Retail Sales were slightly below expectations for April, coming in with an increase of 0.5%, a tick below the 0.6% increase expected. That disappointment is more than offset by a big upward revision to the March numbers. They were revised to an increase of 0.9% from the original report of a 0.4% increase. Total retail sales are up 7.6% from a year ago.

The Retail Sales report covers far more than just the shopping malls and is a very broad-based measure of consumer spending. Since consumer spending makes up 70% of the economy it is a very important number. That overstates things a bit since retail sales are mostly about the sale of goods, not services, and services make up two-thirds of what consumers spend. Still, it is a pretty important thing to watch.

Including, Excluding Autos

Auto sales were a bit of a drag on overall retail sales in April, rising just 0.2% on the month, after falling 0.7% in March (revised significantly from an original decline of 2.3%). On a year-over-year basis they were up a solid 11.0%. That figure includes sales at parts dealers like Autozone (AZO) as well as the dealers like CarMax (KMX).

Excluding autos, retail sales rose 0.6%, in line with expectations, down from the February rise of 1.2%, but down only after a big upward revision from 0.8%. The upward revision makes this a report a positive surprise, even if the headline number was below expectations and the ex-auto number was in line.

Year over year sales are up 6.9%. The year-over-year numbers are pretty robust, but keep in mind that these numbers are not adjusted for price changes, so part of the year-over-year gains simply reflect inflation. However, outside of food and energy, inflation is very tame.

8 Up, 5 Down

The growth was uneven, and that may be the more important story. There was a sharp slowdown from last month in many of the more discretionary types of retail sales. The report tracks 13 major categories of stores, of which eight were up and five down on the month. Year over year, all types of store are showing increases, ranging from 0.8% (Furniture stores) to 21.8% for Gas Stations.

Clearly, gas prices were the major factor in the increased sales at the corner Exxon (XOM) station, not a sudden rise in the number of 44oz. fountain drinks being consumed. Actually the evidence suggests that the volume of gasoline sold is actually declining in response to higher prices.

Aside from the Gas Stations, which are clearly a special case, the next strongest group on a year-over-year basis was the non-store retailers — the group that includes the catalog and internet retailers like Amazon (AMZN). They are up 15.5% year over year. As noted above, the Auto stores were up 11.0% year over year, the third and last group to be up double digits year over year.

Not surprisingly, the best performers on the month were the gas stations, where sales rose 2.7%, after a 4.1% rise last month (revised from 3.6%). Surging revenues at gas stations is not exactly a sign of strong economic growth. Money spent at the pump cannot be spent elsewhere, and much of that cash flows abroad, rather than recirculating in the economy, to pay for oil imports.

The other part of non-core inflation, food, also showed a significant increase, as sales at Grocery stores (and other stores selling food and beverages, excluding restaurants) jumped by 1.2% after rising just 0.2% in March (revised down from 0.3%). Year over year, the rise in Food sales though is relatively tame at 6.0%. Sales of food for the home are among the least discretionary purchases, along with gasoline.

Discretionary Takes a Big Hit

It was the highly discretionary types of retail sales that took it on the chin in April. Sales at Electronics and Appliance stores are Exhibit A. They plunged 2.2% on the month, reversing most of last months sharp 2.9% rise. Year over year, sales are up just 0.9%. However, on the electronics side of things, prices generally decline over time, so the situation is a bit of the flip side of what is going on at the gas stations.

As for appliance sales, they tend to be spurred by housing sales, both new and existing, and both have been soft. Furniture sales are also greatly influenced by home sales. People tend to redecorate when they move into a “new for them” house. Absent that, there are few purchases that are generally easier to put off until next month or next year than a new sofa or dining room table. Furniture sales were down 1.1% on the month, after rising 2.4% in March, and year over year are up just 0.9%.

With all the chatter about food inflation breaking out, one would expect to see a big pop in Grocery store sales. That was not really the case, as sales were up 0.3% for the month, down from a 0.5% increase in February. Year over year, sales were up 4.1%, well below the overall increase in retail sales. That is a bit of an indication that fears of food price inflation are a bit overblown, at least here in the U.S. Overseas they are literally a deadly serious problem, and are one of the sparks that ignited the unrest across the Middle East.

Certainly food commodity prices are way up, but raw commodities make up a pretty small part of the nations shopping cart. The price of wheat is a very small part of the cost of a loaf of bread for example. Spending at the grocery store is about as non-discretionary as spending gets, and tends to be more stable than other retail sales.

Spending at Health Care stores, such as Walgreen’s (WAG) also tends to be relatively stable, but there was a big turnaround there as well, with sales up 0.7% after falling 0.5% the month before, and up 6.3% year over year.

Sporting Goods and Hobby stores saw sales slow, with a rise of just 0.1% down from a 2.8% surge in February. Year over year they are up 6.1%, which is a bit below average.

Clothing stores like The Gap (GPS) also had a slower sales month as well, with sales up 0.6%, down from a 1.8% rise last month. Relative to a year ago they are up 3.4%, which is decidedly below average. A new pair of jeans is a bit less discretionary than a new kitchen table, but less discretionary than going to the grocery store.

General Merchandise stores, a category that includes the Department stores saw a 0.4% increase on the month, down from January increase. Year over year, General Merchandise sales are up 2.5%, so sales are generally on the soft side at the mall anchors as well as the stores in the periphery of the Mall.

Going out to eat and drink is also a very discretionary item, and sales at bars and restaurants were up a strong 1.0%, on top of a 1.8% increase in January. Year over year, sales are up 3.8%.

Encouraging Details

Overall this is an encouraging report, not so much for the headline numbers for this month, but for the internals of the report, and the upward revision to last month’s figures once auto sales are stripped out.

While the numbers for this month were anticipated, the upward revisions to last month’s numbers were not. The retail sales report is at times very interesting when it shows a clear divergence between spending in discretionary spending items and on staple type stores. The more discretionary types of stores showed strong gains for the month, and increases in sales were widespread.

Autos were the exception. They are highly discretionary and had a weak month, but it is clear that Detroit is on the rebound (at least metaphorically; I’m not so sure about the city itself). The year-over-year gains are still robust.

The road ahead might get a little bumpy for a few months as the supply chain disruptions due to the Japanese disaster kick in. However, weak sales from a lack of product availability are a different thing than weak sales simply because the consumer cannot afford, or lacks the confidence to, buy a new car.

The inflation at the gas station however is all too real, and that is likely to bite into consumption of other goods in the near future if it keeps up. Worse, it seems to be accelerating — if the average of the last two months is annualized, it is running at 34.5%.

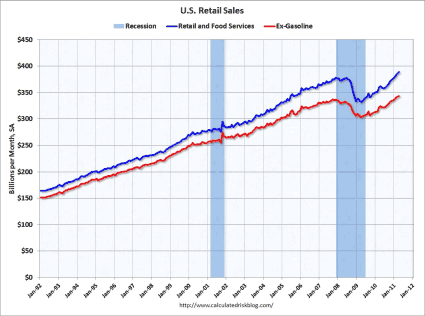

The graph below shows the longer term path of retail sales, both total (blue line) and excluding sales at Gas Stations (red line). In both cases we are at new highs, but recall that these numbers are not adjusted for inflation. While inflation, particularly core inflation, is still very low, over the course of a few years it still plays a significant role.

The pace of growth since the bottom (slope of the lines) appears to be slightly better than what prevailed prior to the Great Recession, but it was not a very fast snap back, more like a reset to a lower level, then a continuation of the previous growth rate from a lower level. The ex-gasoline numbers are probably a better reflection of the overall state of the economy than the total numbers, but both are telling a pretty similar story. Things are getting better, but slowly.

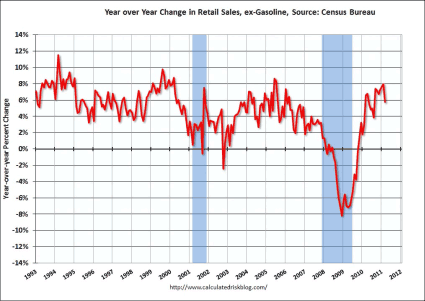

The second graph, shows the year-over-year change in sales excluding gasoline going back to 1993. While the year-over-year gain of 5.8% is down sharply from the 8.0% pace last month, it is still very healthy, and is higher than the increases that we were running for most of the previous economic expansion, and about on par with how we were doing for most of the Clinton economic expansion.

Core inflation was much higher than now in both of those previous expansions (these numbers strip out only the energy side, not the food side of the ex-food and energy inflation, so it is not a perfect match). That suggests that real retail sales outside of gasoline are very healthy.

Then again, we are coming off the biggest downturn in spending in decades. That means there is a lot of pent-up demand out there.

AUTOZONE (AZO): Free Stock Analysis Report

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply