Richmond Federal Reserve President Jeffrey Lacker:

Businesses thus far have absorbed input price increases, presumably believing that competitors would not follow suit, which suggests that they believe that overall inflation will remain low. The responsibility of the Federal Open Market Committee (FOMC) is to validate these expectations by conducting monetary policy in such a way that inflation does not accelerate. That’s not always an easy task at this point in a recovery. In the last cycle, the economy began to grow more rapidly at the end of 2003. Although energy prices showed growth spurts, unemployment had not yet begun to fall and the core inflation measure that excludes energy and food prices was still just 1-½ percent. As a result, many forecasters expected inflation to diminish, and the FOMC kept the funds rate at a very low level well into 2004. Instead of falling, overall inflation soon rose to 3 percent, where it stayed, on average, through the end of the expansion in 2007. Core inflation averaged 2-¼ percent over that horizon. With hindsight, I think it is fair to say that policymakers overestimated the extent to which high unemployment would keep inflation from accelerating, and as a result, waited too long to withdraw monetary stimulus. Four years of 3 percent inflation may not have been the worst of all possible outcomes, but I do not consider it a success. I hope we do better this time. In particular, I believe we need to heed the lesson of the last recovery that inflation is capable of rising even if the level of economic activity has not returned to its pre-recession trend.

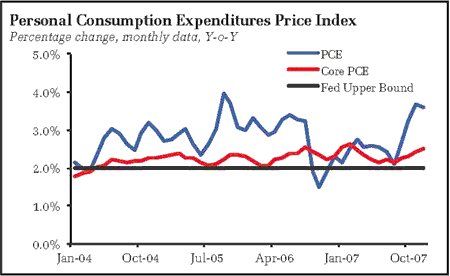

Note that Lacker changes the goalpost – rather than focus on core-inflation, he shifts the focus to headline inflation of 3%. Why? Because otherwise he needs to face the fact that core-inflation averaged a mere 25bp above trend over the 2004-2007 period:

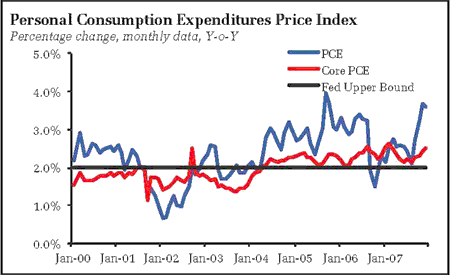

Consider that in context of the entire decade to that point:

One could just as easily make the argument that the Fed was allowed core-prices to catch up after a period of inflation that fell 25bp below the upper bound. Lacker, however, does not see it that way. Instead, he would prefer to hold unemployment rates high in order to prevent prices from returning to trend. That’s dangerous thinking, especially if you believe that we should expect a period of higher inflation if output is to converge with potential. With friends like these….

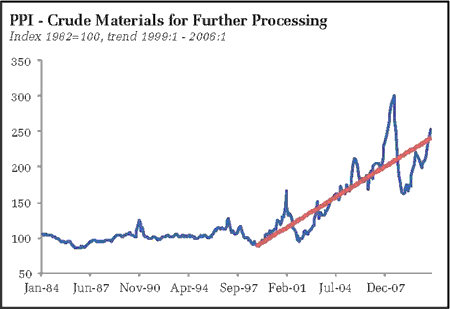

Also note the path of commodity prices during this past decade:

Lacker professes disappointment with inflation results, and would prefer that more people were unemployed to “do better this time.” I would argue just the opposite: Given the upward trend in commodity prices – something the Fed had little if any control over – I think the Fed did a pretty good job maintaining inflation expectations in a period of falling unemployment. And I think it is odd that an insider doesn’t recognize this success.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply