The Wall Street Journal recently published an article “Facing Up to End of ‘Easy Oil’” that highlights the supply constraints I’ve discussed with you for several years. Alex Munton, an energy analyst from Wood Mackenzie, told the WSJ that “the major oil fields in the Gulf region have pumped more than half their oil—the point at which production traditionally begins to decline.”

Specifically, Saudi Arabia, the world’s second-largest oil producer, is experiencing difficulties as its oil fields mature. Known for its ample amount of easy-to-tap, high quality reserves, Saudi Arabia is now exploring the country’s heavy-oil deposits in order to maintain long-term production.

“Heavy” oil refers to a grade of oil that contains high amounts of sulfur and components which make it very dense. Heavy oil, such as Canada’s tar sands, is generally more expensive to pull out of the ground and refine into gasoline.

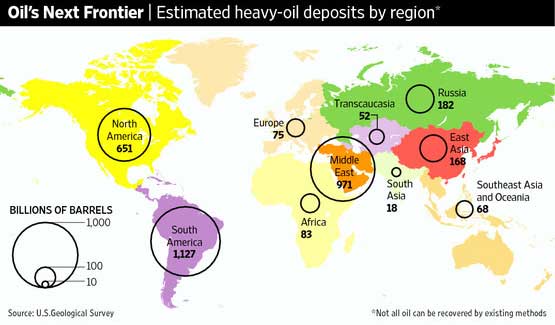

The U.S. Geological Survey estimates that there are 3 trillion barrels of heavy oil scattered around the earth—worth about 100 years of consumption—but only about 400 billion barrels are recoverable with today’s existing technology, according to the WSJ. You can see from the map that the Middle East, North America and South America hold the majority of these deposits. Saudi Arabia is estimated to have 78 billion barrels of recoverable heavy-oil reserves.

In order to tap those reserves, Saudi Arabia is teaming up with Chevron on a pilot program at the country’s Wafra oil field. To pull out the oil, workers “[inject] steam into the ground to heat the oil and make it less viscous, allowing it to flow to the surface…A technique that is tricky, expensive and unproven,” says the WSJ.

If successful, the difficult project will turn Wafra into a steady producer for Saudi Arabia and Chevron.

Chevron is particularly suited for the task since it has been using steam technology at its Kern oil field in California since the 1960s. Steam has successfully taken the production yield at Kern from 10 to 80 percent, the WSJ says.

The project is being watched closely by other Middle East countries and global oil companies alike. Similar partnerships have been forged between Oman and Royal Dutch Shell, Bahrain and Occidental, and Abu Dhabi and Praxair.

As long as oil prices hover at historically high levels, projects such as these remain economical. However, they could quickly be shelved if we were to see a prolonged pullback in prices.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply