The Institute for Supply Management’s Non-Manufacturing, or Service, survey fell in July to 52.7 from 53.3 in June. That is the lowest reading since January 2010. Like its venerable brother the Manufacturing survey, this is a “magic 50” index where any reading above 50 indicates that the economy is expanding and anything below 50 represents an economic contraction.

Thus, this means that the Service side of the economy, which is far larger than the manufacturing side, is still growing, but the rate of growth decelerated in July, relative to June. This makes it 20 straight months that it has been over the “magic 50” level. While the level is still showing an expansion, the number came in below than the 53.7 consensus expectation, and is thus a big disappointment. It was not quite as bad as the ISM Manufacturing report was on Monday.

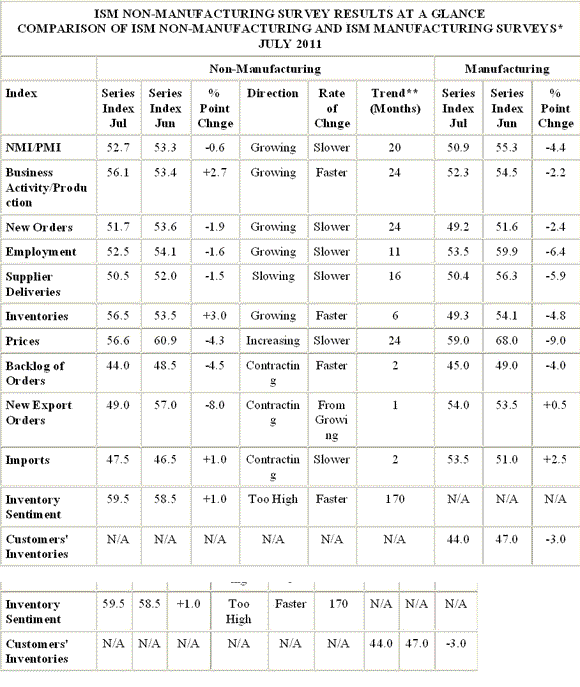

Like the manufacturing survey, this index is made up of ten sub-indexes that roughly correspond to the manufacturing sub-indexes. In this recovery, the manufacturing side of the economy has been stronger than the service side (well, until Monday’s report). The Manufacturing index slipped to 50.9, from 55.3, far below expectations and the lowest level in two years.

Weak, but Not as Bad

This report is weak, but not as weak as the Manufacturing survey. Fortunately, manufacturing is a much smaller part of the economy than the service side. Still, you have to count this as one more piece of bad data, and part of a mosaic that looks like an economy that is near stall speed.

Four of the sub-indexes fell while four increased on the service side this month. Seven are above the “magic 50” level. The performance of the more important sub-indexes were mostly negative (relative to June). The most important measure of current business activity is, well, the business activity sub-index, and was the exception. It rose 2.7 points this month, to 56.1, a very solid reading.

Twelve industries reported higher business activity and just five reported a slowdown in activity. Thus current business activity in July was OK on the service side. The picture looking forward, though, is not quite as pretty.

Backlog of Orders

The most important index for the very short-term future is the backlog of orders index. That dropped by 4.5 points to 44.0, the lowest of any of the sub-indexes. There were just two industries reporting an increase in backlog, and seven with a decline. A falling backlog is a good indication that activity is going to slow in the near future.

As businesses work off their existing backlog of orders, they need to replace them with new orders. There the news is better, but not good, with a drop of 1.9 points to 51.7. That still indicates that new orders are rising, but an anemic clip and a slowdown from last month. There were ten industries reporting higher new orders and four reporting a decline.

Employment

The employment sub-index is also very important, especially with unemployment running at 9.2%, and rising in recent months. The 1.6 point decline is disappointing, as it fell to 52.5. That is still below the manufacturing employment sub-index level of 53.5, but not as big a drop. The manufacturing side plunged 6.4 points. Nine service industries reported higher employment while five reported trimming payrolls.

In today’s ADP report, though, more than all of the job creation appeared to be coming from the service side, not manufacturing. Manufacturing payrolls declined by 1,000, while the service side added 121,0000. The employment sub-index has been above the magic 50 level for eleven straight months now.

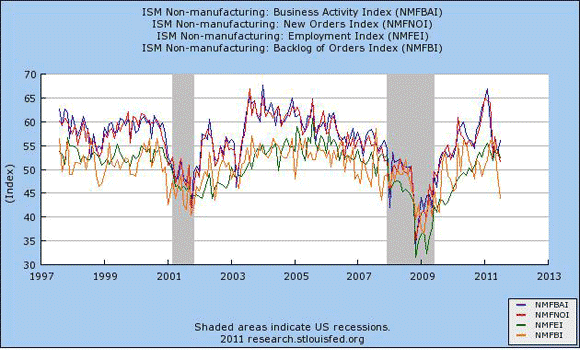

One thing to keep in mind is that these are diffusion indexes (the reading is the number of positive responses, plus one half of negative responses). As such, they measure the number of companies that are adding or trimming jobs, not the number of jobs they are creating or losing. Thus it is not exactly an apples-to-apples comparison. Still, over time, the ISM employment indexes, both manufacturing and non-manufacturing, have tended to track employment well. The graph below shows the history of the key sub-indexes. The declines in recent months are reason for concern, but not for panic.

Another Disappointment

Overall, this was disappointing report. It was well below expectations and level is now distinctly mediocre. It is consistent with a continuation of the pseudo-recovery, where the economy is technically growing, but not fast enough fro anyone to feel it, especially the army of the unemployed. It is unlikely that the economy will slip back into a double-dip recession if the ISM Service index — and the Manufacturing index — are both above the 50 mark, but neither is all that far away from dropping below the “magic 50” level, so it would not take that much to raise the new recession odds.

As the report was below expectations, the stock market should not like it. The deceleration in growth is not welcome. The business activity index was OK, but the market is more concerned with the future than the past, and the drop in both the backlog and new order indexes is not at all welcome.

The very low reading on the backlog index is particularly disturbing. The decline comes on top of a big drop last month, and the trend is not our friend. As I said, this is a reason for concern, not panic. However if we have another drop next month, then some panic might be appropriate.

The table below comes from the ISM report and shows the sub-indexes for the service index, as well as the corresponding sub-indexes on the manufacturing side.

Leave a Reply