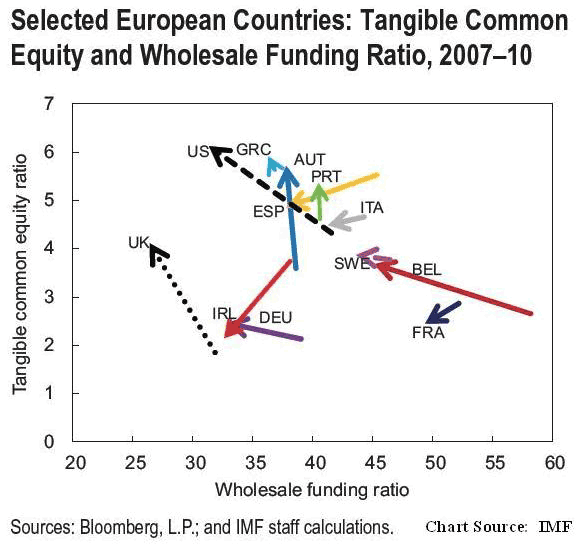

Another informative chart from the IMF showing the fundamental problem in Europe’s banking system – excessive leverage and dependence on wholesale funding. Add to that overexposure to highly indebted sovereigns with deteriorating credit fundamentals. It also illustrates why the German DAX and French CAC stock indices have been hammered over the summer and are two of the worst performing markets this year.

The arrows indicate the direction of the data points from 2007-2010. It also illustrates how the U.S. and U.K. got religion about strengthening their banking systems after the financial crisis.

How did the Euro banks get so levered up? The London Banker explains it best:

A primary fallacy of the Basel Accord is that OECD government debt is risk free and requires no bank reserves. Better yet, the banks can count the government debt they hold as Tier 1 capital, reserving against other debt assets. The Basel Accords assume all OECD government debt is a cash proxy, being liquid in all market conditions…

Roughly, the risk weights of the main asset classes under Basel I were:

– zero for Zone A (EEA and OECD) government debt of all maturities and Zone B (non-OECD) government debt of less than one year;

– 20 percent for Zone A inter-bank obligations and public sector entity debt (e.g. Fannie Mae, Freddie Mac, et al.);

– 50 percent for fully secured mortgage debt;

– 100 percent for all corporate debt…With Basel II they could reduce capital even further by writing each other a daisy chain of credit default swaps for all categories of exposure…

OECD government debt is zero risk weighted and accounts for a disproportionate bulk of Tier 1 capital of major banks. A default by any EEA or OECD government will force banks and central banks to recognise that government debt has inherent risk like all other debt. This would force recognition of a positive risk weighting, and bring into question the assumption that government debt can be counted as a cash-proxy in Tier 1 reserves. The illiquidity of impaired or defaulted government debt would undermine its role as a Tier 1 reserve asset in bank capital models…

If any OECD state were to default there would be very serious implications:

– The Basel Accord zero risk weight of government debt would be proved fanciful;

– The assumption of government debt as a liquid asset suitable for bank Tier 1 reserves to meet unanticipated and sudden cash demands will become unsustainable;

– Banks would be forced to recapitalise at much higher levels, forcing even sharper deleveraging and contraction of lending;

– Governments would lose the captive, uncritical investor base they have relied on to finance excess public expenditure for the past 30 years;

– Central banks could be forced to suddenly monetise even more government debt if required to meet the cash demands of a run on their undercapitalised banks.

Merkel & Co. finally seem to get it. Exit Trichet, enter Super Mario. It’s going to get interesting.

Leave a Reply