With the six-month average of annualized headline inflation running just over 5 percent, this Wednesday’s consumer price index (CPI) report looms a little larger than usual. While it is dangerous to predict such things, there is every reason to believe that the measured increase in CPI inflation for May could be quite low. And there is every reason to believe that this softness will persist into June.

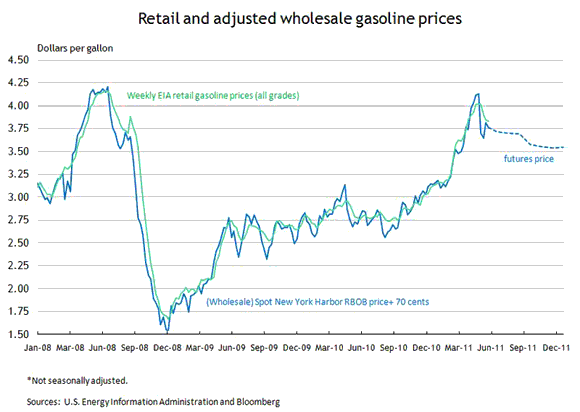

The reason is quite simple. Movements in gasoline and fuel prices really do push around the headline inflation number, and at long last it looks like that movement is in the downward direction. Here’s the relevant picture:

Let’s assume that, annualized, CPI excluding food and energy rises 2.1 percent, as it has so far this year, and food and nongasoline energy prices each rise at 5 percent. Then when you plug in gasoline prices already realized for May and EIA predictions for June, you get a 0.4 percent rise in the headline CPI in May and a 0.7 percent decline in June (both rates annualized).

Despite some probable relief on the headline inflation number, I remain aware of what that relief means and what it does not. Earlier in the year, Atlanta Fed president Dennis Lockhart had this to say:

“I want to contrast inflation to the cost of living. In casual language, we often interpret a rise in the cost of living as inflation. They are not the same thing. Cost-of-living increases are a result of increases in individual prices relative to other prices and especially relative to income. These relative price movements reflect supply and demand conditions and idiosyncratic influences in the various markets for goods and services…

“… The Fed, like every other central bank, is powerless to prevent fluctuations in the cost of living and increases of individual prices. We do not produce oil. Nor do we grow food or provide health care. We cannot prevent the next oil shock, or drought, or a strike somewhere—events that cause prices of certain goods to rise and change your cost of living.”

Two points, then. First, even if things evolve as the chart above suggests, the level of gasoline prices will remain relatively high by recent standards. Low inflation readings for the next couple of months would therefore leave the cost-of-living high by recent standards, a fact that is not lost on us here at the Atlanta Fed.

Second, as President Lockhart’s comments reveal, we were reluctant to attribute the run-up in fuel prices to monetary policy. And I imagine we will be equally reluctant to credit monetary policy with any relief from that trend.

In fact, I will fearlessly predict that, should our guess here about headline inflation in the next couple of months be proved accurate, we will point to core inflation measures as reason to look through some very low inflation readings. See these comments from President Lockhart’s most recent speech for some additional perspective:

“Are the recent outsized increases in headline inflation the best signals of the inflation trend going forward? Or are other statistics—like core inflation or measures of inflation expectations—yielding a truer picture of what lies ahead?

“The answer matters a lot. And it certainly weighs heavily on my thinking. I would not hesitate to support an exit from our current policy stance if I believed that the headline inflation number of the past six months is really indicative of the underlying trend inflation rate. I don’t believe this to be the case. And I am wary of tightening monetary policy in the face of quite ambiguous economic circumstances unless doing so is absolutely necessary to meet the FOMC’s price stability mandate.”

And here’s why it matters, quoting President Lockhart from an interview with Reuters last week:

“In the interview, Lockhart said maintaining an easy Fed policy stance should ensure the moderate U.S. recovery does not fall off the rails.”

But…

“How high would the bar be for further Fed easing?

“It would take ‘a significant deterioration as reflected in the overall economy, a set of deflationary signals and also unemployment numbers that rise dramatically. Last fall (when the Fed launched QE2), by some measures, we were seeing declining inflation expectations that were headed in a pretty negative direction, and that was happening pretty rapidly. We were in a disinflationary environment. So the risk of deflation was plausible. We acted and the situation has turned around. That was, at least in my way of thinking, very central to supporting the policy. We don’t have anything remotely like a deflationary risk at the moment, short of a shock of some kind.’ “

If what I suggest above—falling headline inflation, stable core inflation—comes to pass in the near term, don’t expect me to start ringing the disinflationary bell.

This isn’t the last word on the usefulness of core inflation statistics, and the debate is certain to rage on (see here and here, for recent installments). But I do hope that this post is remembered the next time the Federal Reserve is accused of hiding inflationary pressures behind the rhetoric of core.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply