Although there has been a lot of good discussion about the political difficulties involved in solving the euro crisis, almost everyone seems to be missing two important points, or at least not paying enough attention to these points:

1. While the Greek crisis and the threat of European recession are related, they are two distinct problems. Causation runs in both directions.

2. The role of the ECB in the threat of recession is not passive; it is actively promoting a deflationary policy that it is under no obligation to enact.

Friedman and Schwartz showed that a central bank doesn’t have to be “doing anything” in order to dramatically tighten monetary policy. They don’t need to raise their target interest rate, and they don’t need to reduce the monetary base. David Beckworth has a good discussion of how passively tightening relates to the current recession.

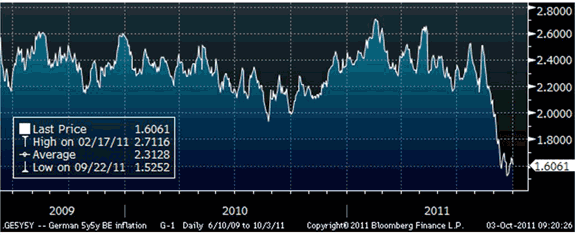

I admit that the concept of passive tightening is an acquired taste. Most people still want to see evidence that the central bank “did something” before they will accuse it of malfeasance. But here’s what I find most amazing of all. The ECB isn’t just engaged in passive tightening, they are actively tightening by the most conventional criterion for tight money–they are raising interest rates. And the monetary tightening is driving inflation expectations sharply lower, despite their mandate to produce stable inflation. Lars Christensen recently sent me the five year, five year forward ”TIPS spreads” from Europe:

So I have a bit of a problem with Venn diagrams showing no overlap between what policies would be helpful, and what policies would be politically feasible. I certainly understand the sense in which these are true. But there is a danger that we pundits will become excessively fatalistic. There are no legal, institutional, or cultural barriers against the ECB refraining from monetary tightening right now. There are no legal, institutional, or cultural barriers preventing the ECB from keeping the expected inflation rate roughly stable, at levels similar to those of recent years. It’s obviously not easy to convince them to do so, but I don’t think we should view the task as impossible. If we took that fatalistic attitude then there would be no hope for sound public policies, and we pundits might as well just close up shop.

Keeping inflation expectations stable would not solve the Greek debt problem. But it would help much more than most people realize, in two distinct ways.

Let’s start with the risk of recession. We know from painful experience in the US that solving a financial crisis doesn’t solve the problem of AD shortfall. When I pointed out in late 2008 that the real problem was falling NGDP, not financial turmoil, I was viewed as something of a nut. My heterodox view is pretty much conventional wisdom in America circa 2011. Aggregate demand/recession and financial turmoil are logically distinct problems. The second point to emphasize is that demand shortfalls tend to reduce inflation expectations. We’ve known this for a long time, but recently it has become truer than ever, thanks to the peculiar nature of the world oil market. We used to think inflation fell gradually during recession, due to sticky prices. But now the price of oil is very sensitive to expected NGDP growth, and hence headline inflation (which is used in TIPS spreads) actually falls fairly fast during demand-side recessions. So any policy that prevents TIPS spreads from falling sharply will, ipso facto, sharply reduce expectations of a demand-side recession. It doesn’t mean a recession can’t occur with stable inflation expectations, but it’s likely to be much milder.

Go back and think about what that graph means. Then think about the fact that this post isn’t relying on controversial “passive tightening” arguments; the ECB is actively and openly raising rates to reduce aggregate demand. They are engaged in monetary tightening by any reasonable definition. And this monetary tightening is reducing inflation expectations and increasing the likelihood of recession. There really should be even more outrage than there is. We are not talking about a conservative, hide-bound institution that is too cautious to take the bold action needed (as many assume), we are talking about a rogue elephant that is actively and aggressively driving Europe into recession. That’s an outrage.

Even worse, a new recession with falling eurozone NGDP will make the debt crisis much worse. Just to be clear, I’m not saying a policy of steady eurozone inflation would solve the debt crisis, obviously it wouldn’t. But the current policy is making it far worse than it needs to be. The US made the same mistake in mid-2008. Even at that time the subprime crisis was well understood, and estimated losses to the US banking system were quite high. But when the Fed drove NGDP expectations much lower in late 2008 (passive tightening) the debt situation got far worse, and spread far outside the original subprime sector. Now we are seeing the euro sovereign debt crisis spread to more and more countries. I wonder why? Do investors understand that falling NGDP makes the Italian and Spanish debt situation even worse? Might they be market monetarists?

PS. Please don’t tell me about the official eurozone inflation target. Even if expected inflation is right on target, the euro “TIPS spreads” will be a bit above target, as under a fiat money regime the tail risk of high inflation almost always exceeds the tail risk of rapid deflation. There is a reason why TIPS spreads are typically a bit above 2% during “normal times.”

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply