Financial markets warmly embraced a perceived opening by Federal Reserve Chairman Ben Bernanke, jumping sharply on news that QE3 was still on the table.

But QE3 was never off the table to begin with. It was simply that the bar to QE3 was very, very high. And I have to agree with Calculated Risk; I don’t see that Bernanke lowered it any today. The key sentence from the Congressional testimony:

On the one hand, the possibility remains that the recent economic weakness may prove more persistent than expected and that deflationary risks might reemerge, implying a need for additional policy support.

Note the two conditions – persistent economic weakness coupled with deflation risks. The latter was a focus when the Fed initiated QE2, with the lack of such risks guaranteeing the Fed would cease asset purchases at the end of June. Bernanke made clear the focus on deflation in his most recent press conference.

Are we seeing signs that such deflationary fears are emerging? Not yet, at least not based upon the kinds of market and survey based indicators the Fed is watching:

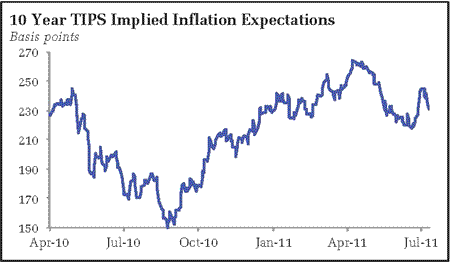

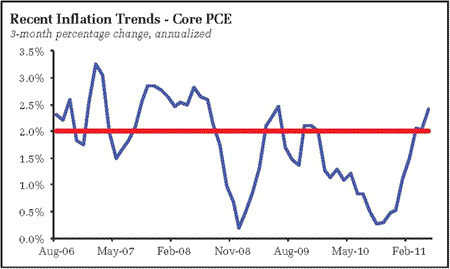

I would be looking for inflation expectations to plunge well below 200bp to trigger Fed action, like we saw last fall. Nor is it evident in the actual inflation data:

Absent a jarring negative shock, it seems difficult to believe the Fed could forge a consensus to ease further given the recent inflation path. Without a clear risk of deflation, it seems any additional asset purchases (or other easing efforts) would not make it through the FOMC.

Of course such a risk could not emerge quickly – the debt ceiling charades and the European debt crisis stand out as big tail risk events. Not really hard to tell a story that more action would be necessary under either scenario. But it shouldn’t be a surprise that the Fed would be ready to step in and support financial markets if such events occur.

And don’t forget that Bernanke made clear another story:

On the other hand, the economy could evolve in a way that would warrant a move toward less-accommodative policy.

He doesn’t lay down any specific data markers for tightening. In short, policy could tighten, could loosen. They are stuck on hold, waiting and watching the evolution of the data. But absent deflation risks, easing policy further seems very, very unlikely.

Bottom Line: Looking for more from the Fed? Then look to conditions that sharply raise the risk of deflation. And note that the FOMC minutes suggest the Fed is not really looking in this direction, instead focused on the commodity-induced inflation shock passing through the economy.

once the dept ceiling is increased, qe3 will follow almost immediately (maybe the same day). the presses will be runnin wide open by fall, at least a trillion will pumped out which will cause inflation to skyrocket but the market will hit 20,000 by years end