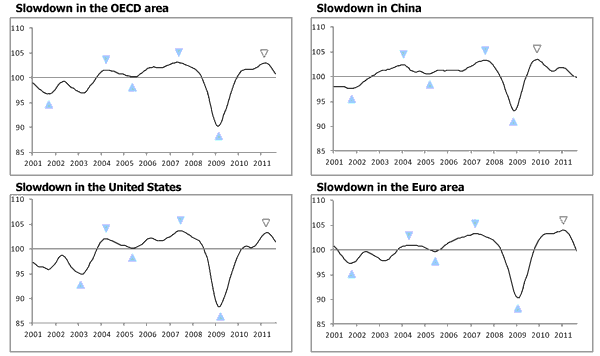

Or at least OECD plus China, on the basis of the OECD’s Composite Leading Indicators for August 2011:

Figure 1: from OECD

These series are scaled so that 100 is the long run trend. The euro area and China are at 100, and so those economies are no longer expanding relative to long run trend. The US remains above, but the gradient is negative. The latest readings on monthly GDP are mixed.

Figure 2: GDP (blue bars), monthly GDP from e-forecasting (red line), and from Macroeconomic Advisers (green line), all SAAR, in billions of Ch.2005$. NBER defined recession dates shaded gray. Source: BEA, 2011Q2 3rd release, e-forecasting, Macroeconomic Advisers, and NBER

These indicators merely confirm the need for additional stimulus. Moves to eliminate regulations, reduce the corporate tax rate, and pass free trade agreements [1] might provide growth at some time in the future, but are unlikely to provide succor to the economy in the short term. (Allowing the payroll tax reductions to lapse is contractionary, and current opponents at some time in the recent past were supporters of this tax reduction.) That leaves measures that have been outlined here.

Leave a Reply