Ryan Avent reminds us of a depressing point:

…Ben Bernanke seems to have forgotten everything he once knew about the crises in the 1930s and in Japan in the 1990s. America is sinking back toward recession while the global economy nears a cliff, and the Fed—by its own acknowledgment—has plenty of heavy ammunition sitting untouched on the shelf.

I recently had reason to re-read then Federal Reserve Governor Ben Bernanke’s 2003 speech on Japanese monetary policy, and realized again that he eliminated virtually every objection to doing more. Concerned about a temporary inflation increase beyond the target rate? Not an problem, according to Bernanke:

A concern that one might have about price-level targeting, as opposed to more conventional inflation targeting, is that it requires a short-term inflation rate that is higher than the long-term inflation objective. Is there not some danger of inflation overshooting, so that a deflation problem is replaced with an inflation problem? No doubt this concern has some basis, and ultimately one has to make a judgment. However, on the other side of the scale, I would put the following points: first, the benefits to the real economy of a more rapid restoration of the pre-deflation price level and second, the fact that the publicly announced price-level targets would help the Bank of Japan manage public expectations and to draw the distinction between a one-time price-level correction and the BOJ’s longer-run inflation objective. If this distinction can be made, the effect of the reflation program on inflation expectations and long-term nominal interest rates should be smaller than if all reflation is interpreted as a permanent increase in inflation.

Fearing the possible capital loss on the Fed’s balance sheet should interest rates need to rise quickly? Bernanke offers a solution:

In short, one could make an economic case that the balance sheet of the central bank should be of marginal relevance at best to the determination of monetary policy. Rather than engage in what would probably be a heated and unproductive debate over the issue, however, I would propose instead that the Japanese government just fix the problem, thereby eliminating this concern from the BOJ’s list of worries. There are many essentially costless ways to fix it. I am intrigued by a simple proposal that I understand has been suggested by the Japanese Business Federation, the Nippon Keidanren. Under this proposal the Ministry of Finance would convert the fixed interest rates of the Japanese government bonds held by the Bank of Japan into floating interest rates. This “bond conversion”–actually, a fixed-floating interest rate swap–would protect the capital position of the Bank of Japan from increases in long-term interest rates and remove much of the balance sheet risk associated with open-market operations in government securities. Moreover, the budgetary implications of this proposal would be essentially zero, since any increase in interest payments to the BOJ by the MOF arising from the bond conversion would be offset by an almost equal increase in the BOJ’s payouts to the national treasury

Is the debt an impediment to additional fiscal policy? We can fix that, too:

In addition to making policymakers more reluctant to use expansionary fiscal policies in the first place, Japan’s large national debt may dilute the effect of fiscal policies in those instances when they are used. For example, people may be more inclined to save rather than spend tax cuts when they know that the cuts increase future government interest costs and thus raise future tax payments for themselves or their children…If, as a result, they react to increases in government spending by reducing their own expenditure, the net stimulative effect of fiscal actions will be reduced. In short, to strengthen the effects of fiscal policy, it would be helpful to break the link between expansionary fiscal actions today and increases in the taxes that people expect to pay tomorrow.

My thesis here is that cooperation between the monetary and fiscal authorities in Japan could help solve the problems that each policymaker faces on its own. Consider for example a tax cut for households and businesses that is explicitly coupled with incremental BOJ purchases of government debt–so that the tax cut is in effect financed by money creation. Moreover, assume that the Bank of Japan has made a commitment, by announcing a price-level target, to reflate the economy, so that much or all of the increase in the money stock is viewed as permanent.

The supposed impediments to additional policy, according to Bernanke himself, are illusionary. Simply ghost stories to scare the public into thinking there are no more policy options. So why the delay? It all comes back to deflation:

In that spirit, my remarks today will be focused on opportunities for monetary policy innovation in Japan, including specifically the possibility of more-active monetary-fiscal cooperation to end deflation.

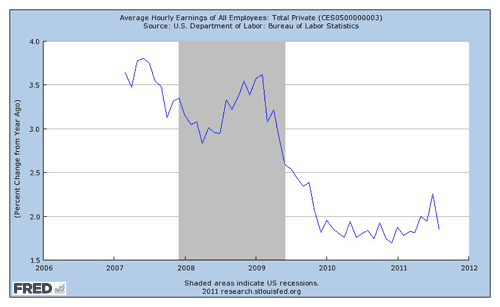

In Bernanke’s view, only obvious evidence of deflation jusifies the use of aggressive policy. And with downward nominal wage rigidities, the US outcome may very well be one of persistent low inflation, not outright deflation like Japan:

If average hourly wages for all employess are locked up on the downside at 1.75% y-o-y growth, I suspect outright, sustained delation will not be likely. And without deflation, aggressive policy is unlikely. And without aggressive policy, a rapid rebound to trend is out of the question.

Bottom Line: It has got to get a lot worse before policmakers will pull out all the stops to try to make it better.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply