Estimates have been moving higher for Ecolab Inc. (ECL) since the company reported better than expected sales and earnings for the first quarter of 2011.

It is a Zacks #2 Rank (Buy) stock.

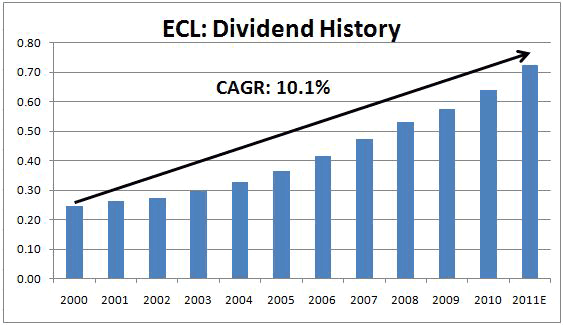

Ecolab is also very shareholder-friendly with 74 consecutive years of dividend payments and a 10-year dividend growth rate of 10.1%. The company also recently announced authorization for a major share repurchase program.

First Quarter Results

On April 26, Ecolab reported first quarter EPS of 45 cents, beating the Zacks Consensus Estimate by 2 cents. It was a 10% increase over the same quarter in 2010.

Net sales rose 6% to $1.518 billion. This was well ahead of consensus estimates too, which called for sales of $1.485 billion. The increase was due in part to strong gains in its U.S. Cleaning & Sanitizing, Asia Pacific and Latin America operations.

Rising raw material costs did squeeze margins a bit, as gross profit as a percentage of sales slid from 50.0% to 49.3% in the quarter. Operating income was still up a solid 9%, however, as the company was able to leverage its selling, general and administrative expenses.

Outlook

Management raised the lower end of its 2011 earnings guidance following solid Q1 results. The company now expects to earn between $2.49 and $2.53 per share, up from previous guidance of $2.47 to $2.53.

Analysts expect solid organic sales growth to be partially offset by continued raw material pressure. The Zacks Consensus Estimate is within management’s guidance at $2.51 per share, representing 13% growth over 2010 EPS.

The 2012 consensus estimate is 14% higher at $2.87.

Analysts are also projecting a 13.2% five-year EPS growth rate.

Returning Value to Shareholders

Ecolab pays a dividend that yields 1.3%. The company has paid dividends for 74 consecutive years. Over the last 10 years, it has raised its dividend at a compound annual growth rate of 10.1%.

Ecolab has also been buying back stock, having repurchased 1.5 million shares during the first quarter. The company also recently announced that its board of directors had authorized up to 15 million additional shares to be repurchased on top of the 3.9 million shares remaining under a previous program.

All in all, this represents about 8% of outstanding shares.

Valuation

Valuation for Ecolab is reasonable with shares trading at 19.6x 12-month forward earnings, which is below its 10-year median of 23.5x.

The company’s return on equity for the last 12 months was a stellar 26.1%, well above the industry average of 11.1%. This helps justify the stock’s premium on price to book (5.4 vs. 2.8).

Ecolab is a global leader in cleaning, sanitizing, food safety and infection prevention products and services.

It is headquartered in St. Paul, Minnesota and has a market cap of $12.0 billion.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply