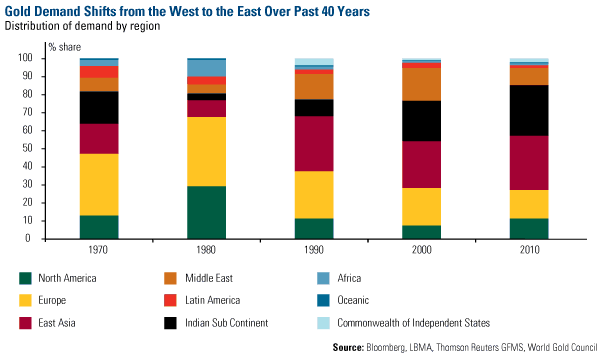

Yesterday we discussed how the landscape of gold mine production has changed over the past 40 years. (Read “South Africa’s Incredibly Shrinking Gold Production” now.) Today, we focus on the other half of the economic model—gold demand’s big shift from the West to the East.

In 1970, according to the latest World Gold Council (WGC) report, half of the world’s gold was purchased in two regions—North America and Europe. Ten years later, that figure jumped all the way to 68 percent during a period of high inflation, a weak economy and spiking gold prices. At the same time, China and India (broadly represented in the chart as East Asia and Indian Sub continent) saw their combined share of gold demand diminish from 35 percent to 15 percent.

Since 1980, there’s been a slow transition in demand, with the Asian tiger clawing its way back. In 1990, East Asia and the Indian Sub continent demanded 40 percent of the world’s total gold; by 2000, demand rose to about 50 percent, and today, the two areas devour roughly 68 percent of the world’s gold.

Jewelry has been a major driver of the shift from west to east, says the WGC as the countries in the east spend their rising discretionary income on gold purchases. The WGC anticipates this level of demand will remain strong in the East, given the ongoing trend of urbanization, rise of the middle class and high savings rates in India and China.

Read more about gold demand in this part of the world in 3 Drivers, 2 Months, 1 Gold Rally?

Leave a Reply