Yesterday’s jobs report seems to have shaken people up. Though he’s been arguing in favor of more stimulus or rather a second stimulus for some time, Paul Krugman amped it up today in a NYT editorial:

O.K., Thursday’s jobs report settles it. We’re going to need a bigger stimulus. But does the president know that?

Since the recession began, the U.S. economy has lost 6 ½ million jobs — and as that grim employment report confirmed, it’s continuing to lose jobs at a rapid pace. Once you take into account the 100,000-plus new jobs that we need each month just to keep up with a growing population, we’re about 8 ½ million jobs in the hole.

And the deeper the hole gets, the harder it will be to dig ourselves out. The job figures weren’t the only bad news in Thursday’s report, which also showed wages stalling and possibly on the verge of outright decline. That’s a recipe for a descent into Japanese-style deflation, which is very difficult to reverse. Lost decade, anyone?

Wait — there’s more bad news: the fiscal crisis of the states. Unlike the federal government, states are required to run balanced budgets. And faced with a sharp drop in revenue, most states are preparing savage budget cuts, many of them at the expense of the most vulnerable. Aside from directly creating a great deal of misery, these cuts will depress the economy even further.

Krugman goes on to cite the pro-cyclical nature of the states’ financial problems to bolster his call for more stimulus. He sees a repeat of the experience of 1937 when stimulus was withdrawn in favor of fiscal conservatism and the recovery from the Depression not only stopped but the economy went into another tailspin.

All of this is fairly standard fare from Krugman. There isn’t a lot new in his arguments or his call for a second stimulus but now he has the jobs report to back him up. However, another economist, the highly respected David Rosenberg had some equally troubling analysis of the numbers:

This in turn has take the total hours worked in the private sector down to a new record low of 33 hours from 33.1 hours in May – in fact, what this means is that if companies had kept hours worked at May’s levels, then to achieve the same labour input that they achieved would have required a 800,000 job slice! Just to put the entire labour market picture into a certain perspective.

When we say that deflation has gripped the labour market, we are not exaggerating. Average weekly earnings – the proxy for wage-based income – fell 0.3% in June and have been flat or down in three of the past four months. During this interval, they have deflated at a 1.6% annual rate – versus a +1.8% trend a year ago and +5.2% two years ago.

Even Krugman was loathe to use the deflation word. He danced around it but didn’t come out and say it’s here. But let’s look at one other bit of data from another economist. This time it’s from Greg Mankiw:

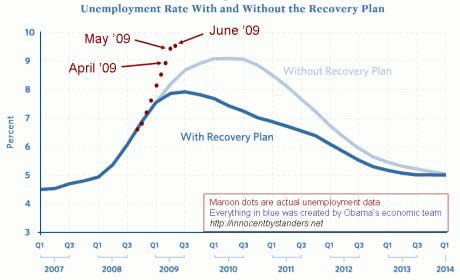

The graph is taken from the Obama administration’s January 2009 presentation. The overlays in maroon are from Mankiw. As you can see, the administration misjudged the effects of their stimulus plan or misjudged the severity of the economic client (I’m not interested in assessing any blame here) substantially. They might also have assumed that the stimulus money would have been flowing more freely than it has been. Whatever, it’s clear, or so it seems to me, that somehow we’re missing the target substantially and probably need to rethink a few things.

First, I think that there is a real danger of deflation taking hold. I wrote an anecdotal post about this early this week (link here) and Rosenberg’s comment convince me that we are on the edge of that abyss. If we topple over into actual wage deflation, you can count the first major battle of this war as having been lost. Recovery then becomes a tediously long affair.

Reverting to Mankiw’s chart, there seems to have been some serious miscalculation with regard to the path of the job market. Rather than worrying about why we’ve so badly missed the mark on stimulating the economy and thus mitigating the job loss numbers, we need to just admit a mistake and adjust the strategy.

I don’t think that there is reason to panic based on one month’s data. It’s tempting to say we should wait and see what transpires in the next few months but that might be more patience than we can afford. Since, it’s no secret that the stimulus has been slow to leak out, the obvious response is to speed up the flow of funds. As I wrote yesterday, that necessarily means abandoning some favored pork type projects and shelving some of the more grandiose schemes for green jobs and renewable technologies. Time for that later.

I think Krugman is jumping the gun or to put it more kindly missing the cause of the problem. We don’t need to be worrying about a second stimulus right now, we need to be worrying about getting the first one working. Despite some rays of sunshine, the jobs report underlines just how fundamentally sick the economy has become. If we can’t get employment under control what little consumption we have is going to go negative and if that happens the free fall will truly begin.

I will say again (link) that it’s time to consider tax cuts. They may not be as efficient as government spending long term but they act immediately. Right now, the economy needs a jolt and right now is not the time for arguments about which will have the biggest multiplier effect. The President needs to act now before he loses any semblance of control.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply