In my last post I noted that the pace of the recovery, now two years old, is in broad terms similar to that of the first two years of the previous two recoveries. The set-up included this observation:

“Though we have grown used to thinking of the rebound from the most recent recession as being spectacularly substandard, that impression (which I share) is driven more by the depth of the downturn than the actual speed of the recovery.”

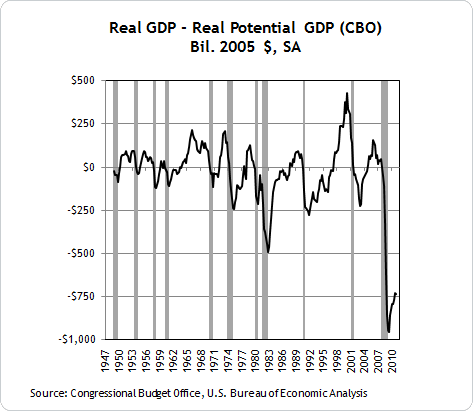

The context of the depth of the downturn is not, of course, irrelevant. One way of quantifying that context is to look at measures of the “output gap,” that is, the difference between the level of real gross domestic product (GDP) and the economy’s “potential.” An informal way to think about whether or not a recovery is complete is to mark the time when the output gap returns to zero, or when the level of GDP returns to its potential.

There are several ways to estimate potential GDP, but for my money the one constructed by the Congressional Budget Office (CBO) is as good as any. And it does not tell a pretty story:

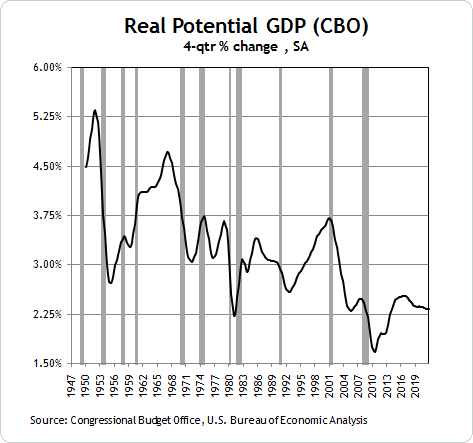

It is worth noting that the CBO’s measure is not a just a simple extrapolation of a constant trend, but a calculation based on historical relationships among labor hours, productivity growth, unemployment, and inflation. Their trend in potential GDP growth rates implied by this methodology, described here, is anything but linear:

Note that the output gaps in the first chart are at historical lows (by a lot) despite the fact that potential GDP growth is at historical lows as well.

These estimates provide one way to assess the pace of the recovery. For example, the midpoints of the Federal Open Market Committee’s (FOMC) most recent consensus forecasts for GDP growth are 2.8 percent (2011), 3.5 percent (2012), and 3.85 percent (2013). If those forecasts come to pass, approximately 60 percent of the CBO-implied gap will be closed. This would still leave, in real terms, more resource slack than existed at the lowest point in the past two recessions.

Put another way, if the economy grows at 4 percent from 2012 forward, the output gap won’t be closed until sometime in 2015. At a growth rate of 3.5 percent—the lower end of FOMC participants’ projections for the next two years—the “full recovery” date gets pushed back to 2016. If, however, the FOMC projections are too optimistic and the economy can only manage to grow at an annual pace of 3 percent (which is currently the consensus view of private forecasters for 2012) output gaps persist until 2020.

The conventional view of the macroeconomy that motivates the CBO estimates of potential GDP (and hence output gaps) at least implicitly embeds the assumption that time heals all wound. But the healing won’t necessarily be fast.

Leave a Reply