We find this Bloomberg piece very interesting. Maybe this is where some of the panic buying in gold is coming from. We’ve been pounding the table on this trade. See here and here. Bloomberg writes,

China should urgently assess risks from being the main foreign investor in U.S. debt and diversify its foreign-currency reserves more quickly, the Financial News reported today, citing Xia Bin, a central bank adviser…

China should buy more non-financial assets with its reserves to diversify risks, Xia wrote, adding that the country should also pursue national strategic interests, and seek to globalize the yuan. He previously said that China should use its reserves to increase holdings of gold and some other precious metals.

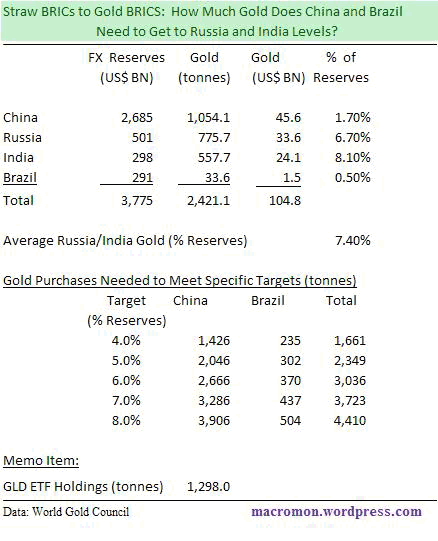

If China’s central bank does get serious about diversifying its reserve assets into gold the price move is just getting started. Take a look at the table we put together last December.

Granted the data are a little dated (Dec 2010) as you don’t pay us enough to pull all-nighters to produce it on a more timely basis. But it does show that if China increased its gold holdings from 1.70 percent to 5.0 percent of reserves, the PBOC would have to buy over 2,000 tonnes, which was almost double what the GLD, the gold ETF, held at the time And that’s just China. Stunning.

Leave a Reply