I am often a fan of neglected small cap stocks. When I find a good one, I add it to my portfolio. But I am generally not a fan of stocks that trade below $1.00. Why? Because there are many promoters of the stocks who deceive those who are illiterate regarding the markets, promising big gains, but end up delivering significant losses.

I see lots of penny stock ads. Big deal. But one ad got under my skin. This article was motivated by an ad that said, “Penny stocks made me rich.” Now, there may be a handful of people for which that is true, but in general, those that invest in penny stocks lose money.

There is a constant in investing, that amateurs who invest in volatile asset classes tend to lose money, and more money as the asset classes get more volatile. Penny stocks are volatile in the extreme. Even leaving aside the promoters who pump-and-dump, it is a rare person who can approach these in a businesslike manner.

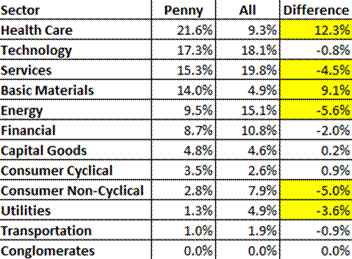

But now, if I can, I’d like to describe the penny stock universe to you. Here is how penny stocks differ versus the market as a whole:

Because biotech companies tend to be small, and have a high failure rate, the healthcare sector is much larger for penny stocks. With basic materials, the adage that a gold mine is a hole with a liar at its mouth holds true. Thus there are more companies in those two sectors.

Services, Energy, Consumer Noncyclicals, and Utilities are all industries where there are increasing returns to scale, and where minimizing costs likely dominate over trying to offer specialized products that add value.

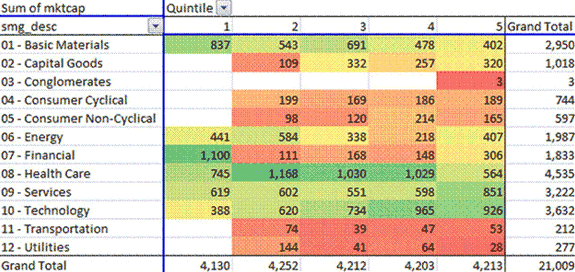

Now let’s look at penny stocks segmented by sector and size. Same sectors, but the $21 billion of market capitalization that the 2,800+ penny stocks live in are divided into five roughly equal quintiles by market capitalization.

Here’s the breakdown:

The financials have Fannie, Freddie, and some other large failed banks in the first quintile.

Health Care has a lot of companies, regardless of size. Services, Basic Materials, Energy and Technology are similarly consistent. Many small companies pursuing advantage versus much larger competitors.

The smaller sectors are random as should be expected. There is no surprise there. After all, they don’t have advantages from economies of scale.

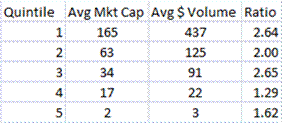

Here is my final table:

In general, the smaller the market capitalization gets, the less liquid the stocks are. This is not perfectly linear, because there are promoters pumping and dumping the stocks in the lowest quintile. (and in higher quintiles as well.) The larger the market capitalization, the harder it is to pump-and-dump.

In general, the smaller the market capitalization gets, the less liquid the stocks are. This is not perfectly linear, because there are promoters pumping and dumping the stocks in the lowest quintile. (and in higher quintiles as well.) The larger the market capitalization, the harder it is to pump-and-dump.

So be wary when buying stocks with small market capitalizations. All the more, pay attention to balance sheets, revenue recognition policies, and other accounting quality measures. Act like an intelligent value investor, if you dare, because you are playing on dangerous ground. There are safer places to play, go elsewhere. Don’t let the seeming cheapness delude you. This is an area where accounting frauds are rife, and where ordinary investors lose a lot.

DON’T BUY PENNY STOCKS.

Leave a Reply