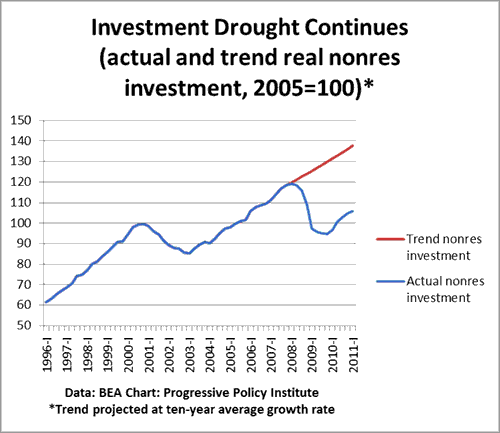

To me, the big news in the first quarter GDP data is that the business investment drought has worsened. I compare the actual level of real business investment with the long-term trend level (assuming that the ten-year growth rate as of 2007IV had continued). Here’s what we see:

As of the first quarter, real nonresidential investment is 23.1% below its long-term pre-crisis trend, slightly wider than in the fourth quarter of 2010. This is the clearest sign of the weakness of the economy, since no one can argue we had a bubble in nonresidential investment before the crisis started. The longer this investment shortfall last, the harder it will be to recover.

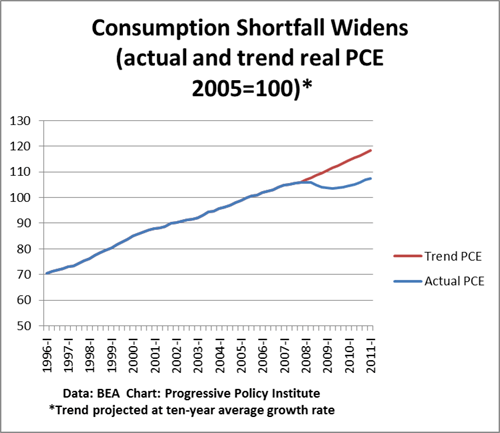

Incidentally, the business investment drought is far bigger than the shortfall in consumer spending. The chart below shows the shortfall in real PCE, relative to long-term pre-crisis trend.

The consumption shortfall is only 9.2% relative to the ten-year trend. That’s widening too, as real PCE growth is still below the long-term trend. However, given the fact that the U.S. was supposedly over-consuming before the crisis, a 9.2% shortfall may not be big enough!

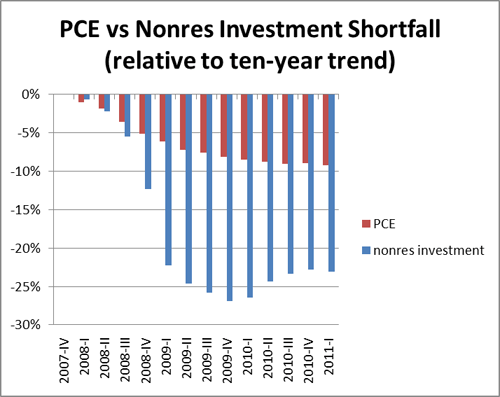

Here’s another comparison:

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply