On Wednesday and Thursday of this week I attended a conference titled “Small Business and Entrepreneurship during an Economic Recovery,” presented by the Federal Reserve Board of Governors, the Federal Reserve Bank of Atlanta, and the Kauffman Foundation.

The conference agenda and papers are available here. Atlanta Fed President Dennis Lockhart gave one of the keynote addresses. His topic was business start-ups, job creation, and the role of banks.

Echoing the findings of research conducted by the Kauffman Foundation and others (for example, here and here), President Lockhart highlighted the vitally important role that business start-ups have played as job creators in the U.S. economy. He also made a distinction between true small business start-ups—those that intend to be small-scale operations (usually with single location and no more than a handful of employees), and growth-oriented start-ups. Both types of start-ups play a role in job creation, but the biggest impact over time comes from successful high-growth start-ups.

“Whether they’re so-called ‘mom-and-pops’ or ‘gazelles,’ they create some jobs at inception. Inherently small enterprises either fail or sustain operations, but tend to level off in terms of employment. The growth businesses ramp up creating initial employment. They may fail in time, or they may grow to what is still small scale and level off, or they may break out and grow to large scale.

“A 2010 Kauffman Foundation study shows that just 1 percent of employer businesses—those growing the fastest—generate roughly 40 percent of new jobs in a given year. Three-quarters of those businesses are less than five years old.”

So, if having a sufficient pipeline of new businesses is important to overall job creation, and especially enough start-ups with high growth potential, what is the role of banks as providers of financial capital to new business ventures? Because a new business is an inherently risky proposition, banks tend to provide a start-up loan only when it can be sufficiently collateralized. That collateralization often means using nonbusiness-related assets such as personal real estate. As President Lockhart’s notes:

“The most prevalent form of hard collateral is real property. Start-up entrepreneurs often hear, ‘If you’ll put up your house, we’ll lend to your new business.’ Real estate related to the business—to the extent the entrepreneur needs such and actually owns it—can be problematic as collateral because its value may be a function of the business cash flow it helps generate.”

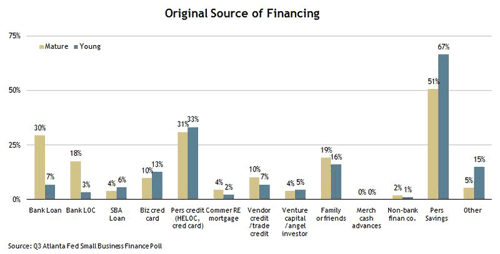

The results of Atlanta Fed’s most recent poll of small business credit conditions in the Southeast are consistent with the view that the combination of weak economic conditions and lower real estate values since 2006 has significantly reduced access to bank loans as a source of start-up capital. One of the questions in the poll asks: “When you started the business, what sources of financing did you use?” We are able to separate the answers from owners of mature businesses (those starting more than five years ago) and younger businesses (those starting in the last five years). The findings are summarized in the following chart.

(click to enlarge)

Although the sample size is pretty small, I found the results to be quite striking. The younger businesses we talked to were much less likely to have used a business loan or line of credit from a bank when they started than their more mature counterparts. Instead, these younger businesses were more likely to have used personal savings or some other source. Almost certainly, these differences between older and younger firms are not simply because young entrepreneurs suddenly didn’t want to get start-up financing from a bank.

There’s obviously still a lot to learn about the business creation process, including the financing of new business ventures in today’s economic and financial environment. I believe it’s important that these topics are moving up in the list of national priorities and that the body of research dedicated to them, as evidenced at this conference, is growing.

Leave a Reply