Back in August, 2010 Fed Chairman Ben Bernanke claimed that monetary policy can be passively tightened by the Fed doing nothing in the midst of a weakening economy. A failure to act by the Fed when aggregate demand was faltering, he argued, was effectively the same as the Fed tightening monetary policy. He made this point in 2010 to explain why the FOMC’s decided to stabilize the size of the Fed’s balance sheet. Here is Bernanke:

At their most recent meeting, FOMC participants observed that allowing the Federal Reserve’s balance sheet to shrink in this way at a time when the outlook had weakened somewhat was inconsistent with the Committee’s intention to provide the monetary accommodation necessary to support the recovery. Moreover, a bad dynamic could come into at play: Any further weakening of the economy that resulted in lower longer-term interest rates and a still-faster pace of mortgage refinancing would likely lead in turn to an even more-rapid runoff of MBS from the Fed’s balance sheet. Thus, a weakening of the economy might act indirectly to increase the pace of passive policy tightening–a perverse outcome. In response to these concerns, the FOMC agreed to stabilize the quantity of securities held by the Federal Reserve by re-investing payments…By agreeing to keep constant the size of the Federal Reserve’s securities portfolio, the Committee avoided an undesirable passive tightening of policy that might otherwise have occurred. The decision also underscored the Committee’s intent to maintain accommodative financial conditions as needed to support the recovery.

In short, the FOMC was concerned that a failure by the Fed to reinvest its payments, which amounts to a reduction in the monetary base, would be contractionary in an economy that was struggling at this time. The FOMC wanted to avoid this passive tightening of monetary policy.

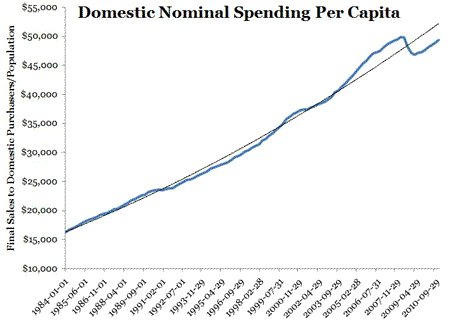

I agree with this line of reasoning about the passive tightening of monetary policy. I, however, see a passive tightening of monetary policy as being more than just the shrinking of the Fed’s balance sheet. It occurs whenever the Fed passively allows total current dollar or nominal spending to fall, either through a fall in the money supply or through an unchecked decrease in velocity. In other words, even if the Fed maintained the size of its balance sheet, a sudden rise in money demand not matched by the Fed would also amount to a passive tightening of monetary policy. With this understanding, monetary policy has been on a passive tightening cycle for the past three years. For nominal spending began to fall in June 2008 and has yet to return to any reasonable trend level growth path (i.e. one that accounts for the housing boom). It is even worse if we look at domestic nominal spending per capita. Not only has it not returned to a reasonable trend level growth path, it has yet to return to even its peak value in late 2007, as seen in the figure below.

A key problem behind this passive tightening of monetary policy is that money demand has been and remains elevated and the Fed has yet to successfully address it. What is frustrating is that the Fed could meaningfully undo this three-year passive tightening cycle by adopting something like a nominal GDP level target. For many reasons–its political capital is spent, internal Fed divisions, the popularity of hard-money views, etc–it won’t and so the U.S. economy remains mired in an anemic recovery.

Leave a Reply