This economic expansion is now in its twenty-fourth month. It is one of the weakest expansions on record. And, it seems to be going nowhere.

One reason for this is that there is just too much debt still outstanding in the economy. The economy is experiencing a debt deflation where more and more people and businesses feel over-burdened with the debt loads they are carrying on their balance sheets.

The government, especially the Federal Reserve, is trying to counter this by pushing hard on the credit inflation button to extend the fifty years or so of credit inflation we have already experienced. The problem with this is that each new round of credit inflation puts more and more people and businesses into unsustainable positions so that expansions rely on a smaller and smaller proportion of the economy to drive further economic growth. (http://seekingalpha.com/article/279283-credit-inflation-or-debt-deflation)

Debt takes time to work off or work out. The bigger the debt-load the longer and harder it is for the people and businesses to climb out of their holes. Repeated cycles of credit inflation not only end up with more people digging holes, it also contributes to some existing holes becoming deeper.

Hence with every cycle recoveries become harder to achieve and the subsequent economic growth becomes less and less robust.

Another reason why economic growth is having trouble picking up momentum is because of the dislocations that exist within the economy. Credit inflation causes many distortions beyond what it does to the balance sheets of people and businesses.

Most analysts concentrate on the unemployment rate. Right now this figure rests just over 9.0 percent. Analysts focus on this variable as the crucial one for the upcoming 2012 election.

To me, a more important measure of the dislocation of human resources in the economy is the amount of under-employment we are experiencing. This number includes those individuals that have left the workforce or are employed but are not fully employed.

The under-employment rate in the United States right now runs about 20.0 percent. About one out of every five Americans is under-employed.

This number was under 10.0 percent in the 1960s and has trended up ever since.

The reason: the number one goal of the economic policy of the United States government was to achieve high rates of employment…low rates of unemployment. The best way to do this when unemployment arose was to stimulate the economy through the monetary and fiscal policies of the United States government to put people back to work in the jobs they have previously been laid off from. This, of course, resulted in more and more of the human capital in the country being underutilized…a capacity utilization problem.

Adding to this was the shift in employment in the country with relatively more and more of the new jobs opening up being in finance and financial services and less and less in manufacturing. Many “potential” workers find themselves limited in terms of opportunity either through geographic location or educational training. Both of these results came from the governments attempt to achieve high levels of employment through credit inflation.

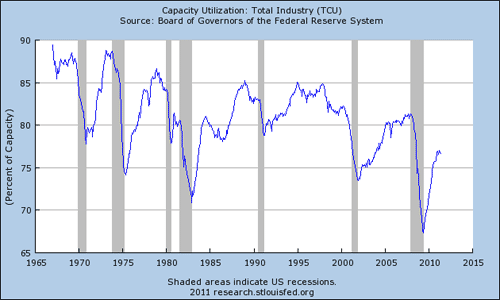

Finally, there is the problem of capacity utilization of physical capital. As one can see in the accompanying chart, capacity utilization in American industry was in the 87.0 to 90.0 percent range in the 1960s. As the proportion of human capital being used in this country trended downward from the1960s to the present, capacity utilization in manufacturing has also trended downward.

One can observe very clearly in this chart the cycles of capacity utilization associated with each recession during this time period. Also, one can not that with every cycle in capacity utilization that the “new” peak achieved is lower than the peak reached during the previous cycle…with the exception of the 1995-1997 experience.

Right now, United States manufacturing seems to be “peaking” out just below 77.0% of capacity, down from a previous peak of about 82.0 percent of capacity. It has been stuck at this level for at least seven months now, through June.

My argument is that just as credit inflation is responsible for the growing under-employment in the United States work force, credit inflation is also responsible for the growing under-employment of the physical capital of the United States. Credit inflation distorts business decisions and leads to a capital stock that is less and less productive over time.

So, here are three reasons why I place a low probability on the United States economy achieving a more robust economic recovery: the debt load on people and businesses; the dislocation existing in the labor market leading to high rates of under-employment; and the dislocation existing in the use of physical capital in the United States leading to low rates of capacity utilization.

Note that credit inflation can only be a short run panacea for these problems. Credit inflation leads to greater debt buildup adding to the unsustainability of the debt load being carried by people and businesses. Credit inflation works to put people back into the jobs they recently lost but as the society changes, the old jobs go away. And, credit inflation affects the productivity of the country’s physical capital making the existing capital stock less and less usable. There are no good answers here.

Leave a Reply