By ANTON TROIANOVSKI And CRAIG KARMIN

Wall Street Journal

The Securities and Exchange Commission is intensifying its scrutiny of the booming business of real-estate investment trusts that aren’t traded on a stock exchange, SEC officials say.

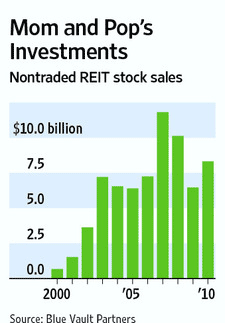

In the past decade, even through the economic downturn, such REITs have raised more than $73 billion from investors. By comparison, they had raised only $6 billion through 1999, according to investment-banking firm Robert A. Stanger & Co., which tracks the business through SEC filings. Money has poured in from individual investors drawn to steady annual returns of about 7% despite initial fees that often are around 10% of their investment.

The SEC has approved about 90 nontraded REITs since 1990, according to Blue Vault Partners LLC, a research firm in Cumming, Ga. The investment vehicles own hundreds of commercial properties, ranging from warehouses to ski resorts.

But the sector now is embroiled in controversy. In late May, the financial industry’s regulating body said one of the most successful money-raisers in the real-estate business, David Lerner Associates Inc., was misleading investors and marketing unsuitable products to them.

The Financial Industry Regulatory Authority said the Syosset, N.Y., firm targeted elderly and unsophisticated customers as it marketed a $2 billion real-estate fund. Finra said the firm provided “misleading” information about the REITs on the firm’s website. Finra also said the firm should have conducted more due diligence on the company that manages its real-estate funds, some of which have been paying out returns greater than the amount of cash actually generated by those funds. The claim is still pending.

The company, run by David Lerner, a former municipal-bond salesman nicknamed “Poppy” in commercials that pitch seminars touting the REITs, has described the Finra action as “ripe with falsehoods.” The seminars offer door prizes such as umbrellas and flat-screen TVs.

Other firms that run nontraded REITs are trying to distance themselves from sales techniques used by Mr. Lerner. His funds, sold as Apple REITs, are managed by Richmond, Va., real-estate investor Glade Knight. A spokeswoman for Mr. Knight declined to comment.

Other firms that run nontraded REITs are trying to distance themselves from sales techniques used by Mr. Lerner. His funds, sold as Apple REITs, are managed by Richmond, Va., real-estate investor Glade Knight. A spokeswoman for Mr. Knight declined to comment.

Other REITs point out that they are sold through numerous financial advisers, while Apple REITs are sold exclusively through David Lerner. “Financial advisers can choose from multiple competing products as opposed to proprietary products,” Jason Mattox, chief administrative officer of Behringer Harvard Holdings, which manages nontraded REITs, wrote in an email.

Still, the SEC wants to know more about how nontraded REITs operate and what they disclose to investors after closing the fund, SEC officials say.

“We believe investors would benefit from more information about how [nontraded REITs] reach their valuations,” said Michael McTiernan, a lawyer in the SEC’s corporation-finance division. “We told the industry we would be reviewing the annual reports for this disclosure, and if it doesn’t appear, they should expect to hear from us.”

U.S. securities regulators are instructing managers of such real-estate funds to specify how they arrive at their valuations, according to SEC officials. Many funds don’t make that clear, and some nontraded REITs keep their share prices relatively constant even though the value of the underlying properties they own might have deteriorated, critics say.

The SEC’s interest is separate from the Finra action against the David Lerner firm, although both involve how nontraded REITs value shares.

Proponents of nontraded REITs tout the funds as a way for investors to profit from real estate without the volatility of publicly traded real-estate investment trusts. Many nontraded REITs promise to pay returns for five to seven years—and then return to investors their original capital, plus profits if property values appreciated.

Such REITs routinely report share prices in statements to investors but don’t make it easy for investors to get their money back. Of the nontraded REITs launched since 1990, just 13 have returned investors’ capital through mergers or acquisitions, with four through listing on a public stock exchange, while two liquidated, Blue Vault said.

Joe Pickard, David Lerner’s general counsel, said it isn’t fair to compare all nontraded REITs against one another. “Each one of these REIT models or companies is different,” he said in an interview. The Lerner firm has said all disclosures on its website “were materially accurate.”

Some critics of nontraded REITs claim unsophisticated investors don’t understand that firms often don’t generate enough cash flow from the properties, at least initially, to cover annual payments to investors. “Borrowing to pay a dividend is a concern,” said Mike Kirby, a principal at Green Street Advisors, which analyzes publicly traded REITs. “You have to wonder how sustainable that business model is.”

A few real-estate companies are responding to the worries by launching products. Cole Real Estate Investments, which offers traditional nontraded REITs, is preparing to offer an unlisted REIT with much lower fees. In addition, the REIT will hire a third party to prepare daily valuations and keep as much as 20% of assets in cash to cover redemptions, according to Marc Nemer, Cole’s chief executive.

Clarion Partners is offering a similar product that will keep as much as 20% of assets in publicly traded real-estate securities, according to a securities filing.

Lerner executives said the most criticized characteristics of nontraded REITs are disclosed in prospectuses. But some investors don’t read those disclosures.

Norman Winston, a retired utility worker in Linden, N.J., and his wife, Vesta, a retired schoolteacher, said they invested about $200,000 in REITs sold by Mr. Lerner’s company. Mr. Winston says he gave the prospectus only a cursory look.

Mr. Winston said he didn’t realize that the REITs’ distributions came from sources other than the properties they own. “I should know better,” he said. “I more or less relied on what the investment people were telling me.”

Contact Securities attorney Jake Zamansky about the David Lerner Apple REIT matter.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply