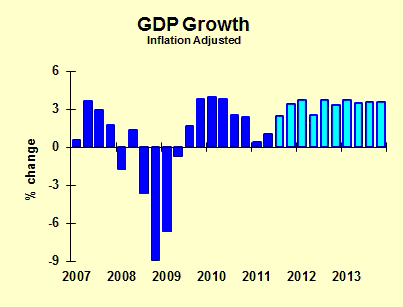

Here’s my revised economic forecast, now going through 2013. Moderate growth in most of the forecast horizon. An acceleration to somewhat stronger growth occurs near the end of this year and the beginning of next.

The mild acceleration is due to lagged effects of monetary policy. QE2 is over, but monetary policy works with long time lags, as I noted in the best book for business managers about economics. Also remember that the economy is naturally self-equilibrating. It may take a while, but the economy will invariably fix itself, absent major policy errors. One key self-equilibrating factor is stronger purchasing thanks to weak inflation, as well as stronger hiring thanks to weak real wage rates. Note that when I say “stronger” I’m speaking of a comparison with the depths of the recession; I’m not saying that spending or hiring will be “strong.” But they don’t need to be “strong,” just stronger than they used to be.

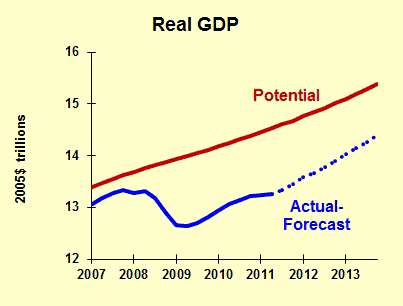

Am I an optimist? Quite often I am, because that has been a good bet. But here is the pessimistic look at my forecast, comparing my GDP prediction with a measure of potential, what we could be producing if we fully utilized our labor and capital resources:

The continuing large gap between actual and potential output will show up in an unemployment rate that gradually declines, but remains above normal throughout the forecast horizon. With this much unusued capacity, overall inflation will be low, on average. Some external inflation in commodity prices will be offset by weakness in the domestic market.

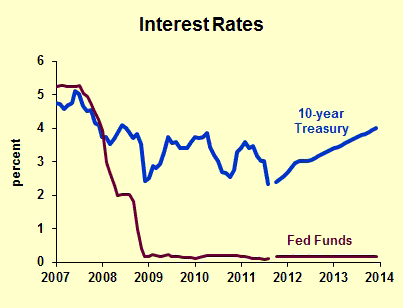

With weak output and low inflationary pressure, the Fed will keep interest rates low for an extended period of time, as Ben Bernanke said recently. No surprise there. Long-term rates will rise as the global economy improves. With gradual economic recovery, the rise of long rates will be gradual as well:

Risks abound, and I would not encourage anyone to take ANY economic forecast as gospel. The greatest risk now is a European recession, which could start at any time. I’m also concerned about the possibility of a Chinese recession, which could start next year. I do NOT forecast either of these events, but the risk is high enough that it warrants economic contingency planning. A European recession would likely lead to a U.S. recession. A Chinese recession, especially if it occurs in a couple of years rather than earlier, probably would not trigger a recession here. Still, our growth rate would slow down.

What about economic policy? There are no magic bullets out there. Even if there were a magic bullet, Ice cream cone it’s unlikely that it would survive the political process. We’ll hear a lot about policy after Labor Day, and there are certainly some policies that would be helpful. However, they are on a par with telling a dieter to skip today’s ice cream cone. Good advice. It will help a little. It will not change the look of the economy immediately, though.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply