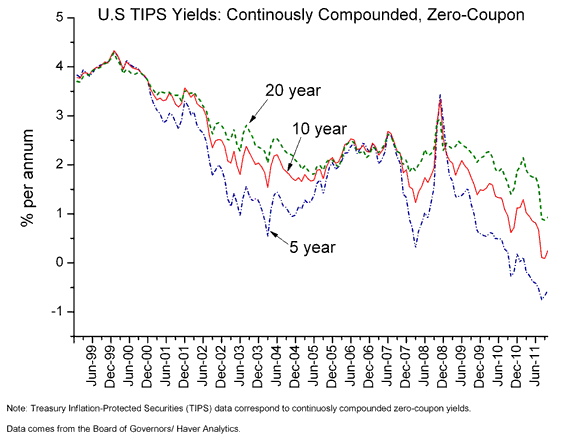

In fact, the terms are even much better than 0%. The real cost of borrowing is measured by the real (inflation adjusted) interest rate. As the figure above shows, the real cost of borrowing has plummeted over the last decade for the U.S. government. As the following figure shows, the U.S. government can now borrow funds for 10 years at close to zero real interest. It can borrow funds for 5 years at a negative real interest.

Now, a negative real rate of interest is a pretty cool deal. Imagine importing 100 bottles of beer from China today, and having to return only 99 bottles next year. If the interest rate remains unchanged one year from now, you can rollover your debt and make a profit. For example, you could borrow another 100 bottles of beer from China, use 99 of these bottles to pay off your maturing obligation, and then drink the remaining beer for free. (Of course, domestic beer brewers would become upset at the lack of demand for their own product, but maybe they can be bribed with free Chinese beer?)

Before we get too carried away, however, I explain here why these very low real rates constitute bad news.

Why are real rates so low?

My own view is that this phenomenon, at its root, has little to do with Federal Reserve or Treasury policy. I believe that the decline in real rates on U.S. treasuries reflects a steady change in how agents and agencies around the world want to structure their wealth portfolios. There has been a massive substitution away from many asset classes into U.S. treasuries; and it is this fundamental market force that is driving real interest rates lower.

The phenomenon began in the early 1990s, with the collapse of the Japanese stock market. Then Mexico in 1994, the Asian crisis 1997-98, Russia in 1998, and Brazil in 1999; see Bernanke (2005). Investors became rationally pessimistic about the returns to investing in these countries, as well as similar countries that had not yet experienced crisis. The natural effect of this would be capital outflows from these countries into relative safe havens, like the United States.

The basic thesis here is very much related to what Ricardo Caballero calls a “global asset shortage.” See his discussion here and here; and my own discussion here and here.

The global investment collapse associated with the recent recession has pushed already low real rates lower still. There has been a flight to U.S. treasuries not only by foreigners, but this time by Americans too. Evidently, the perceived return to domestic capital spending remains low. (Some basic theory available here.)

Policy

Given this pessimistic outlook, it seems unclear what monetary policy can do (the Fed is largely limited to swapping low interest currency for low interest treasuries).

I do, however, believe that there may be a role for the U.S. treasury (in principle, at least). In particular, given the huge worldwide appetite for U.S. treasury debt (as reflected by absurdly low yields), this is the time to start accommodating this demand. Failure to do so at this time will only drive real rates lower (possibly via deflation). For a world economy that is reasonably expected to grow, negative real interest rates imply a dynamic inefficiency. In short, this is the time to start raising real rates, not lowering them (real rates theoretically rise when new debt crowds out private capital, but note that new debt can also be used to finance corporate tax cuts to stimulate investment, if so desired).

Of course, what theory also tells us is that the government should also be prepared to reverse this recommended debt expansion (assuming that tax rates remain unchanged) once the domestic and world economy return to normal. One may legitimately question whether the government can be expected to make these cuts at the appropriate time. If the government lacks credibility along this dimension (or if future governments cannot be expected to abide by policies put in place by previous governments), then political forces may emerge to block an otherwise socially desirable debt expansion. Perhaps this is one way to interpret recent events.

Leave a Reply